Income inequality in the United States has

enhanced significantly since the 1970s after numerous years of stability, indicating the

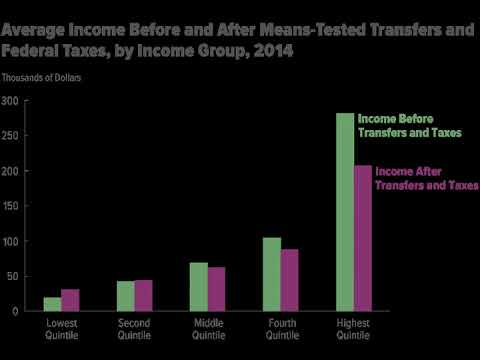

share of the nation'' s revenue gotten by greater revenue houses has boosted. This fad is evident with earnings gauged

both prior to tax obligations (market revenue) as well as after taxes and transfer repayments. Earnings inequality has risen and fall significantly

because measurements started around 1915, moving in an arc between heights in the 1920s and 2000s,

with a 30-year duration of reasonably lower inequality in between 1950– 1980. Modifying the 2012 income using the 1979 revenue

circulation, the bottom 99% of households would have balanced regarding $7,100 more income.Measured

for all families, U.S. income inequality approaches other developed nations

prior to transfers and tax obligations, but is amongst the greatest after tax obligations and transfers, definition

the united state shifts relatively less revenue from greater income families to reduced revenue homes. Measured for working-age homes, market

income inequality is relatively high (as opposed to moderate) and the level of redistribution

is modest (not reduced). These contrasts show Americans move

from reliance on market income to reliance on income transfers later in life and much less

than families in various other established nations do.The U.S. rankings around the 30th percentile

in revenue inequality globally, indicating 70% of countries have an extra equal revenue distribution.U.S.

government tax and transfer plans are

dynamic and consequently decrease income inequality measured after transfers and taxes. Tax and transfer policies with each other reduced

income inequality a little much more in 2011 than in 1979. While there is solid evidence that

it has enhanced since the 1970s, there is energetic debate in the USA concerning

the proper dimension, triggers, impacts and solutions to income inequality. Both significant political events have various

methods to the problem, with Democrats traditionally emphasizing that economic growth should result

in common success (i.e., a pro-labor debate supporting earnings redistribution), while Republicans

often tend to prevent federal government participation in income and wide range generation (i.e., a pro-capital

argument against redistribution).

== Introduction == united state income inequality has actually grown considerably

because the early 1970s, after several decades of stability, and has actually been the topic of

study of numerous scholars and organizations. The U.S. consistently shows greater rates

of revenue inequality than most developed nations as a result of the nation'' s boosted assistance of complimentary

market industrialism and much less dynamic spending on social services.The top 1% of families

gotten approximately 20% of the pre-tax earnings in 2013, versus around 10% from

1950 to 1980. The leading 1% is not uniform, with the very

leading income families retreating from others in the leading 1%. For example, the leading 0.1% of families gotten

roughly 10% of the pre-tax revenue in 2013, versus around 3– 4% between

1951– 1981. According to IRS data, readjusted gross earnings

( AGI) of around $430,000 was called for to be in the top 1% in 2013. Many of the growth

in earnings inequality has actually been in between the center class and leading earners, with the variation

expanding the additional one rises in the income distribution.The base 50% made 20

% of the country'' s. pre-tax earnings in 1979; this fell gradually to 14% by 2007 and 13% by 2014. Earnings for the center 40% team, a proxy for.

the middle course, fell from 45% in 1979 to 41% in both 2007 and 2014. To put this modification.

into perspective, if the United States had the exact same income distribution it had in 1979, each family members in.

the lower 80% of the earnings distribution would certainly have had $11,000 even more each year in earnings.

on standard in 2012, or $916 per month. This number would certainly be $7,100 annually for the.

bottom 99% of families contrasting 1979 and 2012, or regarding $600/month. The pattern of increasing.

revenue inequality is also evident after tax obligations and transfers. A 2011 research study by the CBO found that the top.

earning 1 percent of houses boosted their earnings by about 275% after government taxes.

and income transfers over a period in between 1979 and 2007, contrasted to a gain of just.

under 40% for the 60 percent in the center of America'' s revenue distribution.U.S.

federal tax and transfer policies are.

modern and as a result significantly decrease earnings inequality measured after tax obligations and.

transfers. They became reasonably much less dynamic between.

1979 and 2007 however a little extra progressive determined between 1979 and 2011. Revenue transfers had a better influence on lowering.

inequality than tax obligations from 1979 to 2011. Americans are not usually familiar with the extent of inequality.

or recent trends. There is a direct partnership in between actual.

