Income inequality in the United States has

increased significantly since the 1970s after several decades of stability, meaning the

share of the nation's income received by higher income households has increased. This trend is evident with income measured

both before taxes (market income) as well as after taxes and transfer payments. Income inequality has fluctuated considerably

since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s,

with a 30-year period of relatively lower inequality between 1950–1980. Recasting the 2012 income using the 1979 income

distribution, the bottom 99% of families would have averaged about $7,100 more income.Measured

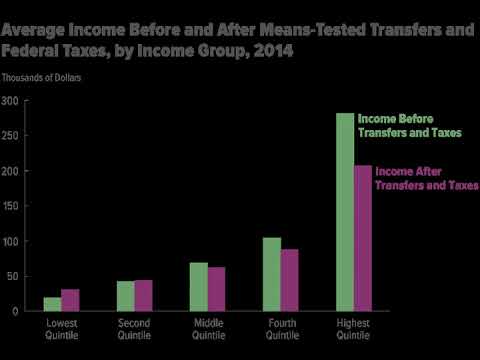

for all households, U.S. income inequality is comparable to other developed countries

before taxes and transfers, but is among the highest after taxes and transfers, meaning

the U.S. shifts relatively less income from higher income households to lower income households. Measured for working-age households, market

income inequality is comparatively high (rather than moderate) and the level of redistribution

is moderate (not low). These comparisons indicate Americans shift

from reliance on market income to reliance on income transfers later in life and less

than households in other developed countries do.The U.S.

Ranks around the 30th percentile

in income inequality globally, meaning 70% of countries have a more equal income distribution. U.S. federal tax and transfer policies are

progressive and therefore reduce income inequality measured after taxes and transfers. Tax and transfer policies together reduced

income inequality slightly more in 2011 than in 1979.While there is strong evidence that

it has increased since the 1970s, there is active debate in the United States regarding

the appropriate measurement, causes, effects and solutions to income inequality. The two major political parties have different

approaches to the issue, with Democrats historically emphasizing that economic growth should result

in shared prosperity (i.e., a pro-labor argument advocating income redistribution), while Republicans

tend to avoid government involvement in income and wealth generation (i.e., a pro-capital

argument against redistribution). == Overview == U.S. income inequality has grown significantly

since the early 1970s, after several decades of stability, and has been the subject of

study of many scholars and institutions.

The U.S. consistently exhibits higher rates

of income inequality than most developed nations due to the nation's enhanced support of free

market capitalism and less progressive spending on social services.The top 1% of households

received approximately 20% of the pre-tax income in 2013, versus approximately 10% from

1950 to 1980. The top 1% is not homogeneous, with the very

top income households pulling away from others in the top 1%.

For example, the top 0.1% of households received

approximately 10% of the pre-tax income in 2013, versus approximately 3–4% between

1951–1981. According to IRS data, adjusted gross income

(AGI) of approximately $430,000 was required to be in the top 1% in 2013.Most of the growth

in income inequality has been between the middle class and top earners, with the disparity

widening the further one goes up in the income distribution. The bottom 50% earned 20% of the nation's

pre-tax income in 1979; this fell steadily to 14% by 2007 and 13% by 2014. Income for the middle 40% group, a proxy for

the middle class, fell from 45% in 1979 to 41% in both 2007 and 2014.To put this change

into perspective, if the US had the same income distribution it had in 1979, each family in

the bottom 80% of the income distribution would have had $11,000 more per year in income

on average in 2012, or $916 per month. This figure would be $7,100 per year for the

bottom 99% of families comparing 1979 and 2012, or about $600/month.The trend of rising

income inequality is also apparent after taxes and transfers. A 2011 study by the CBO found that the top

earning 1 percent of households increased their income by about 275% after federal taxes

and income transfers over a period between 1979 and 2007, compared to a gain of just

under 40% for the 60 percent in the middle of America's income distribution.

U.S. federal tax and transfer policies are

progressive and therefore substantially reduce income inequality measured after taxes and

transfers. They became moderately less progressive between

1979 and 2007 but slightly more progressive measured between 1979 and 2011. Income transfers had a greater impact on reducing

inequality than taxes from 1979 to 2011.Americans are not generally aware of the extent of inequality

or recent trends. There is a direct relationship between actual

income inequality and the public's views about the need to address the issue in most developed

countries, but not in the U.S., where income inequality is larger but the concern is lower. The U.S. was ranked the 6th from the last

among 173 countries (4th percentile) on income equality measured by the Gini index.There

is significant and ongoing debate as to the causes, economic effects, and solutions regarding

income inequality.

While before-tax income inequality is subject

to market factors (e.g., globalization, trade policy, labor policy, and international competition),

after-tax income inequality can be directly affected by tax and transfer policy. U.S. income inequality is comparable to other

developed nations before taxes and transfers, but is among the worst after taxes and transfers. Income inequality may contribute to slower

economic growth, reduced income mobility, higher levels of household debt, and greater

risk of financial crises and deflation.Labor (workers) and capital (owners) have always

battled over the share of the economic pie each obtains.

The influence of the labor movement has waned

in the U.S. since the 1960s along with union participation and more pro-capital laws. The share of total worker compensation has

declined from 58% of national income (GDP) in 1970 to nearly 53% in 2013, contributing

to income inequality. This has led to concerns that the economy

has shifted too far in favor of capital, via a form of corporatism, corpocracy or neoliberalism.Although

some have spoken out in favor of moderate inequality as a form of incentive, others

have warned against the current high levels of inequality, including Yale Nobel prize

for economics winner Robert J.

Shiller, (who called rising economic inequality "the most

important problem that we are facing now today"), former Federal Reserve Board chairman Alan

Greenspan, ("This is not the type of thing which a democratic society – a capitalist

democratic society – can really accept without addressing"), and President Barack Obama (who

referred to the widening income gap as the "defining challenge of our time"). == History == === Post-civil war era to around 1937 ===

The level of concentration of income in the United States has fluctuated throughout its

history.

The first era of inequality lasted roughly

from the post-civil war era or "the Gilded Age" to sometime around 1937. In 1915, an era in which the Rockefellers

and Carnegies dominated American industry, the richest 1% of Americans earned roughly

18% of all income. By 2007, the top 1 percent accounted for 24%

of all income and in between, their share fell below 10% for three decades. === The Great Compression, 1937–1967 ===

From about 1937 to 1947, a period dubbed as the "Great Compression" – income inequality

in the United States fell dramatically. Highly progressive New Deal taxation, the

strengthening of unions, and regulation of the National War Labor Board during World

War II raised the income of the poor and working class and lowered that of top earners. From the early 20th century, when income statistics

started to become available, there has been a "great economic arc" from high inequality

"to relative equality and back again", according to Nobel laureate economist Paul Krugman.For

about three decades ending in the early 1970s, this "middle class society" with a relatively

low level of inequality remained fairly steady , the product of relatively high wages for

the US working class and political support for income leveling government policies.

Wages remained relatively high because American

manufacturing lacked foreign competition, and because of strong trade unions. By 1947 more than a third of non-farm workers

were union members, and unions both raised average wages for their membership, and indirectly,

and to a lesser extent, raised wages for workers in similar occupations not represented by

unions. According to Krugman political support for

equalizing government policies was provided by high voter turnout from union voting drives,

the support of the otherwise conservative South for the New Deal, and prestige that

the massive mobilization and victory of World War II had given the government.On the other

hand, a Marxist writing in the 1950s and 1960s believed "While the American worker enjoys

the highest standard of living of any worker in the world, he is also the most heavily

exploited.

