Income inequality in the United States has

increased substantially considering that the 1970s after numerous decades of stability, implying the

share of the country'' s earnings obtained by greater revenue households has increased. This fad appears with revenue determined

both gross (market earnings) in addition to after taxes and transfer repayments. Revenue inequality has actually fluctuated significantly

since dimensions started around 1915, relocating an arc between optimals in the 1920s and 2000s,

with a 30-year period of relatively lower inequality in between 1950– 1980. Modifying the 2012 earnings utilizing the 1979 revenue

distribution, the bottom 99% of households would have averaged concerning $7,100 more income.Measured

for all homes, united state earnings inequality approaches other developed nations

before taxes and transfers, yet is among the greatest after taxes and transfers, significance

1950 to 1980. 1951– 1981.( AGI) of around$ 430,000 was called for to be in the top 1% in 2013.

The lower 50% made 20 %of the country ' s. pre-tax income in 1979; this fell steadily to 14% by 2007 and 13% by 2014. Earnings for the center 40% team, a proxy for. To place this change.

The fad of climbing. earnings inequality is likewise evident after transfers and taxes.

A 2011 research by the CBO found that the top. United state federal tax and transfer plans are. Revenue transfers had a higher effect on minimizing.

Americans are not generally conscious of the level of inequality. There is a direct relationship between actual.

While before-tax revenue

inequality is subject. U.S. earnings inequality is similar to various other. Revenue inequality might add to slower.

fought over the share of the economic pie each obtains. The impact of the labor motion has subsided

. in the U.S.Since the 1960s along with union involvement and even more pro-capital regulations.

The share of complete employee settlement has. This has actually led to concerns that the economic climate.

== History ==== =Post-civil battle era to around 1937===. The degree of focus of revenue in the United States has varied throughout its. 18 %of all income.

By 2007, the top 1 percent accounted for 24%.

of all revenue and in between, their “share dropped listed below” 10 %for 3 decades. == =The Wonderful Compression, 1937– 1967===.

From regarding 1937 to 1947, a duration dubbed as the “Great Compression”– revenue inequality.

in the United States fell considerably.

Extremely modern New Deal tax, the. strengthening of unions, and law of the National Battle Labor Board during World.

Battle II increased the revenue of the poor and working course and “lowered that of top earners.From the very early 20th century, when earnings

statisticsStats “to family member equality and back once more”, according to Nobel laureate economic expert Paul Krugman.For. Earnings remained fairly high due to the fact that American.

adjusting government policies was supplied by high voter yield from union voting drives,. the support of the otherwise traditional South for the New Deal, and eminence that. the massive mobilization and triumph of Globe War II had actually provided the government.On the various other. hand, a Marxist writing in the 1950s and 1960s believed “While the American worker enjoys. the highest possible standard of life of any worker worldwide, he is additionally one of the most greatly. exploited.This enormously effective functioning class. gets back for its own intake a smaller part of its output and turn over in the form. of earnings to the plutocrat owners of the instruments of production

a better part of. its outcome than does either the English or the French working class.

“=== Post-1970 rise == =The go back to high inequality, or to what. Krugman and journalist Timothy Noah have referred as the “Fantastic Aberration”, began in the 1970s. Studies have actually found revenue expanded much more unequal. nearly continuously except during the financial recessions in 1990– 91, 2001( Dot-com bubble ),. and 2007 sub-prime bust.The Great Divergence varies somehow from the pre-Depression. period inequality.” Before 1937, a bigger share of leading income earners. revenue originated from capital

( passion, rewards, revenue from lease, capital gains ). After 1970, earnings of high-income taxpayers. comes predominantly from labor: work compensation.Until 2011, the Great Aberration. had not been a major political issue in America, yet stagnancy of middle-class income was. In 2009 the Barack Obama administration White. Residence Center Class Working Households Job Pressure assembled to concentrate on economic problems specifically

. influencing middle-income Americans. In 2011, the Occupy motion attracted substantial. attention to income inequality in the country.CBO reported that for the 1979-2007 duration, after-tax. revenue of families in the leading 1 percent of earners expanded by 275%, compared to 65% for. the following 19%, just under 40% for the following 60%, 18% for the lower fifth of households. “As an outcome of that irregular revenue growth,”. the report noted, “the share of complete after-tax earnings received by the 1 percent of the populace.

in families with the highest possible earnings more than increased in between 1979 and 2007, whereas.

the share gotten by low- and middle-income homes declined … The share of income obtained by the top.

1 percent expanded from about 8% in 1979 to over 17% in 2007. The share gotten by the various other 19 percent.

(such as passion from deposits, dividends, and rental income

), and other various otherEarnings 2010 actual typical household revenue increased by 15%. When the definition of revenue was.

more of their income from a lot more unstable sources associated with funding earnings (company income,. funding gains, and returns), instead of labor income (salaries and salaries).

In 2011 the top 1% of revenue. income earners acquired 37% of their income from labor revenue,

versus 62% for the middle quintile.

On the various other hand, the top 1% acquired 58 %. of their income from resources in contrast to 4 %for the middle quintile. Government transfers stood for only 1% of. the income of the top 1% but 25% for the

center quintile; the dollar quantities of these transfers. often tend to climb in recessions.This impact occurred throughout

the Great Recession of 2007– 2009,. when overall earnings going to the bottom 99 percent of Americans decreased by 11.6%, yet dropped by. 36.3 %for the leading 1%. Declines were specifically steep for funding. gains, which fell by 75% in genuine(

inflation-adjusted) terms between 2007 and 2009. Various other resources of resources income additionally dropped:. interest income by 40% and returns income by 33 %. Wages, the biggest income, dropped. by an extra moderate 6%.

The share of pretax revenue received by the. top 1% dropped from 18.7% in 2007 to 16.0% in 2008 and 13.4% in 2009, while the lower four. quintiles all had their share of pretax earnings rise from 2007 to 2009. The share of aftertax income gotten by the. top 1% earnings group fell from 16.7%, in 2007, to 11.5%, in 2009.

=== 2009– present ===. The distribution of house incomes has ended up being much more unequal throughout the post-2008 economic. healing as the impacts of the recession reversed. CBO reported in November 2014 that the share. of pre-tax revenue gotten by the leading 1% had risen from 13.3% in 2009 to 14.6% in 2011. During 2012 alone, incomes of the wealthiest. 1 percent rose virtually 20%, whereas the revenue of the

remaining 99 percent increased 1% in comparison. By 2012, the share of pre-tax revenue obtained.

by the top 1% had actually gone back to its pre-crisis top, at around 23 %of the pre-tax income.

according to a post in The New Yorker. This is based upon commonly mentioned data from financial expert.

Emmanuel Saez, which uses “market income” and depends largely on internal revenue service data.The CBO uses both IRS data and census data.

in its computations and reports a reduced pre-tax number for the leading 1%. The two series were roughly 5 percent.

factors apart in 2011( Saez at about 19.7% versus CBO at 14.6%), which would imply a. CBO number of about 18% in 2012 if that partnership holds, a considerable boost versus the 14.6 %. CBO reported for 2011. The share of after-tax income received by.

the top 1% rose from 11.5% in 2009 to 12.6% in 2011. Between 2010 and 2013, inflation-adjusted.

pre-tax earnings for the lower “90% of American” family members dropped, with the center earnings teams. dropping the most, regarding 6% for the 40th-60th percentiles and 7% for the 20th-40th percentiles. Incomes in the top decile increased 2%. Throughout the. 2009-2012 healing period, the top 1% caught 91% of the actual earnings development per household with.

their pre-tax revenues expanding 34.7 %changed for inflation while the pre-tax revenues of. the bottom

99% expanded 0.8%. Measured from 2009– 2015, the top 1% recorded.