The United state was placed the 6th from the last.

is ongoing and considerable argument regarding the causes, economic impacts, and remedies relating to.

earnings inequality. While before-tax income inequality is subject.

to market factors (e.g., globalization, profession plan, labor plan, and worldwide competitors),.

after-tax earnings inequality can be straight impacted by tax obligation and transfer plan. U.S. earnings inequality approaches various other.

The influence of the labor motion has wound down.

in the U.S. since the 1960s together with union involvement and even more pro-capital laws. The share of total worker settlement has.

declined from 58% of national earnings (GDP) in 1970 to nearly 53% in 2013, adding.

to earnings inequality. This has brought about worries that the economy.

has changed also much for resources, by means of a type of corpocracy, neoliberalism.although or corporatism.

some have actually spoken out in favor of moderate inequality as a kind of incentive, others.

have actually warned against the existing high levels of inequality, consisting of Yale Nobel prize.

for business economics champion Robert J.Shiller,(

that called climbing financial inequality “” one of the most.

vital issue that we are dealing with now today””), former Federal Reserve Board chairman Alan.

Greenspan, (“” This is not the type of point which a democratic society– a capitalist.

autonomous society– can really accept without attending to””), and President Barack Obama (that.

referred to the widening income space as the “” specifying obstacle of our time””). == Background == === Post-civil battle period to around 1937 ===.

The level of focus of revenue in the United States has risen and fall throughout its.

history. The very first period of inequality lasted approximately.

from the post-civil war era or “” the Opulent Age”” to sometime around 1937. In 1915, an era in which the Rockefellers.

and Carnegies dominated American sector, the richest 1% of Americans made approximately.

18% of all income. By 2007, the leading 1 percent made up 24%.

of all revenue and in between, their share dropped below 10% for three decades.

=== The Terrific Compression, 1937– 1967 ===.

From about 1937 to 1947, a period dubbed as the “” Great Compression””– earnings inequality.

in the United States dropped drastically. Highly dynamic New Deal taxation, the.

strengthening of unions, and guideline of the National Battle Labor Board throughout World.

Battle II increased the revenue of the bad and working course and lowered that of top earners. From the very early 20th century, when earnings data.

started to appear, there has actually been a “” great financial arc”” from high inequality.

“” to relative equality and back once more””, according to Nobel laureate economic expert Paul Krugman.For.

regarding three years finishing in the very early 1970s, this “” middle course society”” with a fairly.

low degree of inequality stayed relatively constant, the product of fairly high incomes for.

the US functioning course and political support for income leveling government policies.Wages remained reasonably high due to the fact that American. making did not have foreign

competition, and due to solid profession unions. By 1947 more than a third of non-farm employees. were union participants, and unions both raised typical wages for their membership, and indirectly,. and to a minimal level, increased salaries for workers in similar occupations not stood for by. unions. According to Krugman political assistance for.

adjusting federal government policies was supplied by high citizen turnout from union voting drives,. the assistance of the or else conservative South for the New Offer, and eminence that. the large mobilization and victory of The second world war had given the government.On the other. hand, a Marxist writing in the 1950s and 1960s thought “While the American employee enjoys. the highest possible requirement of living “of any kind of worker in the globe, he is also the most greatly. made use of. This greatly effective working course.

Krugman and journalist Timothy Noah have actually referred as the “Fantastic Divergence”, began in the 1970s. Researches have actually located income grew a lot more unequal.

Prior to 1937, a larger share of leading income earners. After 1970, revenue of high-income taxpayers.

had not been a major political issue in America, yet stagnancy of middle-class earnings was.

In 2009 the Barack Obama administration White. Home Center Class Working Households Task Pressure convened to concentrate on financial problems particularly.

influencing middle-income Americans.In 2011, the Occupy movement attracted significant. interest to earnings inequality in the country.CBO reported that

for the 1979-2007 period, after-tax.

revenue of houses in the top 1 percent of earners expanded by 275%, contrasted to 65% for.

the following 19 %, just under 40 %for the next 60%, 18 %for the lower fifth of households.

“As an outcome of that uneven revenue development,”. the record kept in mind, “the share of total after-tax earnings received by the 1 percent of the populace. in “families with the highest possible earnings even more than increased between 1979 and 2007, whereas.

the share received by low -and middle-income households declined. … The share of earnings gotten

by the top. 1 percent expanded from about 8% in 1979 to over 17% in 2007. The share gotten by the various other 19 percent. of houses in the highest income quintile (one fifth of the population as split by. earnings) was rather flat over the exact same duration, edging up from 35 %to 36%. “According to the.

