I'' m Dr. Daniel Kim, Owner and CEO of Sweetwater Digital Property Consulting. This talk is called “” Sound Cash, Safe Setting”” and it is a wide, broad view introduction to cryptocurrency and Monero. A bit concerning myself– so, academically, I'' m trained as a bit physicist– I did my undergraduate and graduate work in experimental particle physics at Harvard. There, I had actually a behavior ingrained in me to constantly look at information, so there'' s mosting likely to be a great deal of data revealed in this talk. A lot of my occupation was spent in the charitable sector. My very first work out of grad college was with a symphony band, where I finished up doing concerning 700 shows skillfully– very first as a violinist, and after that later on as a keyboardist. Concurrently with that said, I leapt via the hoops to become board licensed in radiation oncology physics.Then as a clinical institution professor in clinical physics, I assisted about a couple thousand individuals with their battles versus cancer, by helping with the technological aspects of providing high strength radiation. It was as a med-school professor that I did my probably most “DEF DISADVANTAGE” thing, which was to invent a device that did packet smelling on a medical network to reconstruct therapy information being provided to cancer clients prior to the moment of treatment. I signed up for the Executive MBA program at Yale due to the fact that I believed that I desired to reveal an interest in the means that the globe operates in a different means than in physics. Naturally in physics, you ' re accessing how the globe works at the smallest levels yet after that to think generally concerning “actual world” human issues from a range of perspectives, the MBA is good for that. While doing that, I made a button to the for-profit” market– I joined a little hedge fund and I became Director of Research there. I was a co-author of a paper that won the top research honor of the CFA Institute. That paper was about the impact of liquidity on property prices. In my leisure, I was getting increasingly more interested into cryptocurrency and after that

I decided that this was an authentic development, of which there are not that many that happen in one ' s life time, so I leapt to my own small company, which is what I do now as an independent specialist. Currently I aid link 2 really different worlds as the owner and chief executive officer of Sweetwater Digital Asset Consulting– there ' s the world that DEF disadvantage represents, which is a non-commercial, open resource, cypherpunk, grassroots, cryptocurrency society– and on the right side is the extremely identical world of'traditional possession count on, family and security office profile management, estate and tax preparation. These 2 separate globes know really little about each other, in technique– they commonly make presumptions regarding each other that are based in concern– and so as one who has substantial experience on both sides of this divide, I speak with “OG” crypto individuals that want support in assembling a plan to shield their crypto from future financial institutions, whether they be arbitrary people that could sue them or a potentially vengeful future ex-spouse– and afterwards from “the various other direction, I speak with typical profile managers in the count on and estate globe that are well accustomed with traditional possessions, have actually found out about this “cryptocurrency stuff,” need to know if it ' s genuine, and desire to connect with a Sherpa that can aid them arrange with all the noise.In my non-profit initiatives these days I am additionally a neighborhood volunteer for the Monero project. My talking here is “on a voluntary basis. Because I personally really feel that this is a vital job for humanity, I ' m doing this. I think it ' s essential for people to speak out and make their voices listened to on issues similar to this. I do not receive any assistance from the Monero job, I ' ve never ever requested for support from the Monero job– I want to preserve my freedom, as my primary duty is to my consulting clients, to whom I owe the task of doing the study and examination of the entire cryptocurrency area and making referrals on what I assume are one of the most engaging jobs out there.Within cryptocurrency, I likewise focus on symbols that do what I assume is the “awesome app” of Nakamoto agreement, which is cash. This talk is called “Sound Money, Safe Mode.” Initially, I ' m going to speak about the pandemic and the economic fallout. Second, the administration of fiat shortage leads to a solid recommendation that it may be an excellent time in background to be considering independent resources of scarcity.Third, I ' ll speak about fungibility– “what that indicates, and why it ' s essential as the world moves increasingly in the direction of “a mass security culture'. And then the fourth component has to do with obtaining entailed. There ' s a superficial way to get entailed and there ' s a deeper means to get entailed. The shallow way would certainly be due to the fact that it ' s a cryptocurrency, it acts like an asset', therefore I place on my bush fund hat and I take a look at Monero and Bitcoin, and likewise gold, as components of one ' s portfolio.But the deeper, more substantial way is obtaining involved directly with your energy and time and experience. I intended to state thanks to a couple of individuals in the Monero area that I had actually sought advice from while preparing this talk: Howard “hyc” Chu, Dr. Sarang Noether of the Monero Research Laboratory, and Dr. Francisco Cabanas of the Monero Core team. Right here in this plot I ' m revealing U.S. federal government data all the method back to 1980, so we ' re looking at 40 years of history right here. The blue line is “U6” unemployment– this is the fraction of people that are either looking for job, or functioning part-time when they wish to be working full-time, or are so dissuaded with “their state of looking for a work that they ' ve quit. This is contrasting with “U3,” which is only counting those individuals that are actively searching for'work and can ' t discover it. So U6 is a wider action therefore it ' s widely thought about to be extra exact. Joblessness in the year 2020 spiked up to the highest degree ever before in recorded history– a minimum of of the U6 joblessness rate– it increased as much as regarding 23 percent.Fortunately that ' s decreased a little bit since after that, yet it ' s still definitely not an attractive'number. Need for solutions like “travel, entertainment– all fell via the floor– and so the federal government ' s reaction to that was to be worried about depreciation. To eliminate that, they expanded the cash supply, because by publishing cash, that lowers the rate of interest price, then it becomes less eye-catching to save your cash and obtain a little bit of passion, and it becomes much more appealing to invest your money. Below in environment-friendly is the MZM cash supply– MZM stands'for “money zero maturity” and what that includes is the M1 supply– which is coins, currency, and checking accounts– and it incorporates that with savings accounts and cash market accounts, which lots of people use as an alternative form of a cost savings account these days.I ' ve normalized that number to the gdp– that is the value of all services and items generated in the U.S. in one year. The money supply as a fraction of the productive outcome of the U.S. has been rising for “the last forty years, and you can see here at 2020 the line spikes up from around 70 percent to over one hundred percent. Words “unprecedented” gets sprayed a whole lot for this dilemma, however absolutely, if you check out lasting plots similar to this and you see the size and the incline of this cash publishing that ' s been occurring in the last several months– it ' s absolutely impressive. Of course the federal government can print as little or as much cash as it desires, with nothing quiting them from doing whatever they want– this has actually held true considering that [Head of state] Nixon abolished the affiliation of the U.S. dollar to gold. Checking out “the lower line” right here, this is exactly how much cash is the united state government taking in minus just how much money is the U.S.Government investing, on a month-to-month basis. It ' s essentially tax obligations minus costs. It increases four times'a year since that ' s when estimated taxes schedule therefore there ' s that seasonal framework to it. As you can see it actually tanked, in particularly quarter 2 of 2020. April 15, which is the normal due date for taxes to be due, got pressed back to July 15, as a result of the pandemic. There was no tax income coming in, yet the federal government was continuing to spend money as it was before. The investing didn ' t quit, just the revenue quit. Therefore this may reverse itself, now that July 15 has actually come and gone, with a similarly high spike in tax obligations– that'is assuming that this July 15 was a bonanza from'the perspective of the IRS with a whole lot of tax obligation cash being available in– we ' ll see if that was in fact the situation. If you integrate this with time, then you get the black line that ' s on the top, which is the complete federal debt stabilized to GDP, again.In the aftermath of the 2008-2009 monetary dilemma, the federal government was spending fairly a little bit more money than it was gathering, and consequently, when you time integrate that, you get the black line up right here in the federal financial obligation to GDP. And now we ' re at this moment below at the start of the year– the financial debt to GDP ratio is regarding 110 percent which is before the pandemic. In the G20, there are 8 nations that have been reporting stats on the quantity of money that ' s in flow in their certain currency.Here, I ' ve stabilized the quantity of money in

every country to be equal to 1 on January of 2020. There ' s this hockey stick form to this contour of just how much money is flowing. In the USA, the M1 development has been to the tune of concerning 1.33 trillion dollars– which amounts to a rise in the money supply of concerning 300 million bucks per hour. Now, if you contrast this to, for instance, the marketplace cap of Monero– that ' s something on the order of one and a fifty percent billion– so the cash supply of the U.S. increased by the size of Monero ' s market cap, about five times daily for the last 6