This tremendously productive working class

gets back for its own consumption a smaller part of its output and hands over in the form

of profit to the capitalist owners of the instruments of production a greater part of

its output than does either the English or the French working class." === Post-1970 increase === The return to high inequality, or to what

Krugman and journalist Timothy Noah have referred as the "Great Divergence", began in the 1970s. Studies have found income grew more unequal

almost continuously except during the economic recessions in 1990–91, 2001 (Dot-com bubble),

and 2007 sub-prime bust.The Great Divergence differs in some ways from the pre-Depression

era inequality.

Before 1937, a larger share of top earners

income came from capital (interest, dividends, income from rent, capital gains). After 1970, income of high-income taxpayers

comes predominantly from labor: employment compensation.Until 2011, the Great Divergence

had not been a major political issue in America, but stagnation of middle-class income was. In 2009 the Barack Obama administration White

House Middle Class Working Families Task Force convened to focus on economic issues specifically

affecting middle-income Americans. In 2011, the Occupy movement drew considerable

attention to income inequality in the country.CBO reported that for the 1979-2007 period, after-tax

income of households in the top 1 percent of earners grew by 275%, compared to 65% for

the next 19%, just under 40% for the next 60%, 18% for the bottom fifth of households.

"As a result of that uneven income growth,"

the report noted, "the share of total after-tax income received by the 1 percent of the population

in households with the highest income more than doubled between 1979 and 2007, whereas

the share received by low- and middle-income households declined. … The share of income received by the top

1 percent grew from about 8% in 1979 to over 17% in 2007. The share received by the other 19 percent

of households in the highest income quintile (one fifth of the population as divided by

income) was fairly flat over the same period, edging up from 35% to 36%."According to the

CBO, the major reason for observed rise in unequal distribution of after-tax income was

an increase in market income, that is household income before taxes and transfers. Market income for a household is a combination

of labor income (such as cash wages, employer-paid benefits, and employer-paid payroll taxes),

business income (such as income from businesses and farms operated solely by their owners),

capital gains (profits realized from the sale of assets and stock options), capital income

(such as interest from deposits, dividends, and rental income), and other income.

Of them, capital gains accounted for 80% of

the increase in market income for the households in top 20%, in the 2000–2007 period. Even over the 1991–2000 period, according

to the CBO, capital gains accounted for 45% of the market income for the top 20% households. In a July 2015 op-ed article, Martin Feldstein,

Professor of Economics at Harvard University, stated that the CBO found that from 1980 to

2010 real median household income rose by 15%. However, when the definition of income was

expanded to include benefits and subtracted taxes, the CBO found that the median household's

real income rose by 45%. Adjusting for household size, the gain increased

to 53%. === Effects of 2007–2009 recession ===

Just as higher-income groups are more likely to enjoy financial gains when economic times

are good, they are also likely to suffer more significant income losses during economic

downturns and recessions when they are compared to lower income groups.

Higher-income groups tend to derive relatively

more of their income from more volatile sources related to capital income (business income,

capital gains, and dividends), as opposed to labor income (wages and salaries). For example, in 2011 the top 1% of income

earners derived 37% of their income from labor income, versus 62% for the middle quintile. On the other hand, the top 1% derived 58%

of their income from capital as opposed to 4% for the middle quintile.

Government transfers represented only 1% of

the income of the top 1% but 25% for the middle quintile; the dollar amounts of these transfers

tend to rise in recessions.This effect occurred during the Great Recession of 2007–2009,

when total income going to the bottom 99 percent of Americans declined by 11.6%, but fell by

36.3% for the top 1%. Declines were especially steep for capital

gains, which fell by 75% in real (inflation-adjusted) terms between 2007 and 2009. Other sources of capital income also fell:

interest income by 40% and dividend income by 33%. Wages, the largest source of income, fell

by a more modest 6%. The share of pretax income received by the

top 1% fell from 18.7% in 2007 to 16.0% in 2008 and 13.4% in 2009, while the bottom four

quintiles all had their share of pretax income increase from 2007 to 2009. The share of aftertax income received by the

top 1% income group fell from 16.7%, in 2007, to 11.5%, in 2009.

=== 2009–present ===

The distribution of household incomes has become more unequal during the post-2008 economic

recovery as the effects of the recession reversed. CBO reported in November 2014 that the share

of pre-tax income received by the top 1% had risen from 13.3% in 2009 to 14.6% in 2011. During 2012 alone, incomes of the wealthiest

1 percent rose nearly 20%, whereas the income of the remaining 99 percent rose 1% in comparison. By 2012, the share of pre-tax income received

by the top 1% had returned to its pre-crisis peak, at around 23% of the pre-tax income

according to an article in The New Yorker. This is based on widely cited data from economist

Emmanuel Saez, which uses "market income" and relies primarily on IRS data. The CBO uses both IRS data and census data

in its computations and reports a lower pre-tax figure for the top 1%. The two series were approximately 5 percentage

points apart in 2011 (Saez at about 19.7% versus CBO at 14.6%), which would imply a

CBO figure of about 18% in 2012 if that relationship holds, a significant increase versus the 14.6%

CBO reported for 2011. The share of after-tax income received by

the top 1% rose from 11.5% in 2009 to 12.6% in 2011.Between 2010 and 2013, inflation-adjusted

pre-tax income for the bottom 90% of American families fell, with the middle income groups

dropping the most, about 6% for the 40th-60th percentiles and 7% for the 20th-40th percentiles.

Incomes in the top decile rose 2%.During the

2009-2012 recovery period, the top 1% captured 91% of the real income growth per family with

their pre-tax incomes growing 34.7% adjusted for inflation while the pre-tax incomes of

the bottom 99% grew 0.8%. Measured from 2009–2015, the top 1% captured

52% of the total real income growth per family, indicating the recovery was becoming less

"lopsided" in favor of higher income families. By 2015, the top 10% (top decile) had a 50.5%

share of the pre-tax income, close its highest all-time level.In 2013, tax increases on higher

income earners were implemented with the Affordable Care Act and American Taxpayer Relief Act

of 2012. CBO estimated that "average federal tax rates

under 2013 law would be higher – relative to tax rates in 2011 – across the income

spectrum. The estimated rates under 2013 law would still

be well below the average rates from 1979 through 2011 for the bottom four income quintiles,

slightly below the average rate over that period for households in the 81st through

99th percentiles, and well above the average rate over that period for households in the

top 1 percent of the income distribution." In 2016, the economists Peter H.

Lindert and

Jeffrey G. Williamson contended that inequality is the highest it has been since the nation's

founding.French economist Thomas Piketty attributed the victory of Donald Trump in the 2016 presidential

election, which he characterizes as an "electoral upset," to "the explosion in economic and

geographic inequality in the United States over several decades and the inability of

successive governments to deal with this."In May 2017, new data sets from the economists

Piketty, Saez, and Gabriel Zucman of University of California, Berkeley demonstrate that inequality

runs much deeper than previous data indicated.