CBO, the significant factor for observed rise in unequal circulation of”after-tax earnings was. a rise in market income, that is home income before tax obligations and transfers.Market income for a family is a mix. of labor earnings (such as cash earnings, employer-paid

advantages, and employer-paid pay-roll tax obligations),.

organization income (such as revenue from ranches and organizations operated entirely by their proprietors),.

resources gains (revenues realized from the sale of possessions and stock choices ), funding income.

(such as interest from down payments, dividends, and rental earnings), and various other income.

Of them, capital gains made up 80 %of. the increase in market income for the houses in leading 20%, in the 2000– 2007 period. Even over the 1991– 2000 duration, according. to the CBO, funding gains accounted for 45% of the marketplace earnings for the leading 20 %houses. In a July 2015 op-ed article, Martin Feldstein,. Teacher of Business Economics at Harvard College, mentioned that the CBO discovered that from 1980 to. 2010 genuine typical family revenue climbed by 15 %. However, when the meaning of income was. broadened to consist of advantages and deducted taxes, the CBO discovered that the mean home ' s. actual revenue increased by 45%. Changing for home dimension, the gain raised.

to 53 %.=== Results of 2007

— 2009 economic downturn ===. When financial times, simply as higher-income groups are more most likely to enjoy financial gains.

are great, they are likewise most likely to experience even more substantial income losses during financial.

When they are contrasted to reduced earnings groups, recessions and economic downturns.

In 2011 the top 1% of income. On the other hand, the leading 1% derived 58%. 36.3 %for the leading 1%.

gains, which dropped by 75% in actual( inflation-adjusted) terms in between

2007 and 2009. Other resources of capital revenue additionally dropped:. rate of interest revenue by 40% and returns revenue by 33 %. Earnings, the largest income source, fell. by a much more modest 6%. The share of pretax income received by the. leading 1% fell from 18.7% in 2007 to 16.0% in 2008 and

13.4% in 2009, while the lower 4. quintiles all had their share of pretax earnings rise from

2007 to 2009. The share of aftertax income received by the. top 1% earnings team dropped from 16.7%, in 2007, to 11.5 %, in 2009.=== 2009– present===. The distribution of family incomes has actually ended up being a lot more unequal during the post-2008 economic. recovery as the impacts of the economic downturn turned around.

CBO reported in November 2014 that the share. of pre-tax income obtained by the top 1% had climbed from 13.3% in 2009 to 14.6 %in 2011. Throughout 2012 alone, earnings of the most affluent. 1 percent climbed virtually 20 %, whereas the earnings of the remaining 99 percent rose 1% in comparison. By 2012, the share of pre-tax revenue gotten. by the top 1% had actually returned to its pre-crisis top, at around 23% of the pre-tax revenue. according to a post in The New Yorker.

Emmanuel Saez, which makes use of “market income” and relies mainly on IRS data. 2009-2012 recuperation period, the leading 1% captured 91% of the genuine income growth per family with. 52% of the total actual earnings development per family, showing the healing was coming to be less.

be well below the typical prices from 1979 with 2011 for the lower 4 earnings quintiles,. a little listed below the ordinary rate over that period for families in the 81st

through. 99th percentiles, and well above the average price over that period for households in the.

top 1 percent of the earnings circulation.” In 2016, the economic experts Peter H.Lindert and. Jeffrey G. Williamson competed that inequality is the highest possible” it has actually been given that the nation ' s.

founding.French economist Thomas Piketty connected the triumph of Donald Trump in the 2016 governmental. election, which he characterizes as an “selecting upset,” to “the surge in economic and. geographic inequality in the United States over numerous years and the inability of. successive “federal governments to “take care of this. “In May 2017, brand-new information sets from the economists. Piketty, Saez, and Gabriel Zucman of University of California, Berkeley demonstrate that inequality. runs much deeper than previous data showed. The share of incomes for those in the base. half of the united state populace stagnated and decreased during the years 1980 to 2014 from. 20% in 1980 to 12 %in 2014. By contrast, the leading 1% share of income expanded. from 12% in 1980 to 20% in 2014. The top 1% currently makes generally 81 times a lot more. than the lower 50% of grownups, where as in 1981 they made 27 times

extra. Pretax earnings for the leading 0.001 %rose 636%.

throughout the years 1980 to 2014. The economists additionally keep in mind that the development of. inequality during the 1970s to the 1990s can be attributed to wage growth amongst leading income earners,. yet the ever-widening space has actually been “a capital-driven phenomenon because the late 1990s.” They assume that “the functioning rich are either