months.'Allow ' s broaden our emphasis to not simply the eight countries in the G20 that have actually reported results lately, however allow ' s take a look at all the G20 fiat currencies and allow ' s likewise expand the moment structure in which we ' re recalling to 2009, the year in which Bitcoin came out.Every country ' s money amounts to 1 at the start of 2009. You can see that there ' s not one of the G20 money that has been flat or has in fact lowered their money supply over time– it ' s all boosted. As a former med-school professor who operated in oncology, the exponential math of unrestrained growth in malignant growths is something that I think of when I see a plot such as this. Pre-pandemic, we ' re considering a doubling time of about 8 years. If you believe about for how long does an average human make it through, let ' s say 80 years– that is 10 doubling times', which implies the quantity of money growth in a typical human ' s lifetime is 2 to the 10th power, which is 1,024– it ' s regarding a thousand times raise in the cash supply. Which is prior to the pandemic– after the pandemic, we ' re looking at a doubling time that ' s closer to 2 years.There ' s a fascinating scholarly publication called “Monetary Regimes and Inflation” which did a research study of 29 historical instances of run-away inflation. A minimum of for Americans, none of us have ever before had to endure that, yet all accounts of what it is'like to endure through something like that is it ' s no fun at all– it eliminates individuals ' s savings, it'promotes social unrest– it ' s simply not pretty. This publication pertained to the conclusion that in 25 out of 29 of these historic situations of devaluation, the trigger was that there was money creation that funded federal government shortages. These charts ought to be persuading evidence that the cash production– which is fifty percent of this equation– is indeed happening.The second fifty percent is the federal government

deficiencies– so unless governments have the ability to make exceptionally tough choices and have the ability to” stabilize their budget plans, now we ' re going to have two out of 2 of these requirements met. The conclusion of individuals that the cash is no more trustable and must be spent quickly or else it decline– that decision, which requires to occur amongst a whole populace in order for devaluation to happen– it ' s a social point. It ' s the herd that makes a decision that they don ' t believe in the cash anymore, it ' s hard to predict. It ' s not an inevitable verdict that money development plus federal government shortages implies hyperinflation or raised rising cost of living– however it certainly doesn ' t help.The takeaway for anyone with assets to save is that it might be smart to think about the opportunity that the future could hold higher rising cost of living than what you are used to, and without a doubt what you might be comfy with. In a hyperinflation circumstance, there have actually been independent sources of scarcity that have been taken a look at to store wealth. Physical commodities, for silver, gold and instance– these are the timeless ones.And given that 2009, there ' s a new choice for mankind, that remains in the type of digital assets, which became possible to think about after the advancement of the Satoshi Nakamoto Bitcoin white paper. Let ' s comparison electronic fiat versus decentralized digital deficiency like Bitcoin and Monero. Fiat cash gives digital deficiency, it ' s just that that deficiency is regulated by a centralized entity.

Accessibility to the data source of that possesses what is shielded– there ' s a moat of firewall programs around that.Once you have accessibility, you have a fair bit of ability to alter things. At the lower degree, like at a bank teller degree, of program you can ' t simply develop cash out of slim air. As you rise in the system, the amount of power that you have more than that data source becomes greater, so that currently you obtain to the level of the Federal Get Financial institution– it becomes approximate write access to this ledger.And obviously the software program that controls this is shut source– why would certainly they open source it– that would assist in negative actors discovering how the system functions. There are disadvantages to this; mismanagement is most likely the principal one– all these stories that I was revealing of the cash supply might be interpreted as signs of mismanagement. The Federal Get is intended to be imposing technique, independent of the political process– the Federal Book is intended to be the entity that says “no, I ' m sorry, please don ' t appearance to us to be making money out of thin air, because that ' s not lasting.” That ' s what the Federal Book is expected to do. It ' s not actually doing that. There ' s additionally expert abuse that is a trouble with these type of central protection models. There are lots of instances of big financial institutions that do outright points to abuse the trust fund of their consumers and

obtain away with it with simply an add the wrist.Basically, you have middlemen in between individuals and the database– these intermediaries who remain in a position of power– and so there ' s little reward to enhance. The decentralized security model of Bitcoin, and additionally Monero, is absolutely different. In these decentralized networks, anyone can sign up with the peer-to-peer network. Anybody can download the Monero code, run it on their computer system, and enter into this network which does the functions of what a bank does.So in “comparison to the central security model where you have a master database sitting in the middle with all kind of firewalls and securities around it to try and safeguard it from abuse, here each node has its own copy of the data source that includes a record of who sent what to who. In the decentralized security model it ' s open source– it would need to be– if anyone is able to sign up with the peer-to-peer network, you ' d far better make your code open source, since otherwise, just how do you understand what you ' re running? “The Sanctuary and the Bazaar,” the traditional open resource software development book that contrasts the building of a sanctuary– which is a central procedure a la Microsoft– compared to the market– which is a farmers ' market where every person is complimentary to turn up and simply develop something– which would certainly be the Linux design. These two scenarios– fiat versus decentralized cash– it ' s truly like Microsoft versus Linux. Of training course there are drawbacks to use of FOSS in cash; it ' s new, less people have listened to of it.It ' s relatively inefficient, due to the fact that if there ' s no “boss” computer system within this peer-to-peer network, after that just how are you mosting likely to choose what real version is of the database that keeps an eye on who has what? Presently, cryptocurrencies are able to be traded for fiat money, yet this made use of to not hold true. Back in 2009, Bitcoin had absolutely no buck value. It was this intriguing inquisitiveness of a system that purported to make a new kind of deficiency that “acted like cash. Back in 2009,” nobody recognized that that was actually the instance; nobody understood if this point would in fact work like it stated it would certainly work. Therefore, I think it ' s a great concept, if you ' re new to cryptocurrency– prior to you obtain' caught up in the most recent rate movement of this and that currency and the equine race– I would recommend making believe that all of cryptocurrency has absolutely no value.It ' ll wind up being good for you in the future since you ' ll have an even more strong understanding of what ' s actually going on with this things that you ' re trading.

Currently there are 3 elements that you need to obtain functioning to produce an exclusive type of money. You have to have some feeling of what is the example of a financial institution account. Second, is you require to have some analogy to what it is to compose a check– and 3rd, you require to have some type of procedure for that check, once it ' s revealed to be legit, to be refined with the system.So, I ' d like to transform the clock back and summarize how Bitcoin functions. Bitcoin is based upon the secp256k1 elliptic contour, and that ' s created out here– it ' s open secret what this elliptic curve is, there ' s absolutely nothing secret concerning it, it'' s a public requirement: y settled is conforming to x cubed plus 7, mod this really large prime number. x and y, usually, you take being real numbers– assume of senior high school algebra, and you wish to plot this contour, you ' ll make a curved shape out of this– but in this instance, we ' re limiting x and y to be integers. And moreover, these integers are modulus this prime number, which is basically clock arithmetic– this is stating that 1 o ' clock, 13 o ' clock, 25 o ' clock are all the exact same, because every 12, your checking goes back.So that ' s the situation here, except as opposed to a clock with 12 numbers, you have a clock with a 70-some digit prime number of numbers on its dial. You have this universe-sized sheet of grid paper with (x', y)collaborates that are each integers– and several of the points on this big'sheet of grid paper are solutions to this specific elliptic contour. If one was to attempt to guess random combinations of x and y ahead up with a remedy to this, it'' s essentially impossible. Luckily, component of the elliptic curve definition is to provide you with a service called the base point. The base point is a service– x sub b, y sub b– which is recognized to solve this formula. And furthermore, due to the fact that of the mathematics of elliptic curves, if somebody provides you an integer n, it'' s possible to calculate an additional remedy, P sub n, which would be n times the base point.It ' s not simply that you take the base factor and you increase both the'x and y coordinates by the number'n, it ' s extra innovative than that. The concept is, if somebody tells you n', you can calculate the n-th factor that is a remedy to the elliptic curve. It ' s a one-way feature– so if someone informs you n, you can get P below n, however if a person tells you P below n, you can ' t get n, you need to brute pressure that.To strength this, is a 10 to the 70th opportunity of obtaining it right, which implies, could as well just not attempt. The location of that factor, converted to a string of letters and numbers, is the Bitcoin address. At the heart of it, a Bitcoin address is representing an(x, y)coordinate on the secp256k1 elliptic curve. The number n is the personal secret, that ' s the key– and knowing that number n is the licensed trademark to spend the money that is related to the public secret, P sub n. They ' re connected to each various other, to make sure that ' s why it ' s not like a password where you can just change the numbers that you ' re assigned– it doesn ' t job like that, there ' s a math formula behind it– so if somebody forgets their secret, there ' s no recourse.Getting a new Bitcoin account actually means you ' re selecting a number– you ' re picking a number in this large numerical area. You ' re calling that number your own. Much like Coca-Cola maintains the formula to its