The share of incomes for those in the bottom

half of the U.S. population stagnated and declined during the years 1980 to 2014 from

20% in 1980 to 12% in 2014. By contrast, the top 1% share of income grew

from 12% in 1980 to 20% in 2014. The top 1% now makes on average 81 times more

than the bottom 50% of adults, where as in 1981 they made 27 times more. Pretax incomes for the top 0.001% surged 636%

during the years 1980 to 2014. The economists also note that the growth of

inequality during the 1970s to the 1990s can be attributed to wage growth among top earners,

but the ever-widening gap has been "a capital-driven phenomenon since the late 1990s." They posit that "the working rich are either

turning into or being replaced by rentiers."A 2017 report by Philip Alston, the United Nations

special rapporteur on extreme poverty and human rights, asserted that Donald Trump and

the Republican Congress are pushing policies that would make the United States the "world

champion of extreme inequality".

== Causes == According to the CBO and others, "the precise

reasons for the [recent] rapid growth in income at the top are not well understood", but "in

all likelihood," an "interaction of multiple factors" was involved. "Researchers have offered several potential

rationales." Some of these rationales conflict, some overlap. They include: the decline of labor unions. A study in the American Sociological Review,

as well as other scholarly research, using the broadest methodology, estimates that the

decline of unions may account for from one-third to more than one-half of the rise of inequality

among men.

As unions weakened, the vast majority of the

gains from productivity were taken by senior corporate executives, major shareholders and

creditors (e.g. major corporate bondholders, banks and other lenders, etc.). As unions have grown weaker, there has been

less pressure on employers to increase wages, or on lawmakers to enact labor-friendly or

worker-friendly measures. the globalization hypothesis – low skilled

American workers have been losing ground in the face of competition from low-wage workers

in Asia and other "emerging" economies.

Skill-biased technological change – the

rapid pace of progress in information technology has increased the demand for the highly skilled

and educated so that income distribution favored brains rather than brawn;

the superstar hypothesis – modern technologies of communication often turn competition into

a tournament in which the winner is richly rewarded, while the runners-up get far less

than in the past; financialization – changing views of linkages

between the corporate and financial sectors led to a significant increase in the capitalization

of the US stock market. In the decade after 1989, market capitalization

rose from 55% to 155% of GDP. At the same time, corporations began to shift

compensation packages of managers toward stock options, increasing incentives for managers

to make short-term decisions to increase share prices.

Over this period, CEO options increased from

$500,000 to over $3 million per year, allowing stocks to comprise almost 50% of CEO compensation. This further incentivized managers to make

decisions on shareholder payout rather than toward long-term contracts with workers; between

2000 and 2007, nearly 75% of increased stock growth has been at the cost of labor wages

and salaries. immigration of less-educated workers – relatively

high levels of immigration of low skilled workers since 1965 may have reduced wages

for American-born high school dropouts; college premium – workers with college degrees

earn more than those that do not and have a lower unemployment rate. This explains some of the gap between the

college-educated middle class and lower income persons, but not the 1% leaving the remainder

behind. automation – The Bureau of Labor Statistics

explained that labor's share of income has declined (with an offsetting increase in share

going to capital, generally higher income persons) due to increased automation that

has "been leading to an overall drop in the need for labor input. This would cause capital share to increase,

relative to labor share, as machines replace some workers." policy, politics and race – movement conservatives

increased their influence over the Republican Party beginning in the 1970s, moving it politically

rightward.

Combined with the Party's expanded political

power (enabled by a shift of southern white Democrats to the Republican Party following

the passage of Civil Rights legislation in the 1960s), this resulted in more regressive

tax laws, anti-labor policies, and further limited expansion of the welfare state relative

to other developed nations (e.g., the unique absence of universal healthcare). Further, variation in income inequality across

developed countries indicates policy has a significant influence on inequality; Japan,

Sweden and France have income inequality around 1960 levels.drug use, particularly opioids,

has been cited by the Federal Reserve as one cause of the decline in the labor force participation

rate.Paul Krugman put several of these factors into context in January 2015: "Competition

from emerging-economy exports has surely been a factor depressing wages in wealthier nations,

although probably not the dominant force. More important, soaring incomes at the top

were achieved, in large part, by squeezing those below: by cutting wages, slashing benefits,

crushing unions, and diverting a rising share of national resources to financial wheeling

and dealing …

Perhaps more important still, the wealthy exert a vastly disproportionate

effect on policy. And elite priorities – obsessive concern

with budget deficits, with the supposed need to slash social programs – have done a lot

to deepen [wage stagnation and income inequality]."According to a 2018 report by the OECD, the U.S. has

higher income inequality and a larger percentage of low income workers than almost any other

advanced nation because the unemployed and at-risk workers get almost no support from

the government and are further set back by a very weak collective bargaining system. == Effects: Economic == === Overview ===

There is an ongoing debate as to the economic effects of income inequality. For example, Alan B. Krueger, President Obama's

Chairman of the Council of Economic Advisors, summarized the conclusions of several research

studies in a 2012 speech. In general, as income inequality worsens: More income shifts to the wealthy, who tend

to spend less of each marginal dollar, causing consumption and therefore economic growth

to slow; Income mobility falls, meaning the parents'

income is more likely to predict their children's income;

Middle and lower-income families borrow more money to maintain their consumption, a contributing

factor to financial crises; and The wealthy gain more political power, which

results in policies that further slow economic growth.Among economists and related experts,

many believe that America's growing income inequality is "deeply worrying", unjust, a

danger to democracy/social stability, or a sign of national decline.

Yale professor Robert Shiller, who was among

three Americans who won the Nobel prize for economics in 2013, said after receiving the

award, "The most important problem that we are facing now today, I think, is rising inequality

in the United States and elsewhere in the world." Economist Thomas Piketty, who has spent nearly

20 years studying inequality primarily in the US, warns that "The egalitarian pioneer

ideal has faded into oblivion, and the New World may be on the verge of becoming the

Old Europe of the twenty-first century's globalized economy."On the other side of the issue are

those who have claimed that the increase is not significant, that it doesn't matter because

America's economic growth and/or equality of opportunity are what's important, that

it is a global phenomenon which would be foolish to try to change through US domestic policy,

that it "has many economic benefits and is the result of …

A well-functioning economy",

and has or may become an excuse for "class-warfare rhetoric", and may lead to policies that "reduce

the well-being of wealthier individuals". === Economic growth === ==== Views that income inequality slows economic

growth ==== Economist Alan B. Krueger wrote in 2012: "The

rise in inequality in the United States over the last three decades has reached the point

that inequality in incomes is causing an unhealthy division in opportunities, and is a threat

to our economic growth. Restoring a greater degree of fairness to

the U.S. job market would be good for businesses, good for the economy, and good for the country." Krueger wrote that the significant shift in

the share of income accruing to the top 1% over the 1979 to 2007 period represented nearly

$1.1 trillion in annual income.

Since the wealthy tend to save nearly 50%

of their marginal income while the remainder of the population saves roughly 10%, other

things equal this would reduce annual consumption (the largest component of GDP) by as much

as 5%. Krueger wrote that borrowing likely helped

many households make up for this shift, which became more difficult in the wake of the 2007–2009

recession.Inequality in land and income ownership is negatively correlated with subsequent economic

growth. A strong demand for redistribution will occur

in societies where a large section of the population does not have access to the productive

resources of the economy.