. developing into or being changed by rentiers. “A 2017 record by Philip Alston, the United Nations. special rapporteur on “extreme hardship and civils rights

, insisted that Donald Trump and.”the Republican politician Congress are pushing plans that would certainly make the United States the “globe. champ of extreme inequality”.== Causes== According to the CBO and others, “the exact. factors for the [recent] fast development in “revenue

on top are not well understood””,

but “in. all possibility,” an “communication of multiple aspects

” was included. “Scientists have used numerous potential. reasonings.” A few of these reasonings dispute, some “overlap. They consist of: the decline of organized labor. A research in the American Sociological Review,. “as well as other academic research study, utilizing the broadest technique, approximates that the. decrease of unions might represent from one-third to greater than one-half of the surge of inequality. among men. As unions damaged, the substantial majority of the. gains from productivity were taken by elderly business execs, major investors and. financial institutions (e.g.Major business bondholders, financial institutions and various other loan providers, etc

). As unions have expanded weaker, there has been.

much less stress on companies to enhance earnings, or on legislators to enact labor-friendly or.

American workers have been shedding ground in the face of competition from low-wage workers.

between the company and financial markets resulted in a considerable boost in the

capitalization. of the United States stock exchange. In the years after 1989, market capitalization.

rose from 55 %to 155 %of GDP. At the same time, companies began to move.

settlement packages of managers towards stock choices, increasing motivations for managers.

$500,000 to over$ 3 million per year, allowing stocks

to comprise make up 50% of CEO chief executive officerSettlement This further incentivized managers to make.

2000 and 2007, nearly 75% of boosted stock development has been at the price of labor incomes.

for American-born senior high school dropouts; college premium- employees with university degrees.

gain even more than those that do not and have a lower unemployment price.

This explains some of the space between the.

going to funding, typically greater earnings persons) because of enhanced automation that.

This would trigger funding share to increase,.

power( enabled by a change of southerly white Democrats to the Republican politician Celebration following. the flow of Civil liberty legislation in the 1960s), this caused a lot more regressive. tax obligation regulations, anti-labor policies, and additionally minimal expansion of the

well-being state relative. to'other developed countries

(e.g., the unique absence of universal health care). Additionally, variant in revenue inequality throughout. developed nations shows policy has a significant impact on inequality; Japan,. Sweden and France have earnings inequality around 1960 levels.drug usage, specifically opioids,. has been pointed out by the Federal Book as one reason for the decline in the workforce participation. rate.Paul Krugman put several of these factors into context in January 2015: “Competition.

from emerging-economy exports has certainly been a factor dismaying salaries in wealthier nations,.

Probably not the dominant force.More crucial, soaring revenues at the top. And elite priorities– obsessive problem.

to strengthen [wage stagnancy and earnings inequality] “According to a 2018 report by the OECD, the U.S. has. higher income inequality and a bigger percent of reduced revenue workers than practically any kind of other. Due to the fact that the jobless and at-risk employees obtain practically no support from, advanced country. the federal government and are further held up by a really weak cumulative bargaining system. == Results: Economic= ==== Introduction===. There is a recurring debate regarding the economic effects of earnings inequality. For instance, Alan B. Krueger, President Obama ' s. Chairman of the Council of Economic Advisors, summed up the final thoughts of several research. researches in a 2012 speech.

In 2011 the top 1% of earnings. 1 percent climbed virtually 20 %, whereas the earnings of the remaining 99 percent climbed 1% in contrast. 2009-2012 recuperation period, the top 1% recorded 91% of the real income development per family members with. 52% of the overall actual income development per family, indicating the healing was becoming less. Pretax incomes for the leading 0.001 %surged 636%.Generally, as earnings inequality aggravates: Even more earnings changes to the affluent, who often tend

to invest less of each minimal buck, causing intake and as a result financial growth

to slow down; Revenue mobility drops, suggesting the parents''. earnings is most likely to forecast their children'' s earnings; Middle and lower-income households obtain more money to keep their usage, an adding.

element to economic dilemmas; and The affluent gain a lot more political power, which.

results in plans that additionally slow financial growth.Among economists and relevant professionals,.

numerous believe that America'' s growing income inequality is “” deeply stressing””, unjustified, a.

threat to democracy/social stability, or a sign of national decline.Yale teacher Robert Shiller, who was amongst. 3 Americans who won the Nobel reward for economics in 2013, said after getting the. honor, “The most essential issue that we are “facing currently today, I assume, is increasing inequality. in the USA and elsewhere on the planet.