soft drink trick, it ' s this piece of information that you can compose on an index card. You, and you alone, are the person who knows the existence of this one certain factor on the elliptic curve which is yours. If you are in possession of a public-private essential pair and you have a message that you desire to send to the world, and you desire to make sure that'every person in the world recognizes that that message came from you, and only you– you would certainly take your message, combine it with your exclusive secret, to produce a trademark– which is a block of bytes that'is distinct'to the mix of the message and the private trick.

Let ' s expand our focus to not just the eight nations in the G20 that have actually reported results recently, yet let ' s look at all the G20 fiat currencies and let ' s likewise broaden the time structure in which we ' re looking back to 2009, the year in which Bitcoin came out.Every country ' s cash is equivalent to 1 at the beginning of 2009. It ' s the herd that determines that they put on ' t have confidence in the money any much more, it ' s tough to forecast. Of training course there are downsides to use of FOSS in money; it ' s brand-new, fewer people have listened to of it.It ' s fairly inefficient, due to the fact that if there ' s no “manager” computer system within this peer-to-peer network, after that exactly how are you going to decide what the real version is of the data source that keeps track of that possesses what? And furthermore, these integers are modulus this prime number, which is essentially clock arithmetic– this is saying that 1 o ' clock, 13 o ' clock, 25 o ' clock are all the exact same, due to the fact that every 12, your counting goes back.So that ' s the instance here, other than instead of a clock with 12 numbers, you have a clock with a 70-some number prime number of numbers on its dial. The number n is the personal secret, that ' s the trick– and recognizing that number n is the licensed signature to spend the cash that is connected with the public secret, P sub n. They ' re linked to each various other, so that ' s why it ' s not such as a password where you can simply change the numbers that you ' re appointed– it doesn ' t work like that, there ' s a mathematics formula behind it– so if someone neglects their key, there ' s no recourse.Getting a new Bitcoin account really indicates you ' re selecting a number– you ' re choosing a number in this large numeric field.After that you would send your message and you would certainly include with your plaintext message the trademark, which is this byte block that you generated.As a recipient now, you get this message and you obtained the trademark from the supposed sender, and you integrate this with the general public key which you recognize to be from the sender. When you combine all three of those, you get a binary confirmation result that says, “yes” this was a genuine message” from the sender, or “no” it was not. This type of message signing happens in a range of calculating contexts– as an example, HTTPS utilizes this– below we ' re simply utilizing it in a self-supporting financial accounting system. “Sending out Bitcoin” suggests that you ' re sending “this authorized message, comparable to a check'. So remarkably, knowledge of the exclusive secret, which is a type of speech, is currently identical to money. It ' s sort of an appealing point for the period that we ' re living in, the idea that knowledge of something can, in itself, be cash.Once you have a person that has a Bitcoin

account and they sign a message saying “I wish to invest this bitcoin,” that ' s going “to do the handling,” that'' s mosting likely to make certain it ' s legit? That is done by'a network of miners in Bitcoin. “” miners”” are just a word for peer-to-peer Bitcoin accountants– there is no “” boss”” computer system, they are all equal. So how do they resolve disagreements? Generally, they gossip a great deal, and they do bulk guidelines. And so each of these accountants, when they receive a spend message, they will certainly check it, and if it'' s legit, then they will certainly pass that message on to their compatriots.A block is merely a checklist of valid signed spend messages. In each block there is a little information field called the nonce that each miner is cost-free to fill with whatever random little bits they want. A block is not approved by the network up until the hash of the block is reduced than a specific number, called the trouble. The problem number is dynamically changed to make sure that the number of valid blocks that happened in a 10-minute period is 1, usually. This is something that ' s difficult to get your head around if this is the very first time you ' re hearing it, due to the fact that usually when you believe concerning hash features, you'don ' t respect the worth of what the hash is– you simply care that the hash matches another thing. As an example, if you ' re examining the download of a documents, you desire to take a hash of what it is you downloaded and inspect that against the hash of what you think you downloaded and install and see to it that they match.Here in this case, we actually care if the hash starts with a no or a one– as a matter of fact, we care concerning the first numerous digits of the hash, and we will need them to all be zeros. So each of these miners is going to attempt repetitively– and usually fail– to find a nonce that causes a block of spend messages to be considered legitimate. You have this globally network of computer systems. Each of them is churning away, brute force thinking various values of the nonce. Among them will ultimately come and be successful up with a block that satisfies the difficulty. The computer in the network that does that obtains what ' s called the block benefit, that is a bitcoin payment to the nonce solver.Once every one of the computers in'the globe obtain information of this new block– once more, since the accounting professionals right here are really gossipy– then they remove the pending deals in their very own lines with the deals that have actually been validated in this new block, and after that they proceed servicing the following block. And it ' s essential to know that every one of the cash originated as a payout to a computer in the network that was aiding to secure the bookkeeping and the bookkeeping for that network. None of the block benefit in Bitcoin was shunted off and a cut mosted likely to a group of people, or to a foundation, or utilized to do advertising. And this matters from a regulative perspective since FinCEN, which is just one of the financial regulators in the united state, defines a decentralized cryptocurrency as a currency in which the block compensates all go directly to the decentralized network that ' s doing the accounting.That ' s important since if you have a portion of cash that'' s going to a team of individuals, then that team of individuals could be taken into consideration as being the masterminds of the procedure, so based on increased policy in terms of AML/KYC regulations. So again, there ' s nobody “boss” computer system that supervises of having the correct variation of the journal. If you have a dispute in the network, who wins? Well, the answer is that the chain with even more hash power is mosting likely to be the one that is deemed to be the authoritative version of the blockchain. So this works as a self-healing system if there ' s a disparity in the state of the network.So to summarize the Bitcoin white paper: Nakamoto agreement manufactures digital shortage. There ' s a couple of various sort of deficiency.

One is account degree deficiency, that is, the establishment of building legal rights in this system of accounting– so that is applied in Bitcoin by the individuals– the individual ' s option and subsequent defense of an elliptic curve exclusive key. How do we understand that we ' re not mosting likely to have a scenario like we have in fiat'banking, where we have a cash supply whose quantity is unpredictable over time, and undergoes the decisions of a central group with approximate control of that cash supply? That is implemented by an open network of peer-to-peer accountants who are rewarded for acting continually with the agreement ruleset. Most of nodes in Bitcoin have actually coded beforehand that the overall number of bitcoins that are mosting likely to be awarded to miners is going to be a total sum of 21 million bitcoin. You need bulk decisions on this network to be thought about right, that ' s just how you get around the truth that there ' s no “manager” computer– basically the bulk regulations comes to be in charge– therefore a rogue computer that ' s introduced to the network is mosting likely to have absolutely no'effect on it– unless it can take care of to obtain 51 percent of the “hash” power, which is challenging and pricey to do.Finally you have data source adjustment deficiency, which is record durability. Every block in the Bitcoin blockchain has a low hash number, therefore that makes each item of data that gets contributed to the blockchain an unusual piece of data.