52% of the total actual revenue development per family members, showing the healing was coming to be much less.

“unbalanced” in favor of greater revenue households. By 2015, the leading 10% (top decile) had

a 50.5%. share of the pre-tax revenue, shut its greatest all-time level.In 2013, tax obligation boosts on greater. revenue earners were carried out with the Affordable Care Act and American Taxpayer Alleviation Act. of 2012. CBO approximated that “typical federal tax rates. under 2013 legislation would be higher– about tax obligation rates in 2011– throughout the income. spectrum. The approximated prices under 2013 regulation would certainly still.

be well below the average prices from 1979 via 2011 for the lower four income quintiles,.

“somewhat” below the ordinary rate over that duration for homes in the 81st via. 99th percentiles, and well above the typical rate over that duration for houses in the.

In 2016, the economic experts Peter H. Lindert and. Jeffrey G. Williamson contended that “inequality is the highest possible it has been given that the nation ' s. founding.French economic expert Thomas Piketty associated the success

of Donald Trump in the 2016 presidential.

“In May 2017, new information sets from the economists. Piketty, Saez, and Gabriel Zucman of University of California, Berkeley demonstrate that inequality. runs much deeper than previous information indicated.The share of incomes for those in all-time low. half of the united state population declined and stagnated throughout the years 1980 to 2014 from. 20 %in 1980 to 12 %in 2014. By comparison, the top

1% share of earnings expanded. from 12% in 1980 to 20% in 2014”. The top 1% currently makes typically 81 times a lot more. than the lower 50% of grownups, where as in 1981 they made 27 times extra. Pretax revenues for the top

0.001% surged 636%. throughout the years 1980 to 2014. The financial experts additionally keep in mind that the growth of.

inequality during the 1970s to the 1990s can be credited to wage growth amongst leading income earners,. The ever-widening

gap space been “a capital-driven phenomenon since the late 1990s.” They presume that “the working

rich are either. becoming or being changed by rentiers. “A 2017 record by Philip Alston, the United Nations. unique rapporteur on severe destitution and human civil liberties, insisted that Donald Trump and. the Republican Congress are pressing policies that would make the USA the “globe. champion of severe inequality”. == Causes== According to the CBO and others, “the specific. factors for the [current]

They include: the decline of labor unions. A study in the American Sociological Evaluation,.

As various other academic study, utilizing the broadest method, estimates that the. decline of unions may represent from one-third to even more than one-half of the “increase of inequality”. amongst men. As unions damaged, the substantial “bulk of the. gains from efficiency were taken by senior corporate execs, significant investors and. creditors “( e.g. major company” shareholders, financial institutions and other lenders, etc). As unions have expanded weaker, there”has been. less stress on employers to enhance wages, or on legislators to pass labor-friendly or. worker-friendly actions. the globalization theory– reduced proficient. American employees have been shedding

ground in the face of competition from low-wage workers. in Asia and other “arising” economic climates.

skill-biased technical change– the. fast pace of development in info modern technology has raised the demand for the very knowledgeable. and enlightened to ensure that earnings circulation preferred brains instead of energy;. the superstar theory– modern innovations of interaction typically transform competition right into. a tournament in which the champion is richly compensated, while the runners-up get far much less. than in the past; financialization– transforming sights of links. between the economic and business industries led to a considerable increase in the capitalization.

of the United States supply market.In the years after 1989, market capitalization. increased from 55% to 155 %of GDP.

At the exact same time, companies started to shift. settlement plans of managers toward stock choices, boosting incentives for managers. to make temporary choices to enhance share prices.

Over this duration, CEO options boosted from. $500,000 to over $3 million annually, allowing stocks to consist of almost 50% of chief executive officer compensation. This more incentivized supervisors to make. choices on shareholder payout instead of towards long-term contracts with workers; between

. 2000 and 2007, nearly 75% of increased stock development has gone to the price of labor incomes. and salaries. migration of less-educated workers– fairly.

high degrees of migration

of low competent employees given that 1965 may have reduced incomes. for American-born high college dropouts; college costs- employees with university degrees. gain greater than those that do not and have a reduced unemployment rate.This discusses several of the gap between the.

college-educated center class and reduced income persons, however not the 1 %leaving the remainder. behind.

automation- The Bureau of Labor Data. described that labor ' s share of earnings has actually decreased (with an offsetting increase in share.

going to funding, usually greater revenue individuals) because of boosted automation that. has actually “been bring about an overall decrease in the requirement for labor input. This would certainly trigger resources share to raise,. about labor share, as devices change some workers.

” plan, politics and race– movement conservatives. increased their influence over the Republican

Celebration starting in the 1970s, relocate politically. rightward.Combined with the Event ' s expanded political.

power (enabled by a shift of southerly white Democrats to the Republican Politician

Celebration following. the flow of Civil liberty regulation in the 1960s), this resulted in more regressive. tax legislations, anti-labor policies, and further limited development of the well-being state relative. to other industrialized countries( e.g., the one-of-a-kind lack of global health care). Even more, variation in earnings inequality across. industrialized nations suggests “policy has a considerable influence on inequality; Japan,. Sweden and France have revenue inequality around 1960 levels.drug use, particularly opioids,.” has actually been mentioned by the Federal Reserve as one source of the decrease in the labor force engagement. rate.Paul Krugman put numerous of these variables right into context in January 2015: “Competitors. from emerging-economy exports has actually certainly been a factor disappointing incomes in wealthier nations,. Most likely not the dominant force.More important, soaring earnings at the top. were attained, in large component, by pressing those listed below: by cutting salaries, slashing advantages,. squashing unions, and diverting a rising share of national resources to monetary wheeling. and dealing … Possibly more crucial still, the rich exert a vastly disproportionate. impact on policy. And elite top priorities– obsessive problem.

with deficit spending, with the expected demand to reduce social programs– have actually done a whole lot. to strengthen [wage stagnation and earnings inequality] “According to a 2018 report by the OECD, the U.S. has.

greater income inequality and a larger percentage of reduced revenue employees than practically any type of “other.

== Results: Economic== === Introduction===. There is a recurring dispute as to the financial impacts of income inequality. In general, as revenue inequality intensifies: More income shifts to the affluent, that have a tendency.

to spend less of each limited buck, triggering consumption and therefore financial growth.

to reduce; Revenue mobility drops, suggesting the parents '. earnings is more probable to predict their children ' s revenue;. Center and lower-income households borrow even more cash to preserve their consumption, an adding. variable to financial crises; and

The wealthy gain more political power, which. lead to plans that further slow-moving economic growth.Among economic experts and relevant professionals,. many think that America ' s growing income inequality is “deeply worrying”, unjustified, a. danger to democracy/social stability, or an indicator of national decline.Yale teacher Robert Shiller, who was amongst. 3 Americans that won the Nobel prize for economics in 2013, claimed after receiving the. honor, “One of the most vital issue that we are dealing with currently today, I assume, is climbing inequality. in the USA and in other places in the globe.

” Economist Thomas Piketty, who has actually spent virtually. 20 years examining inequality mainly in the US, warns that “The egalitarian pioneer.

Old Europe of the twenty-first century ' s globalized economic climate. “On the other side of the problem are.