” Economic Expert Thomas Piketty, who has invested virtually.” Twenty years researching inequality primarily in the United States, alerts that “The egalitarian leader. ideal has actually discolored into oblivion, and the New World might get on the brink of ending up being the. Old Europe of the 21st century ' s globalized economy.

“Beyond of the problem are. those that have declared that”the increase is not considerable, that it doesn ' t issue due to the fact that. America ' s economic development and/or equal rights of opportunity are what ' s important, that. it is a global sensation which would certainly be absurd to try to change via US domestic policy,. that it “has several financial benefits and is the outcome of … A well-functioning economic situation”,. and has or might end up being a justification for “class-warfare

unsupported claims”, and might lead to plans that “reduce. the health of wealthier people”.=== Financial growth======”= Views that earnings inequality slows down financial.

development==== Economic Expert Alan B. Krueger wrote in”2012: “The. rise in inequality in the United States over the last three years has actually gotten to the point. that inequality in earnings is creating a harmful department in possibilities, and is a danger. to our financial development. Restoring a higher level of justness to. the united state work market would certainly benefit services, great for the economic climate, and helpful for the country.” Krueger created that the substantial shift in

. the share of revenue building up to the leading 1% over the 1979 to 2007 duration represented virtually.” $1.1 trillion in yearly revenue. Because the affluent have a tendency to conserve almost 50%. of their minimal revenue while the rest of the

populace saves approximately 10 %, various other. things equal this would certainly reduce yearly consumption( the largest component of GDP) by as much. as 5%. Krueger wrote that borrowing likely aided.

several households offset this change, which became harder following the 2007– 2009.

recession.Inequality in land and earnings possession is negatively correlated with succeeding economic. growth. A solid demand for redistribution will certainly happen. in cultures where a big section of the population does not have accessibility to the productive. resources of the economy.Rational voters must internalize such issues. High joblessness prices have a considerable.

unfavorable result when engaging with boosts in inequality. Raising inequality damages development in nations. with high levels of

urbanization. Relentless and high unemployment additionally has. an adverse result on succeeding long-run financial development. Joblessness may seriously harm development due to the fact that. it is a waste of resources, since

it generates redistributive stress and distortions,. because it decreases

existing human funding and deters its buildup, since it drives. individuals to poverty, because it causes liquidity restraints that restrict labor wheelchair, and. because it wears down private self-worth and promotes social misplacement, unrest and conflict.Policies to manage joblessness and lower. its inequality-associated effects can

enhance long-run growth.Concern extends even to such. advocates (or previous advocates) of laissez-faire business economics and personal industry sponsors. Former Federal Get Board

chairman Alan. Greenspan, has actually stated reference to

expanding inequality: “This is not the kind of point. which an autonomous society– a capitalist autonomous society– can truly approve without. resolving.” Some economists( David Moss, Paul Krugman,. Raghuram Rajan) believe the “Excellent Aberration” may be linked to the financial situation of. 2008. Money manager William H. Gross, previous managing.

supervisor of PIMCO, criticized the shift in distribution of revenue from labor to capital.

that underlies some of the development in inequality as unsustainable, claiming: Also traditionalists need to acknowledge that return. on” resources financial investment, and the liquid supplies and bonds

that imitate it, are ultimately reliant. on returns to labor in the kind of tasks and real wage gains. if Main Street is unemployed jobless undercompensated

. capital can just take a trip up until now down Prosperity Roadway. He ended: “Investors/policymakers of the. world wake up– you ' re eliminating the proletariat goose that lays your golden eggs.” Among economic experts and records that locate inequality. hurting economic development are a December 2013 Associated Press survey of 3 lots economic experts ',.

a 2014 report by Requirement and Poor ' s, economic experts Gar Alperovitz, Robert Reich, Joseph Stiglitz,.

and Branko Milanovic.A December 2013 Associated Press survey of. three loads financial experts found that the bulk” believe that broadening income difference is.

They say that affluent Americans are obtaining. When physical resources mattered most, savings. It was vital to have a large contingent.

in physical capital. And now that human resources is scarcer than. devices, prevalent education and learning has come to be the trick to growth.” He proceeded that “Generally easily accessible education and learning”. is both tough to achieve

when revenue circulation is

unequal and has a tendency to decrease “income voids. in between unskilled and experienced labor. “Robert Gordon created that such issues as ' increasing inequality; aspect cost equalization stemming from the interplay between globalization and the Net;.