It took a whole lot of experimentation, to put it simply, it took a whole lot of proof-of-work to get that information included in the blockchain, therefore it ' s extraordinarily challenging to make modifications to that database– specifically as time goes on and more evidence of job obtains stacked on top of the older purchases. Okay, so allow ' s comparison that with the scarcity attributes of Monero. Monero is not a code fork of Bitcoin– most crucial when evaluating, is Monero something worth thinking about considered that Bitcoin existed first– most cryptocurrencies merely did a copy-paste of Bitcoin ' s code and after that made a couple of, most of the times trivial, changes and after that release that and call it your own cryptocurrency. One standard that one can use to trim the part of cryptocurrencies that deserve thinking about, is this: is it simply a Bitcoin'fork? Just how much original intellectual initiative entered into the production of this various other cryptocurrency? In Monero it has its own separate codebase.In reality, it makes use of an entirely various elliptic curve than Bitcoin: Monero makes use of ed25519. That is, the (x, y) factors on this enormous sheet of grid paper– which is basic to how the cryptocurrency works– that very equation is various in Monero than it is in Bitcoin.

To the degree that the elliptic contour used in Bitcoin might or might not have weak points connected with it– this is a type of technical hedging in which Monero has actually picked, deliberately, a different elliptic curve. In Monero, there are 2 personal tricks: there ' s an invest crucial and a view trick. The invest key works like the Bitcoin personal key– if you understand the spend crucial, you remain in complete control of your account. There ' s a 2nd secret, the sight trick, which is a cryptographic subset of the invest key– if you recognize the view key then you can check out information of deals that you were entailed in.One of the misconceptions regarding Monero is it ' s simply this totally secret box so you can tell nothing about around what ' s taking place in it. If you share your view secret, you can really share information of what ' s going on in your specific Monero account. It supplies opt-in transparency.

In Monero the address space is bigger: 10 to the 76th'different addresses to choose from, versus 10 to the 60th in Bitcoin. This means that there is even more safety and security in regards to the birthday trouble. When one is choosing a cryptocurrency account, one is merely picking a point on this grid paper. What is the danger that somebody else on the planet selects the point that I picked? If they select the point that I select, then they will certainly recognize the private and public tricks for that elliptic curve point. I ' m going to be sharing my my cash with this stranger someplace else in the world.That is an opportunity– so in that sense there is safety by obscurity in cryptocurrencies– yet that is minimized by the vast number of addresses that are feasible. And there ' s an even much more substantial variety of addresses in Monero than there are in Bitcoin– by 10 to the 16th. The disadvantage of this is that you have a much less straightforward

experience, due to the fact that the address lengths in Monero are long strings of letters and numbers. The emission timetable is various in Monero family member to Bitcoin. In Bitcoin, every 210,000 blocks, the miner incentive that heads out per miner who effectively adds a block to the network obtains reduced in half. If you ' re a Bitcoin miner, there is a date coming up at some point in the next four years in which your earnings from aiding add to the Bitcoin community obtains cut in fifty percent. If you ' re doing mining for service this is a rather disruptive thing. This is something in which Monero has checked out the granddaddy cryptocurrency, thought of what they ' re doing, and attempting something a bit various that could aid matters a little bit. Therefore in Monero the exhaust is constantly lowering so we are saved from this dramatization in Bitcoin of having an every-four-year'interruption thrown in to the mining ecosystem.There ' s a type of undesirable deficiency, and that is future miner rewards. In Bitcoin, the miner incentive is reduced in fifty percent every 4 years, as I just described. What that indicates is that in, claim, 40 years from now, the bitcoin incentive is going to be one-half to the 10th power, that ' s regarding 1/1000th of what it is currently. This raises a concern: are miners in the Bitcoin network

— because size of time from now– are they going to discover that to be enough incentive to keep functioning for the network? There ' s some academic study that shows that the service that Bitcoin has actually generated– which is to set up a fee market in which the people who transact end up involving in a auction-like procedure procedure to bid up the charge that they provide– that that idea might not be sufficient to incentivize miners in the future. In Monero what we have what we call the tail discharge, that is, that the block incentive is never ever going to be less than 0.3 Monero per min. In time, the number of Monero around is mosting likely to linearly boost forever. This obtains represented as being “unlimited discharge” by people that are not considering it very, I would certainly say, rather. The reason is that the absolute value of emission is not relevant in any kind of macroeconomic concept. Any macroeconomic concept that thinks about what the cash supply is and the effects of modifications in that cash supply in the macroeconomy will certainly look at the portion increase of that money supply. It ' s not the outright

value of U.S. dollars boosting “that ' s pertinent, it ' s the percent increase in U.S. dollars that ' s relevant. And if you have a cash supply, like Monero, that is enhancing linearly in time– every year, the cash supply is going to expand by a fixed continuous amount– which is what straight development just implies– however that ' s going to be added to a pre-existing base of monero that is mosting likely to be growing.Therefore the rising cost of living price in portion terms is going to be reducing and asymptotically mosting likely to zero. Which suggests that that is the appropriate input to any type of macroeconomic theory that uses the expansion of the money supply– an asymptotically absolutely no inflation price– therefore to claim that identically no rising cost of living rate is an absolutely different circumstance than an asymptotically zero inflation rate is foolish. It ' s just not accurate. It is understandable that 21 million Bitcoin is the only amount that ' s ever going to be produced, however it results in a little bit of a laziness of thinking in which one concerns this false final thought that needs to have a identically no inflation price in order to be macroeconomically negligible. What do we obtain in Monero for having this tail discharge? We understand in Monero that miner motivations are going to be there in perpetuity. In Monero, we do not have a civil battle over who is mosting likely to be paying for miner incentives in the future. Now this sounds like it could be academic and unimportant, but this entire setting in Bitcoin that we are going to get the transactors of Bitcoin to take part in this cost market– the feasibility of that was disputed within Bitcoin and was just one of the factors bring about the separation of Bitcoin versus Bitcoin Cash.We avoid all that in Monero by having this tail discharge. Right here are some graphes that show what I ' m discussing. I ' m considering a time range of 2009, heading out 15 years right into the future to the year 2035. There have had to do with 18 million bitcoin produced and they ' re mosting likely to be 3 million even more developed for the remainder of time. In Monero, we likewise have a predefined schedule wherefore the coin discharge is going to more than time. Therefore to the left of August 2020, you see what actually occurred in regards to discharge in the Monero