The lower 50% gained 20 %of the country ' s. pre-tax income in 1979; this fell steadily to 14% by 2007 and 13% by 2014. (such as rate of interest from deposits, rewards, and rental earnings

), and other incomeEarnings 1 percent climbed nearly 20%, whereas the earnings of the

remaining Staying percent rose 1% in comparisonContrast 2009-2012 recovery period, the leading 1% captured 91% of the actual revenue growth per family with.

In general, as revenue inequality aggravates: Even more revenue shifts to the rich, that have a tendency.a well-functioning economy””,.

and has or might end up being a justification for “” class-warfare unsupported claims””, and may bring about policies that “” lower.

the wellness of wealthier individuals””.

=== Economic growth === ==== Sights that revenue inequality reduces economic.

development ==== Economist Alan B. Krueger created in 2012: “” The.

rise in inequality in the USA over the last three years has reached the point.

that inequality in incomes is creating an undesirable department in possibilities, and is a danger.

to our financial development. Restoring a higher level of fairness to.

the united state work market would be good for companies, great for the economic situation, and great for the country.”” Krueger composed that the substantial change in.

the share of income accruing to the top 1% over the 1979 to 2007 period stood for virtually.

$ 1.1 trillion in yearly revenue. Given that the affluent tend to save almost 50%.

of their low revenue while the remainder of the population saves approximately 10%, other.

things equal this would certainly reduce yearly consumption (the largest part of GDP) by as much.

as 5%. Krueger created that borrowing likely assisted.

several families make up for this change, which ended up being harder in the wake of the 2007– 2009.

recession.Inequality in land and earnings ownership is adversely correlated with subsequent financial.

growth. A solid demand for redistribution will take place.

in cultures where a big section of the population does not have accessibility to the productive.

sources of the economy.Rational voters must internalize such concerns. High joblessness rates have a significant. unfavorable impact when interacting with boosts in inequality. Increasing inequality harms development in nations. with high levels of urbanization. High and persistent unemployment likewise has. a negative effect on subsequent long-run economic growth. Due to the fact that, joblessness might seriously damage growth. it is a waste of resources, due to the fact that it produces redistributive pressures and distortions,. since it depreciates existing human capital and hinders its buildup, due to the fact that it drives. people to hardship, because it results

in liquidity restraints that restrict labor wheelchair, and. since it erodes private self-worth and advertises social misplacement, agitation and problem. Policies to control joblessness and reduce. its inequality-associated results can reinforce long-run growth.Concern extends also to such. advocates( or former advocates )of laissez-faire business economics and private field financiers. Former Federal Reserve Board chairman Alan. Greenspan, has actually stated referral to expanding inequality: “This is not the type

of point. which a democratic culture– a capitalist autonomous society– can actually accept without. resolving.” Some economic experts( David Moss, Paul Krugman,. Raghuram Rajan) think the “Fantastic Divergence” might be linked to the financial situation of. 2008.

If Key Street is undercompensated and jobless,. They say that well-off Americans are obtaining. Greater degrees'of

income revenue increase.

held

in recent times. The primary factor for this shift is the enhancing. relevance of human resources in advancement.

When physical funding mattered most, financial savings. and investments were essential. It was essential to have a big contingent. of abundant individuals that can conserve a greater proportion of their revenue than the inadequate and invest it. in physical funding. And now that human funding is scarcer than.

machines, extensive education has come to be the key to growth.” He continued that “Broadly easily accessible education and learning”. is both tough to accomplish when earnings distribution is irregular and tends to decrease “revenue gaps. in between unskilled and proficient labor. “Robert Gordon created that such problems as ' climbing inequality;. element price equalization stemming from the interaction between globalization and the Web;. the twin academic troubles of cost rising cost of living in “greater education”and bad secondary trainee. performance; the repercussions of ecological regulations and taxes …” make economic development. more difficult to accomplish than in the past.”==== Views that earnings inequality does not.

slow-moving development== == In feedback to the Occupy movement Richard. A. Epstein protected inequality

in a totally free market culture, keeping that “straining the top. one percent also extra means less riches and less work for the remainder people.” According to Epstein, “the inequalities in. wealth … pay for themselves

by the vast boosts in wealth”, while “forced transfers. of wealth with taxation … will

damage the pools of wide range that are required to create.

One record has located a link between. 1947 to 2005. Jared Bernstein found a nuanced connection he.

inequality decreases development to be an open one, worthy of much deeper research study”.

Tim Worstall commented that commercialism would.=== Possibility of economic crises== =.

Revenue inequality was mentioned as one of the root causes of the Great Clinical Depression by Supreme.

Court Justice Louis D. Brandeis in 1933. In his dissent in the Louis K. Liggett Co. v. Lee( 288 U.S. 517) case, he wrote: “Various other authors have actually shown that,

coincident with the. development of these large companies, there has taken place a significant concentration of individual. riches; and that the resulting disparity in incomes is a significant source of the existing depression. “Central. Financial economist Raghuram Rajan argues that “organized financial inequalities, within. the United States and around the globe, have actually developed deep economic ' geological fault ' that. have actually made [economic] crises extra likely “to occur than in the past”– the Financial.

crisis of 2007– 08 being one of the most recent example.To make up for declining and going stale.

acquiring power, political pressure has actually developed to extend simpler debt to the lower and middle.”earnings earners– specifically to acquire homes– and much easier credit as a whole to keep unemployment. prices low.

This has actually provided the American economic situation a tendency. to go “from bubble to 'bubble” fueled by unsustainable monetary excitement.=== Monopolization of labor, combination,. and competitors === Greater earnings inequality can result in monopolization. of the manpower, resulting in fewer companies requiring less employees.

Staying companies can take and consolidate. benefit of the relative lack of competitors, causing decreasing client service, less. consumer option, market abuses, and reasonably higher rates. == =Accumulated demand and debt= ==. Income inequality decreases aggregate demand, leading to progressively large segments of. formerly center course customers incapable to afford as several luxury and necessary products. and solutions.

Tyagi discovered a fivefold increase in the number of households submitting for personal bankruptcy between. The bankruptcies came not from enhanced costs. Increasing inequality might imply a diminishing.

== Effects: Socio-economic movement==== =Summary===. The capability to move from one revenue team right into an additional( earnings movement )is a method. of determining financial chance.

A higher chance of higher earnings flexibility. in theory would help

“reduce higher revenue inequality “, as each generation has a much better. opportunity of accomplishing greater revenue teams. Libertarians and conservatives such as economic expert. Thomas Sowell, and Congressman Paul Ryan( R., Wisc.) suggest that more important than the. degree of equality of outcomes is America ' s equality “of possibility, particularly family member. to various other industrialized nations such as western Europe.Nonetheless,

results from numerous research studies. reflect the reality that endogenous policies and various other various regulations yield distinctive results. on revenue inequality. A research checks out the results of institutional. modification on age-based labor market inequalities in Europe.

There is an emphasis on wage-setting establishments. According to the research, there is proof.