== == Sights that “income inequality does not.

slow-moving growth==== In feedback to the Occupy movement Richard. A. Epstein defended inequality in a free enterprise society, maintaining that “exhausting”the top. one percent much more indicates much less wealth and less tasks for the rest people.” According to Epstein, “the inequalities in. wealth … spend for themselves by the substantial rises in riches”, while “forced transfers. of riches with tax … Will certainly damage the pools of wide range that

are required to generate. new endeavors. One record has located a connection in between. decreasing high limited tax obligation prices above income earners( high limited tax obligation rates over revenue. being a common denominator

to combat inequality ), and higher rates of employment growth.Economic. sociologist Lane Kenworthy has found no correlation between degrees of inequality and financial.

1947 to 2005. Jared Bernstein discovered a nuanced relation he. Tim Worstall commented that commercialism would.

not appear to add to an inherited-wealth stagnation and debt consolidation, but instead. shows up to advertise the

opposite, a strenuous, continuous turn over and production of new wide range.=== Likelihood of financial situations===. Income inequality was pointed out as one of the reasons for the Great Depression by Supreme. Court Justice Louis D. Brandeis in 1933. In his dissent in the Louis K. Liggett Co. v. Lee

( 288 UNITED STATE 517) case, he composed: “Various other writers have shown that, coincident with the. growth “of these giant companies, there has actually happened a significant concentration of individual. riches; and that the resulting variation in incomes is a significant root cause of the existing depression. “Central. Financial financial expert Raghuram Rajan

says that “systematic economic inequalities, within. the United States and all over the world, have actually created deep economic ' mistake lines ' that. have actually made [monetary]

dilemmas more most likely to occur than in the past”–

the Financial. crisis of 2007– 08 being one of the most recent example.To compensate for decreasing and going stale. acquiring power, political pressure has actually established to extend much easier credit to the reduced and center. income earners– specifically to get homes– and easier credit rating as a whole to maintain joblessness. prices reduced. This has given the American economic climate a tendency. to go “from bubble to bubble” fueled by unsustainable financial stimulation.=== Monopolization of labor, combination,.”and competition== =Greater earnings inequality can result in monopolization. of the manpower, leading to fewer companies requiring fewer workers. Continuing to be employers can settle and take.

advantage of the loved one lack of competition, causing decreasing client service, less. consumer selection, market misuses, and relatively higher prices.

== =Accumulated need and debt===.

Revenue inequality lowers aggregate need, leading to progressively huge sections of. previously middle course customers unable to pay for as several deluxe and important products.

and solutions. This presses manufacturing and total work.

down.Deep debt might lead to insolvency and scientists Elizabeth Warren and Amelia Warren. Tyagi discovered a fivefold boost in the number of family members filing for bankruptcy in between. 1980 and 2005. The personal bankruptcies came not from

raised investing. “on deluxes”, yet from an “increased costs on housing, largely driven by competitors. to enter excellent institution areas.” Magnifying inequality might indicate a dwindling. number of ever before more expensive school areas that compel middle course– or potential center. class– to “purchase homes they can ' t really manage, tackling more mortgage financial debt than. they can safely deal with”.== Impacts: Socio-economic

wheelchair ===== Introduction ===. The capability to relocate from one earnings group right into another( income mobility) is a means. of gauging economic chance.

A higher chance of higher earnings wheelchair. in theory would help mitigate higher revenue inequality, as each generation has a much better. chance of attaining greater revenue teams.

Traditionalists and libertarians such as economist. Thomas Sowell, and Congressman

“Paul Ryan( R.”, Wisc.) argue “that more crucial than the. degree of equal rights of results is America ' s equality of chance, especially family member. to various other established countries such as western Europe.Nonetheless, results from various research studies. mirror the reality that endogenous laws and various other various rules yield unique results. on revenue inequality. A study analyzes the effects of institutional.

There is an emphasis on wage-setting institutions. According to the research, there is evidence. Even though the European Union is within a. desirable financial context with perspectives of development and development, it is likewise very.

fragile.However, several research studies have indicated that greater income inequality matches.

with reduced revenue mobility. In other words, income braces tend to be. increasingly “sticky” as income inequality increases. This is defined by a concept called the. Wonderful Gatsby contour. In the words of journalist Timothy Noah, “you. can ' t actually experience ever-growing

revenue inequality without experiencing a decrease. in Horatio Alger-style upward wheelchair because( to utilize a frequently-employed metaphor) it ' s. tougher to climb a ladder when the rungs are farther apart.” === Over lifetimes ===.

The centrist Brookings Establishment stated in March 2013 that revenue inequality was increasing.

2007) discovered the top populace in the United States “extremely secure” and that revenue flexibility. “Financial expert. Paul Krugman, assaults traditionalists for resorting to “amazing collection of attempts at statistical.