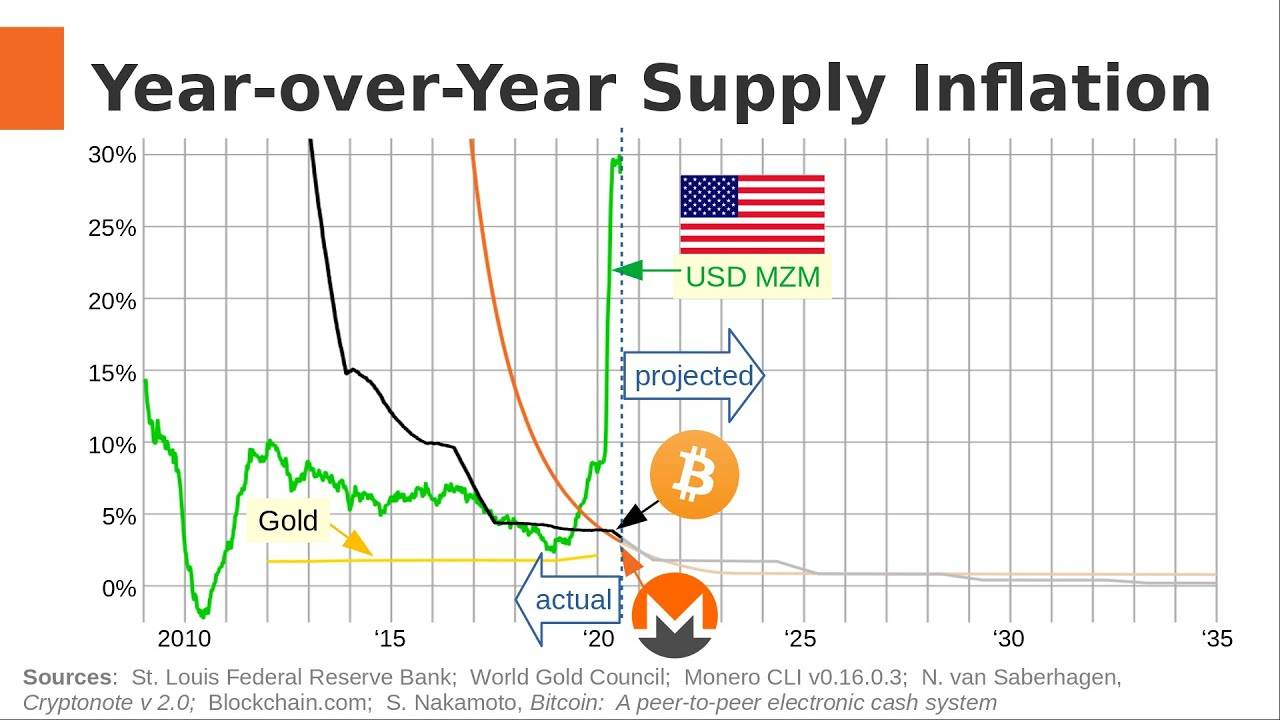

blockchain up to currently, and after that in the future you can see the tail exhaust in Monero appears as a straight line that ' s somewhat tilted up to the right– that ' s the tail exhaust in which there ' s mosting likely to be a set number of Monero devoted to be handed out'to miners every year, in perpetuity.This differs from Bitcoin, in which they have an issue to take care of, which is, exactly how do they guarantee that the miners in the much future are going to be incentivized to keep using their power to maintain sustaining their network? This is year-over-year supply inflation: how much united state bucks have actually there been versus just how much U.S. bucks have actually there been a year back, at'the very same date. We have a terrifying circumstance with the cash supply of the U.S. dollar. As a result of the pandemic, this has increased up to about 30 percent. Hopefully it works out for the best, due to the fact that if it doesn ' t, there ' s mosting likely to be a great deal of suffering by humankind– however the scenario is what it is.For those people trying to find a source of scarcity that is gold or gold-like– this is what you ' re looking at: you have gold and you have brand-new digital options in the kind of Bitcoin and Monero. The Globe Gold Council keeps an eye on its quote of just how much above-ground gold there remains in the world annually, which has actually been boosting at a pretty consistent rate about 1.8 percent per year. If you use that as your base test, a working interpretation of sound money would certainly give deficiency that inflates by 1.8 percent annually, or much less. Bitcoin and Monero both are showing up on a brand-new era of

deficiency. The inflation prices of both Bitcoin and Monero are going to be less than gold, so both will certainly please that definition of audio cash– a digital kind of sound money.There ' s one more kind of undesirable scarcity that I want to chat concerning: that is, mining equipment. In the Bitcoin white paper there ' s this expression, “one CPU, one ballot”– and what that implies is that you intend to have every miner ' s chance of hitting a block benefit be proportional to the financial investment that they place in to safeguarding the network. Now regrettably, silicon economic climates of scale destroy this linearity. If you have an algorithm that is easy sufficient that you can create a piece of silicon to do nothing yet that formula incredibly efficiently, after that you ' ll have an advantage over basic function computer tools like CPUs.In Bitcoin, you have precisely this scenario. The evidence of job formula in Bitcoin is easy sufficient that ASICs got custom-made created to do nothing yet the Bitcoin proof-of-work algorithm over and over. And” unfortunately, every one of the requisite hardware takes place to be all made'in China, so Bitcoin mining currently is a Chinese-dominated oligopoly. This is not necessarily a problem that it ' s China; the problem is that it ' s simply one part of the world that successfully has a monopoly on the manufacturing of the essential devices to maintain the accountancy system. At this moment, if you are simply a normal individual with a gaming computer system at'home, and you want to join that to the Bitcoin network and attempt to see if you can maybe hit

a block– you have a greater chance of winning the lottery than obtaining a Bitcoin block incentive. It ' s unworthy your time, it ' s not worth the added electrical power that your computer system is mosting likely to consume while it ' s attempting to find up with blocks to please the Bitcoin network.So in Monero, we have actually taken steps to try to maintain the proof of job formula feasible for tiny independent miners who wear ' t always have, as an example, 50 million bucks to spend on their very own silicon fabrication facility, or have social invasions with the Chief executive officers of the firms who do have these silicon fabs. If you look at the proof of work of Monero given that 2018, it has altered 4 times. It started as Cryptonight, after that Cryptonight v2 came, Cryptonight v3, after that Cryptonight-R, and currently RandomX. To sustain that narrative, this is a graph of the Monero network'difficulty, 2014 to the here and now. So with variation 0.11 of Monero, the evidence of job was Cryptonight. You can see that the problem was proceeding along for numerous years

, and afterwards there ' s a spike upwards, took ASICs coming onto the system. There were chip suppliers who checked out the Monero evidence of work, found out just how to program the Monero proof of infiltrate a custom-made item of silicon, make that item of silicon, plug it right into the network, and afterwards begin getting an out of proportion share of block rewards.Once that happened, there was some alarm system in the Monero neighborhood, so function begun on a variant of the Cryptonight evidence of job. So Cryptonight v2 was established, and examined, and afterwards released on the network. When that occurred you can see the problem took a nosedive, due to the fact that all these ASICs that were previously viable and collecting a great deal of the block reward were now locked out, due to the fact that the proof of job altered on them. Several months later, there was another higher spike in the trouble– there ' s a several month preparation from the time that you develop an ASIC to the moment that you really fabricate it in adequate quantity to make a large damage on the network– so that was ASICs coming back on the internet. Cryptonight was patched once again.

Once again there was another hard fork in late 2018 to change to Cryptonight v3. That functioned for one more few months. After that the problem spiked up again. And afterwards there was Cryptonight-R– mercifully, there was this silence from the ASIC supplier. And then lastly, there was an advanced modification in the proof-of-work algorithm to RandomX which makes use of a randomly produced algorithm that needs to be carried out in order to do the proof of work. It utilizes not only integer operations however also drifting point procedures, and so it'' s an extremely intriguing example of a proof-of-work algorithm– for which the personalized item of silicon that will certainly do RandomX the most effective takes place to be an AMD Ryzen Threadripper, which is something that you can buy on Amazon.Commodity equipment

is one of the most reliable at doing the Monero evidence of work. These ASIC makers do not have the most straightforward online reputation, shall we claim, of right away shipping their product out once a consumer purchases an ASIC. There has a tendency to be a several month lag because of, you know, “testing”– and why would a ASIC producer want to postpone delivery of item that ' s been spent for? Well, they wish to collect Bitcoin obstruct benefits with their consumers ' hardware prior to they send it out.So that ' s the shenanigans that needs to handle when one does not have a product piece of equipment to do evidence of work. Considering that RandomX has gone right into impact, what is indicated by a hash now is various in RandomX versus Cryptonight, so there ' s a single dive in the difficulty which is worthless– but given that RandomX went in, all indications have been that CPUs have, once more, been dominating the network. There ' s been a huge degree of effort that ' s entered into this. This is exceptional for any cryptocurrency. It ' s a testament to the persistence, and really, the unanimity of the Monero neighborhood in having this objective of something that ' s in fact decentralized in method, with small independent miners having a shot at'obtaining a block incentive in Monero. Another kind of undesirable deficiency is access to layer one. Bitcoin ' s one megabyte block restriction created a job fork.