To put it simply, earnings brackets have a tendency to be. significantly “sticky” as earnings inequality increases. This is defined by an idea called the. Fantastic Gatsby curve. In words of journalist Timothy Noah, “you. can ' t really experience ever-growing income inequality without experiencing a decline. in Horatio Alger-style upward flexibility because( to use a frequently-employed metaphor) it ' s. tougher to climb a ladder when the rungs are farther apart.” === Over lifetimes== =. The centrist Brookings Organization said in March 2013 that revenue inequality was enhancing.

and ending up being long-term, sharply minimizing social movement in the US.A 2007 study( by Kopczuk, Saez and Track in. 2007) found the top populace in the USA “really secure” which income movement.

had actually “not alleviated the dramatic boost in annual revenues concentration considering that the 1970s. “Economist.” Paul Krugman, assaults traditionalists for considering “amazing series of efforts at statistical. distortion”. He suggests that while in any kind of provided year, some.

of individuals with low revenues will be “employees on momentary layoff, little entrepreneurs taking.

writeoffs, farmers struck by poor weather”– the surge in their earnings in being successful years is. not the exact same ' wheelchair ' as poor people rising to middle class or middle revenue climbing to. wide range.

It ' s the wheelchair of “the person who operates in. the university bookstore and has an actual job by his very early thirties.” Research studies by the Urban Institute and the US. Treasury have both found that regarding half of the families who begin in either the leading or.

the lower quintile of the revenue distribution are still there after a decade, which only.

3 to “6% increase from bottom to leading or fall from top to bottom.On the issue of whether the majority of Americans do.”not stay put

in any one earnings bracket, Krugman prices estimate from 2011 CBO distribution of revenue. research study Family income measured over a multi-year. duration is extra just as distributed than earnings gauged over one year, although only modestly. “. Provided the relatively significant activity of houses.

Multi-year revenue steps likewise reveal the exact same.=== Between generations=== A number of research studies have discovered the ability of. The contour outlined “intergenerational earnings.

=== Hardship === Greater earnings inequality can raise the.

Jared Bernstein created: “If less of the economy ' s. market-generated development– i.e., before taxes and transfers begin– winds up in the reduced.

reaches of the revenue scale, either there will be more destitution for any type of given degree of. GDP development, or there will certainly have to be a

whole lot even more transfers to counter inequality ' s poverty-inducing. effect.” The Economic Plan Institute estimated that. better income inequality would have added 5.5 %to the destitution price in between 1979

and. 2007, other aspects equal.Income inequality was the largest vehicle driver of. the adjustment in the hardship price, with economic development, family members education and learning, structure and race. other important factors. An approximated 16% of Americans lived in destitution. in 2012, versus 26% in 1967. An increase in revenue variations deteriorates abilities advancement amongst.

individuals with a poor instructional background in term of the amount” and quality of education and learning.

acquired. Those with a reduced level of experience will always. consider themselves not worthy of any high setting and pay === Additional enrichment of company magnates

.=== Lisa Shalett, chief financial investment police officer at. Merrill Lynch Wide range Monitoring noted that, “for the last twenty years and especially in “. the current'period, … Productivity skyrocketed … [] U.S. genuine typical per hour incomes.

are essentially level to down, with today ' s inflation-adjusted wage equating to about.

the exact same level as that attained by employees in 1970. … So where have the benefits of technology-driven.” productivity cycle gone? Virtually specifically to firms and their. very magnates.” Along with the technical side of it,. the influenced capability originates from the perceived unfairness and the decreased trust fund. of people towards the state. The study by Kristal and Cohen

revealed that. rising wage inequality has produced a harmful competitors in between institutions. and innovation. The technical modifications, with computerization.

of the workplace, appear to give a top hand to the high-skilled employees as the key

. cause of inequality in America.The qualified will always be thought about to. remain in a better setting as compared to those handling hand job bring about substitutes.

and unequal circulation of resources.Economist Timothy Smeeding summed up the present trend:. Americans have the highest possible earnings inequality in

the abundant globe and over the

previous 20– 30. years Americans have actually also experienced the best increase in income inequality among. rich countries. The more in-depth the information we can utilize to observe. this change, the much more manipulated the change shows up to be … the majority of large gains are.

At the top of the distribution. According to Janet L. Yellen, chair of the. Federal Get, …” from 1973 to 2005, genuine per hour salaries of.

those in the 90th percentile– where lots of people have college or innovative levels– increased.

by 30% or more … among this top 10 percent, the development was heavily focused at the. extremely suggestion of the top, that is, the leading 1 percent.This includes individuals that make the extremely. highest possible wages in the united state economic situation, like sports and enjoyment celebrities, investment.

— where several people have at the majority of a high school diploma– real earnings increased by only. 5 to 10%–= =Effects on democracy and culture==. Financial Experts Jared Bernstein and Paul Krugman have struck the focus of income.

the US political system dangers wandering towards a type of oligarchy, with the impact. of corporations, the wealthy, and various other special passion teams.

=== Political polarization===. Climbing revenue inequality has actually been connected to the political polarization

in Washington DC. The ballot is mostly by the rich and for the.

populace( Bonica et al., 2013 ). There is a little variety of individuals who transform. to government insurance policy with the increasing wide range and real income since they think about inequality. within the different government markets. Furthermore, there has been an enhanced. influence by the rich on the regulatory, selecting and legal processes within the country.

that has actually resulted in boosted work requirements for the politicians and political leaders. Professors McCarty,

Pool and Rosenthal wrote. in 2007 that polarization and earnings inequality fell in tandem from 1913 to

1957 and increased. together dramatically from 1977 on. They reveal that Republican politicians have relocated politically. to the right, away from redistributive plans that would lower income inequality

. Polarization therefore produces a comments loop,. intensifying inequality.The IMF advised

in 2017 that climbing earnings inequality within Western. nations, in certain the United States, can result in more political polarization.== =Political inequality=

== Political scientists and numerous economic experts. have suggested that economic inequality equates right into political inequality, particularly in. scenarios where political leaders have financial rewards

to react to unique interest. groups and powerbrokers. Researchers such as Larry Bartels of Vanderbilt. University have shown that politicians are dramatically much more responsive to the political. opinions

of the well-off, also when managing for a series of

variables consisting of instructional. attainment and political understanding.=== Course system===.

Historically, conversations of earnings inequality and capital vs. labor discussions have in some cases.

included the language of class warfare, from Head of state Theodore Roosevelt( referring to.

( “financial royalists … are unanimous in their hate for me– and I welcome their hatred”),. Americans, that pay lower effective tax obligation rates than many middle-class persons.Two reporters. “Today ' s abundant had actually formed their own virtual nation

.

Packer wrote that “Inequality hardens culture into a course system … Inequality divides.

us from one an additional in colleges, in neighborhoods, at job, on aircrafts, in health centers, in what. we eat, in the condition “of our bodies, in what we think, in our youngsters ' s futures,. in how we pass away. Inequality makes it harder to envision the. lives of others.Even these class levels can “impact the politics in particular means. There has actually been an enhanced influence by the. abundant on the regulatory, legal and electoral processes within the nation that has led. to enhanced employment standards for the politicians and politicians.They have a higher influence with'their.

== =Political change===. Loss of earnings by the middle class family member to the top-earning

1% and 0.1% is both a causeReason In the years beginning around 2000, company.

From 1998 through 2010 company interests. and trade teams invested$ 28.6 billion on lobbying'contrasted with$ 492 million for labor, almost. a 60-to-1 business benefit.

== Effects: Socio-economic mobility==== =Introduction===.=== Between generations=== A number of researches have found the ability of.=== Poverty === Greater earnings inequality can boost the.== =Political inequality=

== Political scientists and several numerous.=== Class system===.The outcome, according to Smith, is a political

landscape dominated in the 1990s and 2000s by business teams, especially “” political.

experts””– previous members of Congress and government authorities with a within track.