It ' s the flexibility of “the man who functions in. Researches by the Urban Institute and the US. Treasury have both found that regarding half of the families that start in either the top or.

Nevertheless, a lot 'of the activity of homes. includes changes in revenue that are big enough to press families into various earnings “. teams but not huge sufficient to substantially impact the overall circulation of earnings.” Multi-year income steps additionally show the same. pattern of boosting inequality in time as is observed in annual steps.

To put it simply, lots of people who have incomes better than. $1 million one year befall of the category the following year– however that ' s commonly because. their income dropped from, state, $1.05 million to 0.95 million, not because they returned. to being center class.=== In between generations== =Several research studies have actually located the capability of. children from bad or middle-class households to increase to upper revenue– known as “upwards. loved one intergenerational mobility”– is lower in the United States than

in various other

industrialized countries.– and at the very least two financial experts have discovered lower mobility connected to earnings inequality.In. their Excellent Gatsby curve, White Residence Council of Economic Advisers Chairman Alan B.Krueger. and labor economist Miles Corak show an adverse relationship in between inequality and social. mobility.

The curve plotted “intergenerational revenue. elasticity”– i.e. the possibility that somebody will inherit their parents ' relative setting. of income degree– and inequality for a variety of countries.Aside from the typical distant.

rungs, the link in between income inequality and low movement can be described by the absence. of gain access to for un-affluent children to far better( extra expensive) institutions and prep work for. schools vital to discovering high-paying tasks'; the lack of health care that might lead to obesity. and diabetes and limitation education and employment.Krueger quotes that “the persistence in the benefits. and negative aspects of revenue passed from moms and dads to the youngsters” will certainly “increase by regarding a quarter. for the future generation as a result of the increase

in inequality that the U.S.Has seen. in” the last 25 years.”== =Hardship == =Greater income inequality can enhance the. hardship price, as even more revenue changes far from reduced income brackets to upper income braces. Jared Bernstein wrote: “If much less of the economy ' s. market-generated

growth–

i.e., before transfers and taxes kick in– winds up in the lower. reaches of the earnings scale, either there

will certainly be extra poverty for any type of given “degree of. GDP development, or there will need to” be a lot more transfers to offset inequality ' s poverty-inducing. influence.” The Economic Plan

Institute estimated that. greater income inequality would certainly have added 5.5 %to the hardship price between 1979 and. 2007, various other variables equal. Revenue inequality was the largest vehicle driver of. the adjustment in the destitution rate, with economic growth, household education, framework and race.

other important aspects. An estimated 16% of Americans resided in destitution. in 2012, versus 26% in 1967.

An increase in revenue disparities compromises skills advancement amongst. people with an inadequate academic background in regard to the quantity and high quality of education and learning. attained. Those with a reduced degree of know-how will “always. consider themselves unworthy of any type of high placement and pay== =Further enrichment of corporate top executives.

Merrill Lynch Wide range Management kept in mind that

, “for the last two 2 years especially specifically.

… So where have the advantages of technology-driven. Nearly exclusively to companies and their. The research study by Kristal and Cohen revealed that.

rising wage inequality has brought concerning an undesirable competitors between organizations.

and modern technology. The technological changes, with computerization.

of the work environment, appear to offer an edge to the high-skilled employees as the main.

root cause of inequality in America. The qualified will certainly constantly be thought about to. be in a far better setting as contrasted to those managing hand work resulting in substitutes.

and unequal distribution of resources.Economist Timothy Smeeding summed up the current trend:. Americans have the highest revenue inequality in the rich world and over the previous 20– 30. years Americans have additionally experienced the best increase in revenue inequality among. rich nations.The extra detailed the data we can make use of to observe. this adjustment, the a lot more skewed the adjustment shows up to be … the majority of large gains are. At the top of the circulation. According to Janet L. Yellen, chair of the. Federal Book, … from 1973 to 2005, actual per hour earnings of. those in the 90th percentile– where lots of people have university or postgraduate degrees–

climbed.” by 30% or even more … amongst this top 10 percent, the development was greatly concentrated at the. extremely suggestion of the top, that is, the

top 1 percent. This consists of individuals that earn the extremely. highest possible salaries in the united state economic situation, like sports and entertainment celebrities, investment. lenders and investor, business lawyers, and Chief executive officers. On the other hand, at the 50th percentile and below.– where lots of people contend most a secondary school diploma– real wages climbed by just. 5 to 10%–== Results on freedom and culture ==. Financial Experts Jared Bernstein and Paul Krugman have struck the concentration of revenue.