Rational voters must internalize such issues. High unemployment rates have a significant

negative effect when interacting with increases in inequality. Increasing inequality harms growth in countries

with high levels of urbanization. High and persistent unemployment also has

a negative effect on subsequent long-run economic growth. Unemployment may seriously harm growth because

it is a waste of resources, because it generates redistributive pressures and distortions,

because it depreciates existing human capital and deters its accumulation, because it drives

people to poverty, because it results in liquidity constraints that limit labor mobility, and

because it erodes individual self-esteem and promotes social dislocation, unrest and conflict. Policies to control unemployment and reduce

its inequality-associated effects can strengthen long-run growth.Concern extends even to such

supporters (or former supporters) of laissez-faire economics and private sector financiers. Former Federal Reserve Board chairman Alan

Greenspan, has stated reference to growing inequality: "This is not the type of thing

which a democratic society – a capitalist democratic society – can really accept without

addressing." Some economists (David Moss, Paul Krugman,

Raghuram Rajan) believe the "Great Divergence" may be connected to the financial crisis of

2008.

Money manager William H. Gross, former managing

director of PIMCO, criticized the shift in distribution of income from labor to capital

that underlies some of the growth in inequality as unsustainable, saying: Even conservatives must acknowledge that return

on capital investment, and the liquid stocks and bonds that mimic it, are ultimately dependent

on returns to labor in the form of jobs and real wage gains.

If Main Street is unemployed and undercompensated,

capital can only travel so far down Prosperity Road. He concluded: "Investors/policymakers of the

world wake up – you're killing the proletariat goose that lays your golden eggs." Among economists and reports that find inequality

harming economic growth are a December 2013 Associated Press survey of three dozen economists',

a 2014 report by Standard and Poor's, economists Gar Alperovitz, Robert Reich, Joseph Stiglitz,

and Branko Milanovic. A December 2013 Associated Press survey of

three dozen economists found that the majority believe that widening income disparity is

harming the US economy. They argue that wealthy Americans are receiving

higher pay, but they spend less per dollar earned than middle class consumers, the majority

of the population, whose incomes have largely stagnated.A 2014 report by Standard and Poor's

concluded that diverging income inequality has slowed the economic recovery and could

contribute to boom-and-bust cycles in the future as more and more Americans take on

debt in order to consume.

Higher levels of income inequality increase

political pressures, discouraging trade, investment, hiring, and social mobility according to the

report.Economists Gar Alperovitz and Robert Reich argue that too much concentration of

wealth prevents there being sufficient purchasing power to make the rest of the economy function

effectively.Joseph Stiglitz argues that concentration of wealth and income leads the politically

powerful economic elite seek to protect themselves from redistributive policies by weakening

the state, and this leads to less public investments by the state – roads, technology, education,

etc. – that are essential for economic growth.According to economist Branko Milanovic, while traditionally

economists thought inequality was good for growth, "The view that income inequality harms

growth – or that improved equality can help sustain growth – has become more widely

held in recent years. The main reason for this shift is the increasing

importance of human capital in development. When physical capital mattered most, savings

and investments were key. Then it was important to have a large contingent

of rich people who could save a greater proportion of their income than the poor and invest it

in physical capital. But now that human capital is scarcer than

machines, widespread education has become the secret to growth." He continued that "Broadly accessible education"

is both difficult to achieve when income distribution is uneven and tends to reduce "income gaps

between skilled and unskilled labor."Robert Gordon wrote that such issues as 'rising inequality;

factor price equalization stemming from the interplay between globalization and the Internet;

the twin educational problems of cost inflation in higher education and poor secondary student

performance; the consequences of environmental regulations and taxes …" make economic growth

harder to achieve than in the past.

==== Views that income inequality does not

slow growth ==== In response to the Occupy movement Richard

A. Epstein defended inequality in a free market society, maintaining that "taxing the top

one percent even more means less wealth and fewer jobs for the rest of us." According to Epstein, "the inequalities in

wealth … pay for themselves by the vast increases in wealth", while "forced transfers

of wealth through taxation … will destroy the pools of wealth that are needed to generate

new ventures. One report has found a connection between

lowering high marginal tax rates on high income earners (high marginal tax rates on high income

being a common measure to fight inequality), and higher rates of employment growth.Economic

sociologist Lane Kenworthy has found no correlation between levels of inequality and economic

growth among developed countries, among states of the US, or in the US over the years from

1947 to 2005.

Jared Bernstein found a nuanced relation he

summed up as follows: "In sum, I'd consider the question of the extent to which higher

inequality lowers growth to be an open one, worthy of much deeper research". Tim Worstall commented that capitalism would

not seem to contribute to an inherited-wealth stagnation and consolidation, but instead

appears to promote the opposite, a vigorous, ongoing turnover and creation of new wealth. === Likelihood of financial crises ===

Income inequality was cited as one of the causes of the Great Depression by Supreme

Court Justice Louis D. Brandeis in 1933. In his dissent in the Louis K. Liggett Co.

v. Lee (288 U.S. 517) case, he wrote: "Other writers have shown that, coincident with the

growth of these giant corporations, there has occurred a marked concentration of individual

wealth; and that the resulting disparity in incomes is a major cause of the existing depression."Central

Banking economist Raghuram Rajan argues that "systematic economic inequalities, within

the United States and around the world, have created deep financial 'fault lines' that

have made [financial] crises more likely to happen than in the past" – the Financial

crisis of 2007–08 being the most recent example.

To compensate for stagnating and declining

purchasing power, political pressure has developed to extend easier credit to the lower and middle

income earners – particularly to buy homes – and easier credit in general to keep unemployment

rates low. This has given the American economy a tendency

to go "from bubble to bubble" fueled by unsustainable monetary stimulation. === Monopolization of labor, consolidation,

and competition === Greater income inequality can lead to monopolization

of the labor force, resulting in fewer employers requiring fewer workers.

Remaining employers can consolidate and take

advantage of the relative lack of competition, leading to declining customer service, less

consumer choice, market abuses, and relatively higher prices. === Aggregate demand and debt ===

Income inequality lowers aggregate demand, leading to increasingly large segments of

formerly middle class consumers unable to afford as many luxury and essential goods

and services. This pushes production and overall employment

down.Deep debt may lead to bankruptcy and researchers Elizabeth Warren and Amelia Warren

Tyagi found a fivefold increase in the number of families filing for bankruptcy between

1980 and 2005. The bankruptcies came not from increased spending

"on luxuries", but from an "increased spending on housing, largely driven by competition

to get into good school districts." Intensifying inequality may mean a dwindling

number of ever more expensive school districts that compel middle class – or would-be middle

class – to "buy houses they can't really afford, taking on more mortgage debt than

they can safely handle".

== Effects: Socio-economic mobility == === Overview ===

The ability to move from one income group into another (income mobility) is a means

of measuring economic opportunity. A higher probability of upward income mobility

theoretically would help mitigate higher income inequality, as each generation has a better

chance of achieving higher income groups. Conservatives and libertarians such as economist

Thomas Sowell, and Congressman Paul Ryan (R., Wisc.) argue that more important than the

level of equality of results is America's equality of opportunity, especially relative

to other developed countries such as western Europe. Nonetheless, results from various studies

reflect the fact that endogenous regulations and other different rules yield distinct effects

on income inequality.