— functioning for “” Wall Road financial institutions, the oil, defense, and pharmaceutical sectors; and.

service profession associations.”” In the years or two previous to the Fantastic Aberration,.

middle-class-dominated reformist grassroots initiatives– such as civil liberties activity,.

ecological activity, consumer activity, labor motion– had significant political.

Top-earning households, rich enough to acquire.

have actually triggered U.S. middle-class earnings to stagnate, sustaining the increase of democratic political prospects.

such as Donald Trump.=== Wellness= ==. The reasonably high prices of health problems and social problems, (excessive weight, mental disease,.

murders, teenage births, incarceration, child dispute, medication usage) and lower prices.

of social items( life expectations, instructional performance, trust among strangers

, ladies ' s. status, social mobility, even varieties of patents released per head), in the US contrasted to. various other established nations may be associated with its high earnings inequality.

Making use of statistics from 23 developed countries. and the 50 states of the US, British researchers Richard G.Wilkinson and Kate Pickett have.

found such a relationship which stays after representing ethnicity, national culture,. and occupational courses or education degrees. Their findings, based on UN Human Growth. Reports and other sources, situate the USA at the top of the checklist in relation to. inequality and various

social and health issue amongst established countries. The writers say inequality produces psychosocial. stress and condition stress and anxiety that result in social ills. A 2009 study performed by scientists at Harvard.

College and released in the British Medical Journal connect one in three deaths in the. United States to high degrees of inequality.According to The Planet Institute, life fulfillment. in the US has actually been declining over the last a number of decades, which has been attributed. to rising inequality,

absence of social trust fund and loss of belief in government.It is declared. in a 2015 research study by Princeton University scientists Angus Deaton and Anne Instance that revenue inequality. can be a motoring consider a marked increase in deaths among white males between the ages. of 45 to 54 in the period 1999 to 2013.= == Funding of social programs=

==. Paul Krugman says that the much regreted long-term funding problems of Social Safety.

and Medicare can be condemned partly on the growth in inequality in addition to the normal.

offenders like longer life expectancies.The conventional source of funding for these. social welfare programs– payroll tax obligations– is insufficient since it does not capture. income from funding, and earnings above the payroll tax obligation cap, which make up a bigger

and. bigger share of nationwide earnings as inequality increases.Upward redistribution of revenue. is in charge of regarding 43 %of the predicted Social Safety and security deficiency over the next 75. years.== =Education and learning and human funding== =Disagreeing with this focus on the top-earning. 1%, and advising interest to the economic and social pathologies of lower-income/lower education and learning. Americans, is traditional reporter David Brooks.Whereas in the 1970s, secondary school and college. graduates had “really similar family members frameworks”, today, high college graduates are much less most likely. to obtain married and be active in their areas, and far more most likely to smoke, be overweight, get.

separated, or have “a child out of matrimony.” The zooming wealth of the leading one percent. is a problem, yet it ' s not virtually as large an issue as the 10s

of countless Americans. that have actually left of secondary school or college. It ' s not almost as large an issue as the 40. percent of kids” that are substantiated of union.

It ' s not nearly as'large an issue as the nation ' s. stagnant human capital, its stagnant social mobility and the disordered social material. for the lower half.

Public mindsets '== The growth of inequality has actually provoked a political. 99%”– referrals its discontentment with the focus of earnings in the top 1%. In 1998 a Gallup poll had actually discovered 52% of Americans.

while 45 %regarded it as “an appropriate component of the financial system”. In 2011, those numbers are turned around: Just. 45% see the void as seeking repairing, while 52% do not. Nonetheless, there was a huge “distinction”between. Democrats and Republicans, with 71% of Democrats calling for a fix.In contrast, a January 2014. survey found 61 %of Republicans, 68% of Democrats and “67 %of independents approve”the idea. that earnings inequality in the US has actually been growing over the last decade.The Bench Center survey also suggested that 69%. of Americans sustained the government doing “a whole lot” or “some” to address income inequality. which 73% of Americans supported increasing the minimal wage from$ 7.25 to$ 10.10 per. hour.Opinion surveys of what participants thought was the ideal degree of inequality have discovered. Americans no even more accepting of revenue inequality than other citizens of other countries, but.

much more approving of what they thought the degree of inequality was in” their nation,” being. under the perception that there was much less inequality than there actually was.Dan Ariely and Michael. Norton show in a research study( 2011 )that US citizens throughout the political range significantly.

== States and cities== Earnings inequality( as gauged by the Gini. Earnings inequality has expanded from 2005 to 2012.

=== Comparisons by state=”=

=. The house income Gini index for the United States was 0.468 in 2009, according to the. Washington D.C. and Puerto Rico 10% greater.

After consisting of the effects of federal and. state taxes, the U.S.Federal Reserve estimates 34 states in the United States have a Gini coefficient. in between 0.30 and 0.35, with the state of Maine the most affordable. At the region and community levels, the. pre-tax Gini index varied from 0.21 to 0.65 in 2010 across the USA, according. to Demographics Bureau approximates.= =International contrasts====

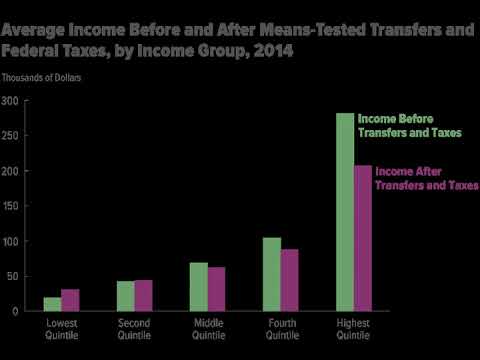

= General== =. Determined for all households, U.S. income inequality approaches other established nations. before

transfers and tax obligations, however is among the worst after tax obligations and transfers

, meaning the. United state changes reasonably less revenue from higher revenue homes to reduced earnings homes.

Gauged for working-age houses, market. earnings inequality is relatively high( instead than

modest) and the level of redistribution. is modest( not reduced).

These contrasts indicate Americans shift. The UN, CIA World Factbook, and OECD

have.

States had one of the highest levels of income inequality amongst similar developed or high. revenue countries, as gauged by the index. While inequality has increased because 1981.

in two-thirds of OECD countries most industrialized countries are in the reduced, a lot more equivalent, end.

American countries such Guyana, Nicaragua, and Venezuela, and roughly on the same level with Uruguay,. Nicaragua, and Venezuela, according to the CIA.The NYT reported in 2014: “With a large. Real mean per capita earnings in lots of various other.

= == Reasons for loved one performance== =. One 2013 study indicated that U.S. earnings inequality is equivalent to various other created. European countries have greater quantities of.

a lot more slowly than much of the developed globe over the previous thirty years;.

Business in the U.S. distribute reasonably less of their earnings as earnings to the middle.

class and inadequate than other industrialized nations, with magnates making reasonably much more,.

a lower base pay, and weak unions; and Various other industrialized countries have tax policies. that more boldy redistribute earnings from rich to inadequate.=== Canada===.

According to The New York City Times, Canadian middle class earnings are currently greater than those.

in the USA as of 2014, and some European nations are closing the space as their.

people have actually been getting greater increases than their American counterparts.