There ' s a second secret, the sight trick, which is a cryptographic subset of the invest vital– if you understand the view key after that you can look at information of purchases that you were included in.One of the misunderstandings about Monero is it ' s simply this totally secret box so you can tell absolutely nothing about about what ' s going on in it. It ' s not the absolute

value of U.S. bucks raising “that ' s pertinent, it ' s the portion boost in United state bucks that ' s pertinent. Ideally it functions out for the ideal, because if it doesn ' t, there ' s going to be a lot of suffering by mankind– however the circumstance is what it is.For those people looking for a resource of shortage that is gold or gold-like– this is what you ' re looking at: you have gold and you have brand-new digital options in the kind of Bitcoin and Monero. It ' s not worth your time, it ' s not worth the extra electricity that your computer is going to consume while it ' s attempting to come up with blocks to please the Bitcoin network.So in Monero, we have actually taken steps to attempt to maintain the proof of job algorithm sensible for small independent miners who put on ' t always have, for example, 50 million dollars to spend on their own silicon manufacture facility, or have social invasions with the CEOs of the firms that do have these silicon fabs. Well, they want to collect Bitcoin obstruct rewards with their clients ' hardware prior to they send it out.So that ' s the wrongdoings that one has to deal with when one does not have an asset piece of hardware to do proof of work.There is a controversy regarding whether this line of code which Satoshi had actually taken into the Bitcoin client, stating that blocks have to be no bigger than one megabyte in dimension, which is something that Satoshi did as a kludgy means of protecting against the network from obtaining spammed.The idea that

there'' s mosting likely to be a difficult block limitation that doesn'' t modification has survived in Bitcoin– at the very least, in the dominant post-divorce execution of Bitcoin. I'' m showing an exponential range, so this is 10 deals a day on the base to a million purchases a day on the top. In Bitcoin you can see that the transactions daily in Bitcoin have actually asymptotically struck a ceiling, which is due to this set megabyte block limit.Again in Monero, we check out what ' s taking place in the grandfather cryptocurrency, and provide everything due respect as the initial to exist– yet we ' re checking out what might be done'as an alternate remedy to some of these concerns. Therefore in Monero, we use what is called a flexible block weight– it utilized to be called the flexible block dimension however there were alterations to the formula so currently it ' s called the flexible block weight– the fundamental concept is that there is no hard-coded restriction on the size of a Monero block.There is a miner disincentive that kicks in when obstructs obtain as well huge– so that disincentivizes miners from consisting of a whole bunch of purchases into a block. There are individual fees that additionally enhance if the blocks obtain also huge. If there is organic growth in the need for Monero deals, the dimension can dynamically broaden. From this past history of transactions daily, you can make a quite excellent argument that the pattern line of this, purchases daily, gets on the means up. It ' s not likely to be spam relevant– it ' s not likely that spammers are simply very carefully spamming the network by just a bit and afterwards increasing the quantity of spam that they send gradually– this appears to be natural growth in the need for Monero purchases. [From] 2016 to this time around today, that ' s a 10x increase in the deals daily. It doesn ' t resemble much on this graph, but that is fairly significant. In four years, at this speed, we ' re mosting likely to be checking out a hundred thousand deals each day, and after that in the year 2028, possibly in DEF CON we ' ll be revealing a million purchases a day, that recognizes. Now of the talk I intend to speak about fungibility and transparency– and this is where the 2 “goal declarations” of these 2 cryptocurrency jobs start to split rather highly. Bitcoin is transparent. Etched forever for everybody to see, is for each purchase, you can see the sender the amount and the receiver; for every address, you can see a full online balance history.This contrasts what you may have spoken with the prominent press, if you ' re new to getting involved in the real details of cryptocurrency, since the news reports always make Bitcoin out

to be this anonymous currency that no one understands anything around. Absolutely nothing might be additionally from the fact– it ' s actually totally clear. For high-net-worth customers that I work with in my consulting technique, this has a tendency to be a show stopper, once they understand regarding it– when they come to be mindful of this fact, that if you place a million bucks into Bitcoin, as quickly as they recognize your Bitcoin address, anybody on the planet can most likely to their blockchain traveler, enter that address and see there ' s 100 bitcoin in there, that ' s worth a great deal of money.No one with wide range wants to relay that to the globe– it ' s just unthinking, and it ' s dangerous. The fact that there ' s this openness in Bitcoin places innocent individuals at risk. Additionally, services– because businesses have, as component of their secret sauce as to how they are able'to offer humankind and earn a profit at the very same time– is that they have a particular pattern of providers they get their inputs from. Typically times, the rates of those products might not be public expertise. There are great deals of profession keys that organizations have and there ' s no embarassment because– somehow, for some people, any kind of kind of wish for privacy obtains depicted as being something nefarious.Businesses regularly require privacy in order to endure as companies, in order for their copyright, their profession keys, to not be duplicated by rivals. One more trouble in Bitcoin that goes past privacy is fungibility.

Every coin in the Bitcoin network is traceable back to the miner. It ' s as if you have a$ 10 expense and on the back of the$10 costs there ' s a cool chart that reveals your financial institution account numbers, and the account numbers of everybody prior to you that had that$10 expense going all the means back to the U.S.Mint that produced the $10 expense. It ' s even worse than that, because if it were in fact on a physical item'of paper after that the owner of the item of paper would be the only one that might see it. In Bitcoin, everybody worldwide can see that transaction list for each piece of currency that ' s in the whole system'. That invites voyeurism. If you understand a Bitcoin address it ' s all-natural to visit a Bitcoin explorer and enter the address and see just how much money is there and see the amount of purchases they do. I assume it ' s a pernicious social result of this feature of'the method– it ' s normalized being snoopy. There ' s likewise regret by organization, and this is even more severe. There are lots of firms out there whose work it is to attempt and link names and faces'with every address in Bitcoin. They ' re attempting to dox everybody on the Bitcoin network. And what do they finish with that information? They basically develop the matching of a social credit rating. Because every bitcoin out there can be mapped, they can make a graph showing individuals transacting money with'each other, and if any of these individuals take place to be a “bad” individual, then those people that happen to have traded money with that evildoer are now flagged as potentially being negative themselves. The problem with this is that it ' s based on imperfect info that is very easy to misinterpret. In contrast, Monero is fungible. Every Monero is equivalent from every various other Monero. There are 3 modern technologies that promote this indistinguishability. One is ring signatures, those keep negotiating senders private;

stealth addresses keep transacting receivers personal; and RingCT keeps deal amounts sent out private. When an individual joins the Monero network by downloading and install the software at getmonero.org, and running that on their computer system, and downloading a copy of the blockchain from their peer miners, then they are getting a full background of who sent what to that in Monero. The distinction is: in Monero it ' s all encrypted, since by default, it ' s none of your service. You will certainly recognize that deals happened; you will certainly recognize when they took place, and you will certainly understand that they occurred, however you won ' t see the information of what happened.Two of these three modern technologies were consisted of in the original whitepaper that specified Monero– which is the Cryptonote whitepaper– however RingCT was not. RingCT was an innovation. And the background of how this entered into the network is an example of the dedication of this team of individuals to place it in. RingCT needed several active ingredients to come to fulfillment: initially it required initial cryptographic study– we ' re talking postdoc, PhD mathematician level cryptographic research study– that experiences audit and peer evaluation. Second, you need development of code to execute this brand-new math. The math is not unimportant, and after that to create code that consistently executes that brand-new mathematics is additionally not insignificant– simply in situation there were troubles in the code that got created, it got subject to exterior audit, so primarily the Monero community was obtained for contributions to pay for outside auditors to analyze the code of RingCT and ensure that there were no subtle mistakes of memory overwrites or such, which got approved. After that finally, it doesn ' t issue if code obtains created if no one really runs it. The area of Monero node owners needed to obtain on board and download this and upgrade their computers once the new code came out, since this was a tough fork. All these active ingredients had to occur for RingCT to go in. On the top I ' m revealing daily standard bytes per purchase on both the Bitcoin network and the Monero network.Bitcoin is in black, and it ' s been rather consistent over time. That ' s part of their community principles over at Bitcoin, is that they want a secure procedure, they put on ' t intend to upset the apple cart. In Monero, we are made use of to acknowledging that they ' re mosting likely to be new research study, new developments that make fungibility also much better– and we undergo the difficulty and the time and the initiative to really make that happen. In the birth days of Monero, you see that the deal size in bytes was extremely small, due to the fact that those were primarily coinbase deals going out to vacant blocks. After that individuals began utilizing it, and after that in the early days of Monero the system utilized denominated outcomes. You can consider there resembling a one-Monero gold piece that is encased in plastic and it ' s inscribed with the owner ' s essential information on it. Once a person invests that one-Monero outcome, then it transmits, and it comes to be the property of someone else on the Monero network. And so, in the early days of Monero, you had every round number– so you had 1 with 9, 10 via 90, 100 through 900– and afterwards going the other means: 0.1 through 0.9, 0.01 via 0.09 … And so therefore there were a multitude of inputs and a lot of results on every deal. This was not so helpful for personal privacy, since if you invest 341 Monero, just to comprise a number, you can see the 300 and the 40 and the 1, you can see they ' re circumnavigating– that ' s what you could see in Monero pre-RingCT. And so, it was made a decision in the area that this was not appropriate, and so when the research for RingCT was tested and vetted and likewise externally examined there was a decision in the neighborhood to do it. Now, this was although that when RingCT was allowed, you can see there ' s this large dive in 2017 of the purchase dimension, so it mosted likely to about 10 kilobytes per transaction.But that was a cost that was determined in the Monero area was worth it to improve fungibility of the coin– which would certainly secure the innocent. Later, bulletproofs came– more creative mathematics to ensure that the balance of outputs and inputs, that is assured making use of greater mathematics in RingCT, can be done with much much less byte area than it formerly did. There ' s a research procedure, an audit process, a coding procedure, and a vetting procedure for all this for bulletproofs. However when that went online'on the network– that remained in late 2018– you can see that the purchase dimension come by primarily an order of magnitude.And then you can see here on the transaction charge side, the charges likewise came by an order of magnitude. You might argue that the Monero transaction dimensions are still a fair bit larger than Bitcoin ' s, yet there ' s a brand-new information product in the Monero research study pipeline– CLSAGs are a method to press the byte size need of purchases also additionally, in addition to what bulletproofs have done– that simply experienced an audit process and it ' s being coded up for incorporation in the following tough fork. In Monero, “difficult fork” is not a term of battle; it ' s something we expect because it indicates that new excellent stuff is going to come on