A study examines the effects of institutional

change on age-based labor market inequalities in Europe. There is a focus on wage-setting institutions

on the adult male population and the rate of their unequal income distribution. According to the study, there is evidence

that unemployment protection and temporary work regulation affect the dynamics of age-based

inequality with positive employment effects of all individuals by the strength of unions. Even though the European Union is within a

favorable economic context with perspectives of growth and development, it is also very

fragile.However, several studies have indicated that higher income inequality corresponds

with lower income mobility. In other words, income brackets tend to be

increasingly "sticky" as income inequality increases. This is described by a concept called the

Great Gatsby curve. In the words of journalist Timothy Noah, "you

can't really experience ever-growing income inequality without experiencing a decline

in Horatio Alger-style upward mobility because (to use a frequently-employed metaphor) it's

harder to climb a ladder when the rungs are farther apart." === Over lifetimes ===

The centrist Brookings Institution said in March 2013 that income inequality was increasing

and becoming permanent, sharply reducing social mobility in the US.

A 2007 study (by Kopczuk, Saez and Song in

2007) found the top population in the United States "very stable" and that income mobility

had "not mitigated the dramatic increase in annual earnings concentration since the 1970s."Economist

Paul Krugman, attacks conservatives for resorting to "extraordinary series of attempts at statistical

distortion". He argues that while in any given year, some

of the people with low incomes will be "workers on temporary layoff, small businessmen taking

writeoffs, farmers hit by bad weather" – the rise in their income in succeeding years is

not the same 'mobility' as poor people rising to middle class or middle income rising to

wealth. It's the mobility of "the guy who works in

the college bookstore and has a real job by his early thirties." Studies by the Urban Institute and the US

Treasury have both found that about half of the families who start in either the top or

the bottom quintile of the income distribution are still there after a decade, and that only

3 to 6% rise from bottom to top or fall from top to bottom.

On the issue of whether most Americans do

not stay put in any one income bracket, Krugman quotes from 2011 CBO distribution of income

study Household income measured over a multi-year

period is more equally distributed than income measured over one year, although only modestly

so. Given the fairly substantial movement of households

across income groups over time, it might seem that income measured over a number of years

should be significantly more equally distributed than income measured over one year. However, much of the movement of households

involves changes in income that are large enough to push households into different income

groups but not large enough to greatly affect the overall distribution of income.

Multi-year income measures also show the same

pattern of increasing inequality over time as is observed in annual measures. In other words, many people who have incomes greater than

$1 million one year fall out of the category the next year – but that's typically because

their income fell from, say, $1.05 million to 0.95 million, not because they went back

to being middle class. === Between generations === Several studies have found the ability of

children from poor or middle-class families to rise to upper income – known as "upward

relative intergenerational mobility" – is lower in the US than in other developed countries

– and at least two economists have found lower mobility linked to income inequality.In

their Great Gatsby curve, White House Council of Economic Advisers Chairman Alan B.

Krueger

and labor economist Miles Corak show a negative correlation between inequality and social

mobility. The curve plotted "intergenerational income

elasticity" – i.e. the likelihood that someone will inherit their parents' relative position

of income level – and inequality for a number of countries.Aside from the proverbial distant

rungs, the connection between income inequality and low mobility can be explained by the lack

of access for un-affluent children to better (more expensive) schools and preparation for

schools crucial to finding high-paying jobs; the lack of health care that may lead to obesity

and diabetes and limit education and employment.Krueger estimates that "the persistence in the advantages

and disadvantages of income passed from parents to the children" will "rise by about a quarter

for the next generation as a result of the rise in inequality that the U.S.

Has seen

in the last 25 years." === Poverty === Greater income inequality can increase the

poverty rate, as more income shifts away from lower income brackets to upper income brackets. Jared Bernstein wrote: "If less of the economy's

market-generated growth – i.e., before taxes and transfers kick in – ends up in the lower

reaches of the income scale, either there will be more poverty for any given level of

GDP growth, or there will have to be a lot more transfers to offset inequality's poverty-inducing

impact." The Economic Policy Institute estimated that

greater income inequality would have added 5.5% to the poverty rate between 1979 and

2007, other factors equal. Income inequality was the largest driver of

the change in the poverty rate, with economic growth, family structure, education and race

other important factors.

An estimated 16% of Americans lived in poverty

in 2012, versus 26% in 1967.A rise in income disparities weakens skills development among

people with a poor educational background in term of the quantity and quality of education

attained. Those with a low level of expertise will always

consider themselves unworthy of any high position and pay === Further enrichment of corporate top executives

=== Lisa Shalett, chief investment officer at

Merrill Lynch Wealth Management noted that, "for the last two decades and especially in

the current period, … productivity soared … [but] U.S. real average hourly earnings

are essentially flat to down, with today's inflation-adjusted wage equating to about

the same level as that attained by workers in 1970. … So where have the benefits of technology-driven

productivity cycle gone? Almost exclusively to corporations and their

very top executives." In addition to the technological side of it,

the affected functionality emanates from the perceived unfairness and the reduced trust

of people towards the state. The study by Kristal and Cohen showed that

rising wage inequality has brought about an unhealthy competition between institutions

and technology.

The technological changes, with computerization

of the workplace, seem to give an upper hand to the high-skilled workers as the primary

cause of inequality in America. The qualified will always be considered to

be in a better position as compared to those dealing with hand work leading to replacements

and unequal distribution of resources.Economist Timothy Smeeding summed up the current trend:

Americans have the highest income inequality in the rich world and over the past 20–30

years Americans have also experienced the greatest increase in income inequality among

rich nations. The more detailed the data we can use to observe

this change, the more skewed the change appears to be … the majority of large gains are

indeed at the top of the distribution. According to Janet L.

Yellen, chair of the

Federal Reserve, … from 1973 to 2005, real hourly wages of

those in the 90th percentile – where most people have college or advanced degrees – rose

by 30% or more … among this top 10 percent, the growth was heavily concentrated at the

very tip of the top, that is, the top 1 percent. This includes the people who earn the very

highest salaries in the U.S. economy, like sports and entertainment stars, investment

bankers and venture capitalists, corporate attorneys, and CEOs. In contrast, at the 50th percentile and below

– where many people have at most a high school diploma – real wages rose by only

5 to 10% – == Effects on democracy and society ==

Economists Jared Bernstein and Paul Krugman have attacked the concentration of income

as variously "unsustainable" and "incompatible" with real democracy.

American political scientists Jacob S. Hacker

and Paul Pierson quote a warning by Greek-Roman historian Plutarch: "An imbalance between

rich and poor is the oldest and most fatal ailment of all republics." Some academic researchers have written that

the US political system risks drifting towards a form of oligarchy, through the influence

of corporations, the wealthy, and other special interest groups. === Political polarization ===

Rising income inequality has been linked to the political polarization in Washington DC. According to a 2013 study published in the

Political Research Quarterly, elected officials tend to be more responsive to the upper income

bracket and ignore lower income groups.Paul Krugman wrote in November 2014 that: "The

basic story of political polarization over the past few decades is that, as a wealthy

minority has pulled away economically from the rest of the country, it has pulled one

major party along with it … Any policy that benefits lower- and middle-income Americans

at the expense of the elite – like health reform, which guarantees insurance to all

and pays for that guarantee in part with taxes on higher incomes – will face bitter Republican

opposition." He used environmental protection as another

example, which was not a partisan issue in the 1990s but has since become one.As income

inequality has increased, the degree of House of Representatives polarization measured by

voting record has also increased.