Bloomberg reported in August 2014 that just. the rich saw pay raises since the 2008 economic downturn, while average American employees. saw no increase in their incomes.== Policy actions===== Introduction ===. Economists have recommended a variety of remedies for dealing with revenue inequality.For example, Federal Reserve Chair Janet Yellen. explained 4 “building blocks” that could help deal with income and wide range inequality. in an October 2014 speech. These consisted of increasing sources available.

to kids, affordable college, service possession, and inheritance. While before-tax income inequality is subject. to market aspects, after-tax income inequality can be straight affected by tax and transfer.

policy. United state revenue inequality approaches other. established countries before transfers and tax obligations, yet is among the worst after taxes and transfers. This suggests that even more modern tax obligation and. transfer policies would certainly be required to align the U.S.With various other developed nations.

The Center for American Progression suggested.

Federal Book Financial Expert Thomas. Garrett created in 2010: “It is important to understand that income inequality is a result. Individuals ' earnings are straight associated.

income distribution by rearranging earnings from the much more

effective to the much less efficient. simply for ' justness.

' “Public policy responses addressing domino effects. of earnings inequality consist of: modern tax obligation

incidence adjustments, reinforcing social. security web provisions such as Temporary Assistance for Needy Households, welfare, the food stamp. program, Social Protection, Medicare, and Medicaid, enhancing and reforming college. aids, boosting framework spending, and positioning limitations on and taxing rent-seeking. Democrat and Republican politicians additionally supplied. a collection of suggestions for enhancing median salaries in December 2014. These included raising the base pay, facilities.

stimulation, and tax reform. === Resources offered to youngsters===. Research study shows that youngsters from lower-income families who obtain 'good-quality pre-Kindergarten. education are much more likely to graduate from senior high school, go to university, hold a task and. have higher incomes. In 2010, the U.S. placed 28th out of 38 progressed. countries in the share of four-year-olds enrolled in public or exclusive early youth education and learning. Gains in enrollment stalled after 2010, as. did development in funding, as a result of budget plan cuts emerging from the Great Economic downturn. Per-pupil costs in state-funded programs.

declined by 12 %after inflation considering that 2010.

The U.S. differs from various other countries because. it funds public education mostly with sub-national (state and local) tax obligations. The top quality of funding for public education and learning. varies based on the tax obligation base of the institution system, with considerable variant in local. tax obligations and costs per pupil. Better educators additionally raise

the instructional. achievement and future revenues of pupils, but they tend to move to greater earnings. school districts.Among established countries, 70% of 3-year-olds.

most likely to preschool, versus 38 %in the United States.=== Cost effective medical care=== Raising tax obligations on greater revenue persons to. fund healthcare for lower

income persons lowers after-tax inequality. The CBO defined exactly how the Affordable Treatment. Act( ACA or “Obamacare” )reduced earnings inequality for calendar year 2014 in a March 2018 report: “In 2014, homes in the most affordable and second.

quintiles [the lower 40%] got an average of an added$ 690 and $560 respectively,.

as a result of the ACA …” “A lot of the concern of the ACA fell on homes. in the leading

1% of the earnings distribution, and relatively little dropped on the rest.

of families in that quintile. Houses in the top 1 %paid an added.

$ 21,000, largely

as a result of the net investment income tax obligation and the extra Medicare tax.”===. Affordable college === Median yearly revenues of permanent workers. with a four-year bachelor ' s

degree is 79% more than the average for those with just. a high school diploma.The wage premium for a graduate degree is. considerably greater than the bachelor’s degree. University expenses have climbed much faster than. revenue, resulting in a boost in pupil “finance debt from$ 260 billion in 2004 to $1.1.

The unemployment price is

also considerably. European nations, frequently funded by higher tax obligations

.=== Public well-being and infrastructure investing.

to the U.S. well-being state in the instructions of the Nordic social democratic design, consequently.

boosting economic safety and security

and level playing field. Currently, the united state has the weakest social. safeguard of all established nations.Welfare spending may entice the inadequate away from finding. profitable work and toward dependency on the state. Removing social safety internet can discourage. free enterprise entrepreneurs by raising the danger of business failing from a temporary. problem to monetary spoil.=== Taxes on the rich=== CBO reported that much less dynamic tax and. transfer policies added to

a boost in after-tax income inequality in between 1979. and 2007. This shows that even more progressive income. tax policies( e.g., higher revenue tax obligations on the affluent and a higher earned-income

tax obligation. credit rating) would certainly reduce after-tax income inequality.

Plans established under President Obama enhanced. As reported by The New York Times in January. 2014, these legislations consist of several tax rises on people gaining over $400,000 and pairs

.

earnings and a 0.9% tax on regular income.These changes are estimated to add$ 600 billion.

to profits over 10 years,

while leaving the tax obligation concern on every person else mainly as it was.This turns around a lasting fad of reduced tax obligation. rates for upper earnings persons.The NYT reported in July 2018 that: “The top-earning 1 percent. of homes– those making even more than $607,000 a year– will certainly pay a combined$ 111. billion less this year in government tax obligations than they would certainly have if the laws had actually continued to be unmodified. because 2000. That ' s a huge windfall. It ' s much more, in overall dollars, than the tax obligation. cut received over the very same duration by the whole bottom 60 percent of earners.” This stands for the tax cuts for the leading 1%. from the Bush tax cuts and Trump tax cuts, partly balanced out by the tax boosts on the.

28.1% in 2008 to 33.6% in 2013, minimizing after-tax revenue inequality loved one to a baseline without. Against Austerity, amongst others, call for an economic purchases tax( additionally recognized as. 400 highest possible earnings in the United States averaged 26.4 %of adjusted gross earnings.

In 2009, the price was 19.9 %. == =Minimize tax expenditures == =Tax obligation expenses( i.e., exclusions, deductions,.

preferential tax obligation rates, and tax obligation credits) create revenues to be a lot less than they would

. or else be for any type of offered tax price framework. The gain from tax obligation expenses, such as.

revenue exclusions for health care insurance premiums spent for by companies and tax reductions.

for home mortgage passion, are dispersed unevenly across the income range. They are often what the Congress offers to. unique passions in exchange for their support.According to a record from the CBO that analyzed.

The top 20% of earnings earners got roughly. The biggest solitary tax expenditure was the. === Corporate tax obligation reform=

==.

for the business revenue tax obligation contributes to increasing revenue inequality by permitting big. corporations with lots of accounting professionals to decrease their tax problem and by permitting big bookkeeping. firms to get settlements from smaller sized businesses in exchange for helping these businesses minimize. their tax obligation burden.He says that this rearranges large amounts. of money that would certainly or else be strained to people who are already wealthy yet add. absolutely nothing to culture in order to get this wide range. He additionally says that because a large section. of company earnings is reinvested in the service, straining corporate income total up to a tax obligation on. reinvestment, which he states need to be left untaxed.

He concludes that removing the business. income tax obligation, while needing to be countered by profits increases in other places, would lower.

revenue inequality.== =Minimum incomes== =In his 2013 State of the Union address, Barack.

Obama recommended elevating the federal base pay. The dynamic financial think storage tank the Economic. Policy Institute concurs with this placement, stating: “Raising the base pay would assist.

turn around the ongoing erosion of wages that has actually added considerably to expanding revenue.

inequality.” In response to the fast-food employee strikes. of 2013, Labor Assistant Thomas Perez stated that

it was another sign of the need to elevate. the base pay for all workers: “It ' s important to hear that voice … For all a lot of people. functioning minimum wage tasks, the rungs on the ladder of opportunity are feeling further. and further apart.

“The Economic expert composed in December 2013: “A minimum wage, supplying. … America ' s federal minimum wage, at 38%. U.S. minimal wage was last increased to$ 7.25 per hour in July 2009.

with minimum incomes above the Federal minimum, with the State of Washington the highest possible at.