online. CLSAGs are set to go live on the network this October, and as soon as that takes place, I ' m showing in a dotted line right here the magnitude of enhancement that we ' re expecting to see post-CLSAG. There ' s a space here in between the purchase dimensions between Monero and Bitcoin, however it ' s diminishing. The factor it ' s shrinking is that there is continuous active study in Monero to boost the way the engine functions under the hood. This is the kind of thing that is actually uncommon to see in various other cryptocurrencies. Other cryptocurrencies tend to make huge announcements, use great deals of buzzwords, and not really boost anything. It ' s in fact the contrary in Monero– people work quietly without fanfare, and every now and then, present something that enhances the real item. Monero benefits individuals with nothing to hide. It does that by getting rid of the threat of obtaining coins that are polluted', as a result of no mistake of the receiver. For instance– let ' s state you ' re offering your made use of vehicle, and the individual that you market your automobile to offers you bitcoin.And, like every person else who markets their cars and truck to a complete stranger by uploading an advertisement on Craigslist, you didn ' t do a comprehensive background check on this individual who acquired your car. They had bitcoin, you had an automobile, you did an exchange, you went on your method. Unbeknownst to you, the means that they got their'bitcoin was that they were, as an example, offering drugs on the dark web– which ' s just how they came up with that bitcoin, which currently you possess, because you sold your cars and truck to he or she. And now, since the firms that are doing blockchain evaluation understand that– currently they are considering you, believing, “he or she'just got ten thousand bucks well worth of bitcoin from a known pusher … maybe

he or she is providing medicine materiel to that supplier.” Currently he or she attempts to put their tainted bitcoin into a crypto exchange to get USD out of it.Once they send their impure bitcoin to their exchange, it gets icy, and now the customer needs to go through all kinds of added hoops to show their innocence. And they ' re attempting to prove their innocence to somebody that truly doesn ' t care to recognize the reality– they just want to cover responsibility on their side, they just wish to ensure that they put on ' t enter trouble.The most convenient thing to do is simply to quarantine that cash, not give it back to the customer, “and wait for the authorities to offer them authorization to provide it back. And none of this had anything to do with the innocent person included. This is why the openness of Bitcoin is a trouble– even for innocent people that have nothing to hide. False allegations can be made versus them due to insufficient misconceptions that various other 3rd celebrations are making based on that transaction information due to the fact that the system is clear. It ' s even worse than that. So, as an example, let ' s state you ' re a proprietor of Bitcoin, you ' re entirely 100 percent spotless, and you obtain hacked. Someone steals your bitcoin. Let ' s say that the person that stole your bitcoin now takes place the dark web and spends it.Now your address, your identity, is connected with that. You could be examined for criminal activities that were committed with your bitcoin that got swiped. Therefore, now, not just are you enduring the loss of your money, you ' re having to now clarify that “it ' s not the case that I paid this guy to buy drugs for me, I in fact had my cash swiped from me!” For individuals that actually are spotless, any involvement in the Bitcoin blockchain means you have a chance of engaging with somebody else on the Bitcoin blockchain who is'not as spotless as you are. And if that takes place, that ' s mosting likely to be flagged in these'companies doing blockchain evaluation as a link, when the reality is, it ' s a false favorable. However'you as the customer have no power over that. You have no recourse; you have no other way of interacting to these companies and saying “hey, yo, I ' m really squeaky tidy.” They don ' t understand. They wear ' t treatment. One way to consider this remains in the Akerloff structure. This was a Nobel Prize winning paper in business economics; it has to do with used cars and trucks. So “first, I ' ll clarify the paper, and after that I ' ll apply it, because it has applications to both DEF CON “Safe Setting,” our online conference that we ' re doing– and additionally a surveillance state with clear coins. There are 2 pre-owned auto kinds: there are lemons and there are peaches. Lemons are the cars and trucks that are going to break today, and peaches are the well-maintained previously owned cars'. Vendors understand which kind of automobile they have– if you have a lemon, you understand it, since you were there in the hurricane when your cars and truck was under 5 feet of water and now you ' re attempting to offer your vehicle since it ' s damaged, that ' s a lemon– a peach “is an auto with the type of proprietor that transforms the'oil and does all the'upkeep that you have to do on a cars and truck to keep it in excellent condition.So the vendors

understand what kind of vehicle they have, yet the customers don ' t, since both lemon sellers and peach sellers make certain that the paint task on their automobile is additional shiny. On a shallow level, both lemons and peaches look the same to buyers. So the purchasers can ' t tell lemons in addition to peaches, yet they know that they are oblivious in this situation– they recognize that they might finish up with a lemon. The Akerloff paper remarkably clarifies this race to the base that happens in this asymmetric information market in which customers are armed with much less information than the vendors are. What is the deal rate that a customer is mosting likely to offer for a cars and truck? At the minimum, you'' re mosting likely to be offering'the lemon cost–'and then you ' re going to provide greater than the lemon rate section on what you think the probability is that you ' re going to get a peach versus a lemon.So if you think there ' s a no percent opportunity you ' re going to get a peach– well you ' re just mosting likely to supply the lemon rate. If you assume there ' s 100 percent chance that you ' re going to obtain a peach, then you ' re mosting likely to provide the lemon price plus the difference'in between the peach and the lemon rate. Simply put, you ' ll use the peach rate. If you believe the possibility is somewhere in between– after that you ' re mosting likely to adjust your offer rate to be someplace in between. That ' s the offer rate that a logical buyer is going to offer for a cars and truck in this market, in which they are oblivious, but they understand that they ' re oblivious, and they can'adjust their offer rate to account for this uncertainty.So what do the lemon sellers do when they see this rate? Well, they see'a great deal– this fool below is offering

quite a little bit higher rate'than the lemon cost. So the lemon vendor is happy– they ' re mosting likely to claim, “Okay, I thought of it and'yeah, I guess I ' ll accept your offer.” The peach seller'– they ' ve done the maintenance on their cars and truck, they know that the value of their automobile is worth what a peach is– yet you'can inform them all the time that you ' ve done an excellent task of preserving your car, but the purchaser', at the end of the day, they ' re going to be skeptical. If you ' re truly informing them the truth, they wear ' t know. They put on ' t understand if you ' re informing them the partial reality. So the rate that the buyer is mosting likely to deal is much less than that of the peach price.