The voting is mostly by the rich and for the

rich making it hard to achieve equal income and resource distribution for the average

population (Bonica et al., 2013). There is a little number of people who turn

to government insurance with the rising wealth and real income since they consider inequality

within the different government sectors. Additionally, there has been an increased

influence by the rich on the regulatory, legislative and electoral processes within the country

that has led to improved employment standards for the bureaucrats and politicians. Professors McCarty, Pool and Rosenthal wrote

in 2007 that polarization and income inequality fell in tandem from 1913 to 1957 and rose

together dramatically from 1977 on. They show that Republicans have moved politically

to the right, away from redistributive policies that would reduce income inequality. Polarization thus creates a feedback loop,

worsening inequality.The IMF warned in 2017 that rising income inequality within Western

nations, in particular the United States, could result in further political polarization. === Political inequality === Several economists and political scientists

have argued that economic inequality translates into political inequality, particularly in

situations where politicians have financial incentives to respond to special interest

groups and lobbyists.

Researchers such as Larry Bartels of Vanderbilt

University have shown that politicians are significantly more responsive to the political

opinions of the wealthy, even when controlling for a range of variables including educational

attainment and political knowledge. === Class system ===

Historically, discussions of income inequality and capital vs. labor debates have sometimes

included the language of class warfare, from President Theodore Roosevelt (referring to

the leaders of big corporations as "malefactors of great wealth"), to President Franklin Roosevelt

("economic royalists …

Are unanimous in their hate for me–and I welcome their hatred"),

to more the recent "1% versus the 99%" issue and the question of which political party

better represents the interests of the middle class.Investor Warren Buffett said in 2006

that: "There's class warfare, all right, but it's my class, the rich class, that's making

war, and we're winning." He advocated much higher taxes on the wealthiest

Americans, who pay lower effective tax rates than many middle-class persons.Two journalists

concerned about social separation in the US are economist Robert Frank, who notes that:

"Today's rich had formed their own virtual country .. [T]hey had built a self-contained

world unto themselves, complete with their own health-care system (concierge doctors),

travel network (Net jets, destination clubs), separate economy … The rich weren't just

getting richer; they were becoming financial foreigners, creating their own country within

a country, their own society within a society, and their economy within an economy.George

Packer wrote that "Inequality hardens society into a class system … Inequality divides

us from one another in schools, in neighborhoods, at work, on airplanes, in hospitals, in what

we eat, in the condition of our bodies, in what we think, in our children's futures,

in how we die.

Inequality makes it harder to imagine the

lives of others.Even these class levels can affect the politics in certain ways. There has been an increased influence by the

rich on the regulatory, legislative and electoral processes within the country that has led

to improved employment standards for the bureaucrats and politicians. They have a greater influence through their

lobbying and contributions that give them an opportunity to immerse wealth for themselves. === Political change ===

Loss of income by the middle class relative to the top-earning 1% and 0.1% is both a cause

and effect of political change, according to journalist Hedrick Smith. In the decade starting around 2000, business

groups employed 30 times as many Washington lobbyists as trade unions and 16 times as

many lobbyists as labor, consumer, and public interest lobbyists combined. From 1998 through 2010 business interests

and trade groups spent $28.6 billion on lobbying compared with $492 million for labor, nearly

a 60-to-1 business advantage. The result, according to Smith, is a political

landscape dominated in the 1990s and 2000s by business groups, specifically "political

insiders" – former members of Congress and government officials with an inside track

– working for "Wall Street banks, the oil, defense, and pharmaceutical industries; and

business trade associations." In the decade or so prior to the Great Divergence,

middle-class-dominated reformist grassroots efforts – such as civil rights movement,

environmental movement, consumer movement, labor movement – had considerable political

impact.

Economist Joseph Stiglitz argues that hyper-inequality

may explain political questions – such as why America's infrastructure (and other public

investments) are deteriorating, or the country's recent relative lack of reluctance to engage

in military conflicts such as the 2003 invasion of Iraq. Top-earning families, wealthy enough to buy

their own education, medical care, personal security, and parks, have little interest

in helping pay for such things for the rest of society, and have the political influence

to make sure they don't have to.

So too, the lack of personal or family sacrifice

involved for top earners in the military intervention of their country – their children being

few and far between in the relatively low-paying all-volunteer military – may mean more willingness

by influential wealthy to see its government wage war.Economist Branko Milanovic argued

that globalization and the related competition with cheaper labor from Asia and immigrants

have caused U.S. middle-class wages to stagnate, fueling the rise of populist political candidates

such as Donald Trump. === Health ===

The relatively high rates of health problems and social problems, (obesity, mental illness,

homicides, teenage births, incarceration, child conflict, drug use) and lower rates

of social goods (life expectancy, educational performance, trust among strangers, women's

status, social mobility, even numbers of patents issued per capita), in the US compared to

other developed countries may be related to its high income inequality. Using statistics from 23 developed countries

and the 50 states of the US, British researchers Richard G.

Wilkinson and Kate Pickett have

found such a correlation which remains after accounting for ethnicity, national culture,

and occupational classes or education levels. Their findings, based on UN Human Development

Reports and other sources, locate the United States at the top of the list in regards to

inequality and various social and health problems among developed countries. The authors argue inequality creates psychosocial

stress and status anxiety that lead to social ills. A 2009 study conducted by researchers at Harvard

University and published in the British Medical Journal attribute one in three deaths in the

United States to high levels of inequality. According to The Earth Institute, life satisfaction

in the US has been declining over the last several decades, which has been attributed

to soaring inequality, lack of social trust and loss of faith in government.It is claimed

in a 2015 study by Princeton University researchers Angus Deaton and Anne Case that income inequality

could be a driving factor in a marked increase in deaths among white males between the ages

of 45 to 54 in the period 1999 to 2013.

=== Financing of social programs ===

Paul Krugman argues that the much lamented long-term funding problems of Social Security

and Medicare can be blamed in part on the growth in inequality as well as the usual

culprits like longer life expectancies. The traditional source of funding for these

social welfare programs – payroll taxes – is inadequate because it does not capture

income from capital, and income above the payroll tax cap, which make up a larger and

larger share of national income as inequality increases.Upward redistribution of income

is responsible for about 43% of the projected Social Security shortfall over the next 75

years. === Education and human capital === Disagreeing with this focus on the top-earning

1%, and urging attention to the economic and social pathologies of lower-income/lower education

Americans, is conservative journalist David Brooks. Whereas in the 1970s, high school and college

graduates had "very similar family structures", today, high school grads are much less likely

to get married and be active in their communities, and much more likely to smoke, be obese, get

divorced, or have "a child out of wedlock." The zooming wealth of the top one percent

is a problem, but it's not nearly as big a problem as the tens of millions of Americans

who have dropped out of high school or college.

It's not nearly as big a problem as the 40

percent of children who are born out of wedlock. It's not nearly as big a problem as the nation's

stagnant human capital, its stagnant social mobility and the disorganized social fabric

for the bottom 50 percent. Contradicting most of these arguments, classical

liberals such as Friedrich Hayek have maintained that because individuals are diverse and different,

state intervention to redistribute income is inevitably arbitrary and incompatible with

the concept of general rules of law, and that "what is called 'social' or distributive'

justice is indeed meaningless within a spontaneous order".