$ 9.32. Ten states index their base pay to inflation.The. Pew Facility reported in January 2014 that 73% of Americans supported increasing the minimum. wage from$ 7.25 “to$ 10.10 per hour.By party, 53 %of Republicans and 90% of Democrats. favored this activity. In January 2014, 6 hundred financial experts. sent out the Head of state and Congress a letter advising for a base pay trek to$ 10.10 an hour. by 2016. In February 2014, the CBO reported the effects of a minimal wage rise under. 2 “situations, a rise to $10.10 with indexing for inflation afterwards and an

boost. to$ 9.00 without any indexing: Earnings inequality would be boosted under.

both situations.”Families with earnings more than 6 times the. “hardship threshold would certainly see their incomes fall (due in part to their company earnings. declining with greater worker expenses), while families with revenues listed below that threshold. would rise.Employment would likely drop by 500,000 under. the$ 10.10 alternative and 100,000 under the$ 9.00 alternative, with a wide variety of possible end results.

= =International contrasts====

= OverallTotal= =.== Plan feedbacks===== Overview ===.=== Cost effective medical care=== Raising taxes on greater earnings persons to.=== Taxes on the affluent=== CBO reported that much less modern tax obligation and. === Business tax obligation reform=

==.Approximately 16.5 million employees would have

their wages rise under the $10.10 alternative versus 7.5 million under the $9.00 option. The variety of individuals listed below the destitution revenue

limit would drop by 900,000 under the $10.10 option versus 300,000 under the $9.00.

alternative. === Maximum wage implementation ===.

Amalgamated Transit Union international president Lawrence J. Hanley has actually called for a maximum.

wage law, which “” would certainly restrict the quantity of settlement an employer can obtain to.

a defined multiple of the wage gained by his or her most affordable paid employees.”” Chief executive officer pay at the largest 350 U.S.Companies. was 20 times the typical

employee pay in 1965; 58 times in 1989 and 273 times in 2012.== =Subsidies and income warranties===. Others say for a basic income warranty, ranging from civil liberties leader Martin Luther. King, Jr. to libertarians such as Milton Friedman (in the kind of negative income tax obligation), Robert. Anton Wilson, Gary Johnson( In the form of the reasonable tax obligation “prebate”) and Charles Murray. to the Environment-friendly Event. === Rent-seeking limitations=”= =. General restrictions on and taxation of rent-seeking is prominent with huge sections of both Republicans. and Democrats.= == Financial freedom===. The economists Richard D. Wolff and Gar Alperovitz assert that higher financial equality could. be attained by extending freedom right into the economic round.

In an essay for Harper ' s Magazine, investigative. journalist Erik Reece argues that “With the political right entrenched in its resistance. to unions, worker-owned cooperatives stand for a less divisive yet a lot more extreme

design for. returning wide range to the workers who earned it.”=== Monetary policy== =. The impact on income inequality of monetary plan gone after by the Federal” Book is challenging.

to measure. Monetary policy can be used to stimulate the. economic situation (e.g., by decreasing passion rates, which motivates borrowing and costs, added. task production, and

inflationary pressure) or tightened up, with the opposite effects.Former Fed Chair Ben Bernanke wrote in June.

2015 that there are a number of effects on income and wealth inequality from financial stimulus

. that work in opposing directions: Stimulation reduces income inequality by producing. or maintaining work, which mostly aids the middle and lowers ranks that obtain even more of. their revenue from labor than the wealthy. Stimulus blows up the costs of financial. possessions( owned generally by the wealthy ), however also housing and the worth of small companies.( possessed more commonly). Stimulation might enhance the price of rising cost of living.

or lower rates of interest, which helps borrowers (mostly the center and lowers ranks) while. injuring lenders (mainly the affluent ), as they are paid back with cheaper bucks or. through lower variable price lendings.== Dimension techniques === == Introduction == =. Different techniques are used to determine revenue inequality and different sources may offer. different numbers for gini coefficients or ratio different ratio of percentiles, and so on. The. USA Demographics Bureau researches on inequality of home

revenue and private earnings. show reduced degrees of inequality than some other resources( Saez and Piketty

, and the CBO),. Do not include information for the highest-income homes where most of modification in earnings. distribution has occurred.Two typically pointed out resources of income inequality information are the.

CBO and financial expert Emmanuel Saez, which vary rather in their sources and methods.According to Saez, for 2011 the share of “market. revenue much less transfers” received by the leading 1% had to do with 19.5%. Saez used IRS information in this procedure. The CBO uses both internal revenue service data and Census data. in its calculations and reported

a lower “pre-tax” figure for the “leading 1% of

14.6%. Both information series were around 5 percentage. factors apart in current years. === Irs (INTERNAL REVENUE SERVICE )data=

==. Pioneers in making use of internal revenue service income data to assess earnings circulation are Emmanuel Saez. and Thomas Piketty at the Paris School of Business economics showed that the share of earnings. held by the leading 1 percent was as large in 2005 as in 1928. Other resources that have actually noted the increased. inequality included financial expert Janet Yellen who stated, “the growth [in genuine earnings] was.

Those between the top 1 percent and.== =Demographics Bureau information== =. The comparative use of Demographics Bureau data, as well as most sources of demographic income.

Contrasting changes in these top income restrictions. Some individuals shed earnings over time because. Therefore, comparing various earnings quintiles.

gradually resembles comparing apples to oranges, due to the fact that it indicates contrasting incomes of

various. individuals at various stages in their revenues profile.Gary Burtless of the Brookings Organization. notes that several financial experts and experts that use U.S. demographics data fall short to identify current. and significant lower- and middle-income gains, primarily due to the fact that demographics data does not catch. The primary problem with this earnings step. It fails to account for changing tax burdens. 2001-2003 and 2008-2012 are missed out on in the census statistics.Furthermore, the Demographics Bureau measure disregards.

tax obligation cuts in the recession, the Demographics Bureau ' s cash earnings action seriously overstated.

the earnings losses that middle-income family members endured in the recession.New CBO earnings statistics. are starting to reveal the growing significance of these items.In 1980, in-kind advantages and employer and. federal government investing on medical insurance made up simply 6% of the after-tax revenues of families.

in the center one-fifth of the circulation. By 2010 these in-kind revenue sources represented.

17% of middle class households ' after-tax income. The earnings things missed out on by the Census Bureau.

are increasing faster than the earnings products included in its cash income measure. What many onlookers miss, however, is the.

success of the nation ' s tax obligation and transfer systems in protecting low- and middle-income Americans

. against the complete impacts of a depressed economy. As an outcome of these programs, the spendable.

revenues of poor and middle-class families have been much better shielded versus recession-driven.

losses than the earnings of Americans in the leading 1%. As the CBO statistics show, revenues. in the center and at the end of the circulation have actually gotten on better considering that 2000 than revenues. at the extremely top.”=== Earnings actions: Pre-and post-tax===.

Inequality can be gauged before and after the effects of tax obligations and transfer repayments.

such as social safety and security and unemployment insurance. Market income, or income before taxes & transfers:.

Know-how, job and productiveness experience, inheritance, race, and gender have had a strong.

CBO reported in 2011 that: “The equalizing.=== Market issues===. Contrasts of income over time ought to readjust for adjustments in ordinary age, household dimension, number.