Therefore what ' s going to take place after that? The peach vendors are mosting likely to become prevented. They ' re going to be disappointed by the truth that their ethical benefits in caring for their automobile is not going to be shown in a high market price.So they will leave the market– they will certainly remove their Craigslist advertisement– they will just maintain their cars and truck up until it runs into'the ground. Currently, a higher fraction of the cars and trucks that are available up for sale are now lemons. And at some point, purchasers are going'to obtain smart to that reality. When they get wise to that reality, they ' re mosting likely to reduced further their deal cost– and hence, the unfavorable responses loophole is'birthed. Every time the offer price drops, even more peach sellers are'going to obtain dissuaded and leave the marketplace. You have a circumstance at the end where just lemons exist in this vehicle market. So this was the Akerloff paper that got the Nobel Reward. Let ' s consider this in terms of the pandemic. In'health terms, peaches are people who are healthy and balanced. And they are currently encountered with the choice of: “do I take part in this very thing called DEF CON, in which a whole number of smart people obtain with each other, and speak about awesome geeky stuff, and you make new geeky close friends in Vegas and have enjoyable”– primarily, are you going to involve in this social marketplace in which you are handling other individuals? You could be dealing with all peaches when you reach the online, in-person DEF DISADVANTAGE– that is, everybody can be healthy– however you are mindful that that ' s not the case.There are mosting likely to be some lemons. There are mosting likely to be some individuals that are ill, and put on ' t know it, as a result of the nature of the infection. You have to evaluate your overall social energy of going to the conference by the possibility that you ' re going to end up with a lemon– i.e., get sick. If the charge function of getting a lemon is huge enough, and the possibility of it is big enough, then the rational point to do is to take out from that industry and determine to do DEF CON in “secure mode,” which ' s precisely what we ' ve done this year. Allow ' s apply this to the marketplace for clear coins, or monitoring coins, as I like to call them.The total history of every coin is traceable returning. That indicates, if you are a spotless individual with a great track record, you are a peach seller. Your social standing is healthy. The important things is, if you take care of bitcoin with'other individuals, are you

going to unknowingly, by mistake, do a deal with somebody who is not healthy and balanced, in terms of a lawful condition?

For high-net-worth clients that I work with in my consulting method, this has a tendency to be a show stopper, once they understand concerning it– as soon as they become conscious of this reality, that if you put a million bucks right into Bitcoin, as soon as they recognize your Bitcoin address, any person in the world can go to their blockchain explorer, kind in that address and see there ' s 100 bitcoin in there, that ' s worth a whole lot of money.No one with wide range wants to relay that to the globe– it ' s simply unthinking, and it ' s hazardous. You can suggest that the Monero purchase dimensions are still rather a bit larger than Bitcoin ' s, however there ' s a brand-new news item in the Monero research study pipeline– CLSAGs are a way to compress the byte dimension need of purchases also additionally, on top of what bulletproofs have actually done– that simply went via an audit process and it ' s being coded up for incorporation in the following difficult fork. For example, let ' s say you ' re a proprietor of Bitcoin, you ' re entirely 100 percent squeaky clean, and you obtain hacked. “initially, I ' ll explain the paper, and after that I ' ll apply it, due to the fact that it has applications to both DEF DISADVANTAGE “Safe Setting,” our online meeting that we ' re doing– and likewise a surveillance state with transparent coins. At the minimum, you'' re going to be using'the lemon price–'and then you ' re going to provide more than the lemon rate contingent on what you believe the chance is that you ' re going to get a peach versus a lemon.So if you think there ' s a no percent possibility you ' re going to get a peach– well you ' re just going to use the lemon price.You don'' t recognize

that.You could experience a “” lemon repercussion,”” simply by handling other individuals in this network, since this network has this unwanted feature that the coins are not fungible. What is a squeaky clean individual going to do? They'' re mosting likely to often tend to intend to most likely to a coin that does not put them at risk as a result of the activities that they can'' t control of other individuals on the network. You'' re going to see the squeaky tidy people going to something like Monero.Which is counterintuitive, absolutely, according to the biased and misleading representation that usually obtains put on Monero. It'' s the spotless people who need Monero one of the most. Monero is what Bitcoin noobs think they got– it'' s sound money, in secure mode. I started this talk discussing the unmanageable fiat cash supply around the globe that is presently happening as a result of the pandemic, which caused the concept that a person must perhaps spend a long time checking into alternating forms of shortage that are not regulated by governments– that would be rare-earth elements and also, currently that there'' s Nakamoto consensus, Bitcoin and Monero. Just how does one process the relative expensiveness or cheapness of these properties? Here is, I think, the only cost chart that should be looked at by any individual that'' s aiming to consider cryptocurrency as an investment.I ' m doing a long-term time range– so this is from 2009 to today, and what I ' m doing right here is I ' m revealing the worth of all the world ' s bitcoin and I ' m splitting that'by the value of all the globe ' s above-ground gold. So there are a number of variables that go right into this graph: initially, there ' s the variety of bitcoin out there at any type of provided time; there'' s the rate of bitcoin; there ' s the amount of gold around at any provided time; and there'' s the cost of gold. You need all 4 of those components to find up with this ratio chart, which I'' m revealing on log scale, once again.

And then I'' ve done that again for the value of all the world'' s Monero separated by the value of all the globe'' s gold. Presently all the world'' s bitcoin deserves something like 2 percent that of all the world'' s gold. And all the Monero worldwide deserves concerning 1/100th of one percent of all the globe'' s gold. You could be mindful that there'' s been a recent spike of rate of interest in cryptocurrency prices– bitcoin is back over 10 thousand bucks– yet you don'' t see that right here since there'' s likewise been a spike in the rate of gold. The relative appraisal of crypto to gold has actually been flat in the post-pandemic period. Is this sensible that crypto to gold cap ratios have been level during the pandemic? I'' ll leave that to you to make a decision. Second, of these two cryptocurrencies, there is one that really imitates gold, due to the fact that it'' s fungible. Gold does not carry the back of every gold bar, a listing of everybody who had that gold prior to you did. It'' s actually a much more proper comparison to compare the worth of Monero versus gold.So is it rational that the evaluation of Monero is one ten-thousandth of that of gold, whereas the valuation of bitcoin is one fiftieth of that of gold? One point I likewise wished to show was a chart that counters this extremely stagnant story that there'' s boundless rising cost of living in Monero. Allow ' s say you have a financier that decides that they wish to acquire one one-millionth of among these alternate kinds of deficiency. To shield themselves versus inflation, they are not mosting likely to acquire one one-millionth of today'' s supply; they are going to purchase one one-millionth of the supply in 100 years' ' time. So they ' re mosting likely to “take a look at: “what is the supply of this scarce asset mosting likely to remain in the year 2120– and I would certainly like to acquire one one-millionth of that, today.”” First, allow'' s check out gold. Currently, there are about 200,000 statistics heaps of above-ground gold, and gold has been expanding at regarding 1.8 percent per year.When you worsen that over a hundred years, that finishes up being quite substantial. So in 2120, at that rate, there'' s mosting likely to more than a million metric heaps of gold– which means to buy one one-millionth of all the gold in the globe, you'' re going to end up buying greater than a statistics bunch of it– which, at the current rate, is mosting likely to be $76 million worth of gold. That purchases you one one-millionth of the predicted gold supply in the year 2120. So allow'' s do that with Bitcoin. With Bitcoin, they ' re going to be really honored that a hundred years from today, there'' s going to be just 21 million bitcoin in existence. To purchase one one-millionth, just how much does it cost? 244 thousand bucks. Just how around in Monero? Currently we have the tail emission, to ensure that typically obtains tossed regarding as being “” unlimited rising cost of living.”” Well, really, we recognize what it'' s mosting likely to be. And in a hundred years from currently, the coin supply will be less than dual what it is today. That'' s not also poor for a century.So to get one

one-millionth of all the Monero that will remain in the world in the year 2120? 3 thousand bucks. If you wish to discover more about Monero– there'' s monerovillage.org for the rest of the festivities occurring this week. Also, the main site is getmonero.org– that'' s essential to recognize, it'' s “obtain monero dot org””– not various other versions. If you wish to contact me over email, it'' s Daniel at Sweetwater dot Consulting. Thanks for your interest.