Those who would use the state to redistribute,

"take freedom for granted and ignore the preconditions necessary for its survival." ==

Public attitudes == The growth of inequality has provoked a political

protest movement – the Occupy movement – starting in Wall Street and spreading to 600 communities

across the United States in 2011. Its main political slogan – "We are the

99%" – references its dissatisfaction with the concentration of income in the top 1%. A December 2011 Gallup poll found a decline

in the number of Americans who felt reducing the gap in income and wealth between the rich

and the poor was extremely or very important (21 percent of Republicans, 43 percent of

independents, and 72 percent of Democrats). In 2012, several surveys of voters' attitudes

toward growing income inequality found the issue ranked less important than other economic

issues such as growth and equality of opportunity, and relatively low in affecting voters "personally". In 1998 a Gallup poll had found 52% of Americans

agreeing that the gap between rich and the poor was a problem that needed to be fixed,

while 45% regarded it as "an acceptable part of the economic system".

In 2011, those numbers are reversed: Only

45% see the gap as in need of fixing, while 52% do not. However, there was a large difference between

Democrats and Republicans, with 71% of Democrats calling for a fix.In contrast, a January 2014

poll found 61% of Republicans, 68% of Democrats and 67% of independents accept the notion

that income inequality in the US has been growing over the last decade. The Pew Center poll also indicated that 69%

of Americans supported the government doing "a lot" or "some" to address income inequality

and that 73% of Americans supported raising the minimum wage from $7.25 to $10.10 per

hour.Opinion surveys of what respondents thought was the right level of inequality have found

Americans no more accepting of income inequality than other citizens of other nations, but

more accepting of what they thought the level of inequality was in their country, being

under the impression that there was less inequality than there actually was.Dan Ariely and Michael

Norton show in a study (2011) that US citizens across the political spectrum significantly

underestimate the current US wealth inequality and would prefer a more egalitarian distribution

of wealth.

Joseph Stiglitz in "The Price of Inequality"

has argued that this sense of unfairness has led to distrust in government and business. == States and cities == Income inequality (as measured by the Gini

coefficient) is not uniform among the states: after-tax income inequality in 2009 was greatest

in Texas and lowest in Maine. Income inequality has grown from 2005 to 2012

in more than 2 out of 3 metropolitan areas. === Comparisons by state ===

The household income Gini index for the United States was 0.468 in 2009, according to the

US Census Bureau, though it varied significantly between states.

The states of Utah, Alaska and Wyoming have

a pre-tax income inequality Gini coefficient that is 10% lower than the average, while

Washington D.C. and Puerto Rico 10% higher. After including the effects of federal and

state taxes, the U.S. Federal Reserve estimates 34 states in the USA have a Gini coefficient

between 0.30 and 0.35, with the state of Maine the lowest. At the county and municipality levels, the

pre-tax Gini index ranged from 0.21 to 0.65 in 2010 across the United States, according

to Census Bureau estimates. == International comparisons == === Overall ===

Measured for all households, U.S. income inequality is comparable to other developed countries

before taxes and transfers, but is among the worst after taxes and transfers, meaning the

U.S.

Shifts relatively less income from higher income households to lower income households. Measured for working-age households, market

income inequality is comparatively high (rather than moderate) and the level of redistribution

is moderate (not low). These comparisons indicate Americans shift

from reliance on market income to reliance on income transfers later in life and less

fully than do households in other developed countries.The U.S. was ranked the 41st worst

among 141 countries (30th percentile) on income equality measured by the Gini index. The UN, CIA World Factbook, and OECD have

used the Gini index to compare inequality between countries, and as of 2006, the United

States had one of the highest levels of income inequality among similar developed or high

income countries, as measured by the index.

While inequality has increased since 1981

in two-thirds of OECD countries most developed countries are in the lower, more equal, end

of the spectrum, with a Gini coefficient in the high twenties to mid thirties.The gini

rating (after taxes and government income transfers) of the United States is sufficiently

high, however, to put it among less developed countries. The US ranks above (more unequal than) South

American countries such Guyana, Nicaragua, and Venezuela, and roughly on par with Uruguay,

Nicaragua, and Venezuela, according to the CIA.The NYT reported in 2014: "With a big

share of recent income gains in this country flowing to a relatively small slice of high-earning

households, most Americans are not keeping pace with their counterparts around the world." Real median per capita income in many other

industrialized countries was rising from 2000-2010 while the U.S. measure stagnated. The poor in much of Europe receive more than

their U.S.

Counterparts. === Reasons for relative performance ===

One 2013 study indicated that U.S. income inequality is comparable to other developed

countries before taxes and transfers, but rated last (worst) among 22 developed countries

after taxes and transfers. This means that public policy choices, rather

than market factors, drive U.S. income inequality disparities relative to comparable wealthy

nations.Some have argued that inequality is higher in other countries than official statistics

indicate because of unreported income. European countries have higher amounts of

wealth in offshore holdings.The NYT reported in 2014 that there were three key reasons

for other industrialized countries improving real median income relative to the United

States over the 2000-2010 period: Educational attainment in the U.S. has risen

more slowly than much of the industrialized world over the past 30 years;

Companies in the U.S. distribute relatively less of their income as wages to the middle

class and poor than other industrialized countries, with top executives making relatively more,

a lower minimum wage, and weaker unions; and Other industrialized countries have tax policies

that more aggressively redistribute income from rich to poor.

=== Canada ===

According to The New York Times, Canadian middle class incomes are now higher than those

in the United States as of 2014, and some European nations are closing the gap as their

citizens have been receiving higher raises than their American counterparts. Bloomberg reported in August 2014 that only

the wealthy saw pay increases since the 2008 recession, while average American workers

saw no boost in their paychecks. == Policy responses == === Overview ===

Economists have proposed a variety of solutions for addressing income inequality. For example, Federal Reserve Chair Janet Yellen

described four "building blocks" that could help address income and wealth inequality

in an October 2014 speech. These included expanding resources available

to children, affordable higher education, business ownership, and inheritance. While before-tax income inequality is subject

to market factors, after-tax income inequality can be directly affected by tax and transfer

policy. U.S. income inequality is comparable to other

developed nations before taxes and transfers, but is among the worst after taxes and transfers.

This suggests that more progressive tax and

transfer policies would be required to align the U.S. with other developed nations. The Center for American Progress recommended

a series of steps in September 2014, including tax reform, subsidizing and reducing healthcare

and higher education costs, and strengthening labor influence.However, there is debate regarding

whether a public policy response is appropriate for income inequality. For example, Federal Reserve Economist Thomas

Garrett wrote in 2010: "It is important to understand that income inequality is a byproduct

of a well-functioning capitalist economy.

Individuals' earnings are directly related

to their productivity … A wary eye should be cast on policies that aim to shrink the

income distribution by redistributing income from the more productive to the less productive

simply for the sake of 'fairness.'"Public policy responses addressing causes and effects

of income inequality include: progressive tax incidence adjustments, strengthening social

safety net provisions such as Temporary Assistance for Needy Families, welfare, the food stamp

program, Social Security, Medicare, and Medicaid, increasing and reforming higher education

subsidies, increasing infrastructure spending, and placing limits on and taxing rent-seeking. Democrat and Republican politicians also provided

a series of recommendations for increasing median wages in December 2014. These included raising the minimum wage, infrastructure

stimulus, and tax reform. === Resources available to children ===

Research shows that children from lower-income households who get good-quality pre-Kindergarten

education are more likely to graduate from high school, attend college, hold a job and

have higher earnings.