Individuals ' s revenues have a tendency to rise over their. functioning lifetimes, so “photo measures of income inequality can be deceptive.” The inequality of a recent university” grad. and a 55-year-old at the top of his/her profession is not a problem if the grad has the very same. occupation course. Conservative scientists and organizations. have actually concentrated on the imperfections of household revenue as an action for standard of life in order. to shoot down claims that revenue inequality is expanding, becoming excessive or presenting an issue. for society.According to sociologist Dennis Gilbert, expanding. inequality can be discussed partially'by growing participation of ladies in the labor force. High earning homes are more likely to. be twin earner households, And according to a 2004 evaluation of income quintile information by. the Heritage Structure, inequality ends up being less when household income is adjusted for. dimension of household. Aggregate share of income held by the upper. When figures are adjusted to show, quintile( the top earning 20 percent) decreases by 20.3%. household size.However the Church bench Proving ground located family revenue has shown up to decline.

much less than individual income in the twenty-first century

because those that are no more able. to afford their very own real estate have increasingly been moving in with family members, creating larger. households with more revenue earners in them.The 2011 CBO research study “Patterns in the Distribution. of Household Income” stated in this short article adjusts for house size so that its quintiles. have an equal variety of people, not

an equivalent variety of homes. Looking at the concern of how regularly workers. or families move right into greater or reduced quintiles as their earnings falls or increases over the years,. the CBO found income circulation over a multi-year duration “modestly” a lot more equivalent than yearly income.The CBO research confirms earlier studies.Overall,. according to Timothy Noah, fixing for demographic factors (today ' s population is. older than it was 33 years ago, and separation and solitary being a parent have actually made homes.

smaller), you discover that earnings inequality, though much less extreme than revealed by the criterion. step, is also growing quicker than revealed by the conventional step.

=== Gini index=== The Gini coefficient summarizes revenue inequality. It uses a scale from 0 to 1– the greater.

revenue).( Index scores are generally increased by 100. to make them simpler to comprehend.

) Gini index ratings can be made use of to contrast. inequality within (by race, gender, employment) and in between countries, prior to and after taxes. Different resources will commonly

offer different. gini values for the very same nation or population measured. The United state Demographics Bureau ' s official. Gini coefficient for

the USA was 47.6 in 2013, up from 45.4 in 1993, the earliest. year for comparable data.By comparison, the OECD ' s Gini coefficient for.

income inequality in the USA is 37 in 2012 (consisting of

earnings and various other cash. transfers), which is still the greatest in the developed globe, with the most affordable being. Denmark (24.3), Norway( 25.6 ), and Sweden (25.9).

Professor Salvatore Babones of the. College of Sydney notes: A significant gap in the dimension of revenue inequality.

Obviously, the rich make much a lot more from investments. As a result, genuine'degrees of earnings inequality.=== Determining inequality with intake.

Will Wilkinson of the liberal Cato Institute. According to Johnson, Smeeding, and Tory,. The argument is summed up in “The Hidden Success.

Other researches have not found intake inequality.

It did agree that home consumption numbers reveal extra equal circulation than.

much less or going deeper right into financial debt. A “expanding body of work” recommends that earnings.

inequality has actually been the driving consider the growing family financial obligation, as high earners. quote up the rate of genuine estate and center revenue earners go deeper into debt trying. to keep what once was a center class lifestyle.Between 1983 and 2007, the leading 5 percent saw. their financial debt autumn from 80 cents for every dollar of income to 65 cents, while the bottom 95. percent saw their financial obligation rise from 60 cents for “every buck of revenue to$ 1.40. Financial expert Krugman has actually located a solid correlation. in between inequality and home debt in the USA over the last a century.

== Riches inequality== Associated with income inequality is the subject. of riches inequality, which refers to the circulation of total assets( i.e., what is possessed. minus what is owed) rather than annual earnings. Total assets is affected by movements in the. rates of properties, such as stocks, bonds, and property, which can rise and fall significantly. over the short-term. Income inequality additionally has a substantial result. over long-lasting shifts in riches inequality, as revenue is built up.

Wealth inequality is additionally extremely concentrated.

and increasing: The leading 1% possessed roughly 40 %of the. wealth in 2012, versus 23 %in 1978. The top 1% share of riches was at or listed below. 30% from 1950– 1993. The top 0.1% owned approximately 22 %of the. riches in 2012, versus 7 %in 1978. The top 0.1 %share of wealth went to or below. 10% from 1950– 1987. The threshold for the leading 1% of wealth group. was approximately$ 8.4 million measured for the 2008– 2010 period. Almost half the leading 1% team by earnings is. Stood for in the top 1% group by wealth.The rise in riches for the 1%

was not homogeneous,. with much of the wealth gains in the leading 0.1 %. Those between the top 1 percent and leading 0.5. percent have really lost a considerable share of riches over the previous 50 years.Further,.

the leading 400 Americans had total assets of$ 2 trillion in 2013, which was greater than the. combined total assets of the lower 50 %of U.S. families. The average net worth of these 400 Americans.

was $5 billion. The reduced 50 %of houses held 3% of the.

riches in 1989 and 1% in 2013. The ordinary total assets of the lower 50% of. homes in 2013 was about $11,000.

This wealth inequality is obvious in the share. Financial wide range is determined as net worth. Amongst the top 20 percent of households by web.

2010.”== See additionally=== =Recommendations==== More analysis= === Outside web link= =. A Giant Analytical Round-up of the Revenue Inequality Crisis in 16 Charts from The Atlantic.

Slate-Timothy Noah-The Great Divergence-Book Passages. Emmanuel Saez-Income and Wide Range Inequality Presentation-October 2014. The Leading 1 Percent: What Jobs Do They Have?( What percent of what professions are in. the top 1% revenue brace )New york city Times January 15, 2012. What Percent Are You?( Enter your household income and see how you. ranking) “New York Times January 14, 2012 Islands of High Income. Richard Wilkinson: Exactly how financial inequality hurts societies.TED, Oct 2011. Five Financial Reforms Millennials Ought To Be. Fighting For. Wanderer, January 3, 2014.

Revenue Inequality in the USA: Hearing. Before the Joint Economic

Committee, Congress of the United States, One Hundred Thirteenth. Congress, Second Session, January 16

, 2014 “Riches

Space”– A Guide( AP News– January. 27, 2014). U.S. Census Bureau- Earnings, Hardship and Health and wellness. Insurance Coverage in the USA: 2013 Bloomberg-Quick Take-Income Inequality-Retrieved. December 2014 Can worker cooperatives alleviate income inequality? Al Jazeera America. January 13, 2015. Wolfers, Justin( March 2015). All You Required to Understand About Income Inequality,.

' Scandinavian Desire ' is true solution for America ' s income inequality.Joseph Stiglitz for CNN Cash, June 3, 2015. Hershey: U.S. Revenue Inequality Is Transforming. Stanford record reveals that U.S. performs improperly.

Stanford Information. February 2, 2016. Huge new information set suggests financial inequality.

will get back at worse. The Washington Message. January 4, 2018. Michael Hiltzik( 10 July 2018).

“Companies will certainly do nearly anything to find. employees to fill jobs– except pay them even more”. Los Angeles Times.

( with historic graphes ).

== =Subsidies and earnings warranties===. United States Demographics Bureau studies on inequality of household

income revenue individual specific. Leaders in the usage of Internal revenue service revenue information to assess earnings circulation are Emmanuel Saez.=== Revenue actions: Pre-and post-tax===.

=== Gini index=== The Gini coefficient sums up income inequality.