In 2010, the U.S. ranked 28th out of 38 advanced

countries in the share of four-year-olds enrolled in public or private early childhood education. Gains in enrollment stalled after 2010, as

did growth in funding, due to budget cuts arising from the Great Recession. Per-pupil spending in state-funded programs

declined by 12% after inflation since 2010. The U.S. differs from other countries in that

it funds public education primarily through sub-national (state and local) taxes.

The quality of funding for public education

varies based on the tax base of the school system, with significant variation in local

taxes and spending per pupil. Better teachers also raise the educational

attainment and future earnings of students, but they tend to migrate to higher income

school districts. Among developed countries, 70% of 3-year-olds

go to preschool, versus 38% in the United States. === Affordable healthcare === Raising taxes on higher income persons to

fund healthcare for lower income persons reduces after-tax inequality.

The CBO described how the Affordable Care

Act (ACA or "Obamacare") reduced income inequality for calendar year 2014 in a March 2018 report: "In 2014, households in the lowest and second

quintiles [the bottom 40%] received an average of an additional $690 and $560 respectively,

because of the ACA …" "Most of the burden of the ACA fell on households

in the top 1% of the income distribution, and relatively little fell on the remainder

of households in that quintile. Households in the top 1% paid an additional

$21,000, primarily because of the net investment income tax and the additional Medicare tax." ===

Affordable higher education === Median annual earnings of full-time workers

with a four-year bachelor's degree is 79% higher than the median for those with only

a high school diploma.

The wage premium for a graduate degree is

considerably higher than the undergraduate degree. College costs have risen much faster than

income, resulting in an increase in student loan debt from $260 billion in 2004 to $1.1

trillion in 2014. From 1995 to 2013, outstanding education debt

grew from 26% of average yearly income to 58%, for households with net worth below the

50th percentile. The unemployment rate is also considerably

lower for those with higher educational attainment. A college education is nearly free in many

European countries, often funded by higher taxes.

=== Public welfare and infrastructure spending

=== The OECD asserts that public spending is vital

in reducing the ever-expanding wealth gap. Lane Kenworthy advocates incremental reforms

to the U.S. welfare state in the direction of the Nordic social democratic model, thereby

increasing economic security and equal opportunity. Currently, the U.S. has the weakest social

safety net of all developed nations.Welfare spending may entice the poor away from finding

remunerative work and toward dependency on the state. Eliminating social safety nets can discourage

free market entrepreneurs by increasing the risk of business failure from a temporary

setback to financial ruin.

=== Taxes on the wealthy === CBO reported that less progressive tax and

transfer policies contributed to an increase in after-tax income inequality between 1979

and 2007. This indicates that more progressive income

tax policies (e.g., higher income taxes on the wealthy and a higher earned-income tax

credit) would reduce after-tax income inequality. Policies enacted under President Obama increased

taxes on the wealthy, including the American Taxpayer Relief Act of 2012 and the Affordable

Care Act.

As reported by The New York Times in January

2014, these laws include several tax increases on individuals earning over $400,000 and couples

earning over $450,000: Raised the top marginal tax rate to 39.6%

from 35%; Raised the rate on dividends and capital gains

by 5 percentage points, to 20 percent; and Two new surcharges – a 3.8% tax on investment

income and a 0.9% tax on regular income.These changes are estimated to add $600 billion

to revenue over 10 years, while leaving the tax burden on everyone else mostly as it was. This reverses a long-term trend of lower tax

rates for upper income persons.The NYT reported in July 2018 that: "The top-earning 1 percent

of households — those earning more than $607,000 a year — will pay a combined $111

billion less this year in federal taxes than they would have if the laws had remained unchanged

since 2000. That's an enormous windfall. It's more, in total dollars, than the tax

cut received over the same period by the entire bottom 60 percent of earners." This represents the tax cuts for the top 1%

from the Bush tax cuts and Trump tax cuts, partially offset by the tax increases on the

top 1% by Obama.The CBO estimated that the average tax rate for the top 1% rose from

28.1% in 2008 to 33.6% in 2013, reducing after-tax income inequality relative to a baseline without

those policies.The economists Emmanuel Saez and Thomas Piketty recommend much higher top

marginal tax rates on the wealthy, up to 50 percent, or 70 percent or even 90 percent.

Ralph Nader, Jeffrey Sachs, the United Front

Against Austerity, among others, call for a financial transactions tax (also known as

the Robin Hood tax) to bolster the social safety net and the public sector.The Pew Center

reported in January 2014 that 54% of Americans supported raising taxes on the wealthy and

corporations to expand aid to the poor. By party, 29% of Republicans and 75% of Democrats

supported this action.During 2012, investor Warren Buffett advocated higher minimum effective

income tax rates on the wealthy, considering all forms of income: "I would suggest 30 percent

of taxable income between $1 million and $10 million, and 35 percent on amounts above that." This would eliminate special treatment for

capital gains and carried interest, which are taxed at lower rates and comprise a relatively

larger share of income for the wealthy.

He argued that in 1992, the tax paid by the

400 highest incomes in the United States averaged 26.4% of adjusted gross income. In 2009, the rate was 19.9%. === Reduce tax expenditures === Tax expenditures (i.e., exclusions, deductions,

preferential tax rates, and tax credits) cause revenues to be much lower than they would

otherwise be for any given tax rate structure. The benefits from tax expenditures, such as

income exclusions for healthcare insurance premiums paid for by employers and tax deductions

for mortgage interest, are distributed unevenly across the income spectrum. They are often what the Congress offers to

special interests in exchange for their support. According to a report from the CBO that analyzed

the 2013 data: The top 10 tax expenditures totaled $900 billion. This is a proxy for how much they reduced

revenues or increased the annual budget deficit. Tax expenditures tend to benefit those at

the top and bottom of the income distribution, but less so in the middle. The top 20% of income earners received approximately

50% of the benefit from them; the top 1% received 17% of the benefits.

The largest single tax expenditure was the

exclusion from income of employer sponsored health insurance ($250 billion). Preferential tax rates on capital gains and

dividends were $160 billion; the top 1% received 68% of the benefit or $109 billion from lower

income tax rates on these types of income.Understanding how each tax expenditure is distributed across

the income spectrum can inform policy choices. === Corporate tax reform ===

Economist Dean Baker argues that the existence of tax loopholes, deductions, and credits

for the corporate income tax contributes to rising income inequality by permitting large

corporations with many accountants to reduce their tax burden and by permitting large accounting

firms to receive payments from smaller businesses in exchange for helping these businesses reduce

their tax burden. He says that this redistributes large sums

of money that would otherwise be taxed to individuals who are already wealthy yet contribute

nothing to society in order to obtain this wealth. He further argues that since a large portion

of corporate income is reinvested in the business, taxing corporate income amounts to a tax on

reinvestment, which he says should be left untaxed. He concludes that eliminating the corporate

income tax, while needing to be offset by revenue increases elsewhere, would reduce

income inequality.

=== Minimum wages === In his 2013 State of the Union address, Barack

Obama proposed raising the federal minimum wage. The progressive economic think tank the Economic

Policy Institute agrees with this position, stating: "Raising the minimum wage would help

reverse the ongoing erosion of wages that has contributed significantly to growing income

inequality." In response to the fast-food worker strikes

of 2013, Labor Secretary Thomas Perez said that it was another sign of the need to raise

the minimum wage for all workers: "It's important to hear that voice …

For all too many people

working minimum wage jobs, the rungs on the ladder of opportunity are feeling further

and further apart."The Economist wrote in December 2013: "A minimum wage, providing