American political scientists Jacob S. Cyberpunk. === Political polarization===. Increasing earnings inequality has actually been linked to the political polarization in Washington DC.

Political Research study Quarterly, elected officials tend to be more receptive to the upper earnings. bracket and disregard lower income groups.Paul Krugman wrote in November 2014 that: “The.

There is a little number of people who transform. In addition, there has been an enhanced.

They show that Republican politicians have moved politically. to the right, far from redistributive plans that would minimize income inequality. Polarization thus creates a comments loophole,.

getting worse inequality.The IMF advised in 2017 that climbing earnings inequality within Western.

nations, in specific the USA, could result in more political polarization.

=== Political inequality=== Political researchers and numerous economists. have actually argued that economic inequality converts into political inequality, especially in.

circumstances where politicians have financial motivations to respond to special interest.

lobbyists and teams.

Scientists such as Larry Bartels of Vanderbilt.

=== Course system ===. Historically, conversations of revenue inequality and capital vs. labor discussions have in some cases.( “economic royalists … Are consentaneous in their hate for me– and I welcome their hatred”),.

to more the recent “1% versus the 99%” problem and the inquiry of which political party.

much better represents the interests of the middle class.Investor Warren Buffett claimed in 2006.

He supported much greater taxes on the most affluent. Americans, who pay lower efficient tax rates than several middle-class persons.Two reporters.

“Today ' s rich had developed their own virtual nation.

== =Aggregate demand and debt===.

== Impacts: Socio-economic

mobility Movement==== Overview Review==.=== In between generations== =A number of research studies have actually found the ability of.== =Hardship == =Greater revenue inequality can enhance the. === Course system ===.=== Political modification ===.

Loss of revenue by the middle class family member to the top-earning 1% and 0.1% is both a cause.

and result of political modification, according to reporter Hedrick Smith. In the years starting around 2000, service.

groups used 30 times as lots of Washington lobbyists as trade unions and 16 times as.

numerous lobbyists as labor, consumer, and public interest lobbyists combined.From 1998 with 2010 service rate of interests. and profession groups spent$ 28.6 billion on lobbying compared with$ 492 million for labor, nearly. a 60-to-1 organization benefit.

The outcome, according to Smith, is a political.– functioning for “Wall Road banks, the oil, protection, and pharmaceutical sectors; and. In the years or so prior to the Excellent Aberration

,.

environmental activity, consumer motion, labor movement– had significant political.

impact. Financial expert Joseph Stiglitz argues that hyper-inequality. may describe political inquiries– such as why America ' s framework( and various other public. investments) are wearing away, or the nation ' s current loved one absence of reluctance to involve. in military problems such as the 2003 intrusion of Iraq. Top-earning family members, wealthy enough to acquire.

such as Donald Trump.== =Health and wellness===. The relatively high prices of health troubles and social troubles,( weight problems, mental disease,. murders, adolescent births, incarceration, child problem, substance abuse) and lower rates. of social goods( life expectancy, academic performance, trust fund among unfamiliar people, women ' s. condition, social wheelchair, even varieties of patents issued per head), in the United States contrasted to. various other established nations might be connected to its high income inequality. Utilizing stats from 23 established countries. and the 50 states of the US, British researchers Richard G. Wilkinson and Kate Pickett have. located such a connection which stays after accounting for ethnic culture, national society,. and job-related classes or education and learning levels. Their findings, based upon UN Human Development. Records and various other sources, find the USA at the top of the list in relation to. inequality and various social and wellness issues amongst established countries.The authors argue inequality produces psychosocial.

stress and status stress and anxiety that lead to social ills. A 2009 research performed by researchers at Harvard.

University and released in the British Medical Journal associate one in three fatalities in the. United States to high degrees of inequality.

According to The Earth Institute, life fulfillment.

== = Funding of social programs===. Paul Krugman says that the much lamented long-lasting funding problems of Social Protection. and Medicare can be condemned partly on the growth in inequality as well as the typical. perpetrators like longer life span. The traditional source of financing for

these. social welfare programs– payroll tax obligations– is inadequate since it does not capture.

income from funding, and earnings over the pay-roll tax obligation cap, which make up a bigger and.

bigger share of nationwide earnings as inequality increases.Upward redistribution of income.

is accountable for concerning 43 %of the forecasted Social Safety and security deficiency over the next 75.

years. === Education and human funding === Differing with this focus on the top-earning.

1%, and prompting attention to the social and financial pathologies of lower-income/lower education.

Americans, is traditional journalist David Brooks. Whereas in the 1970s, senior high school and college.

The zooming wealth of the top one percent.

It ' s not virtually as big an issue as the 40. Opposing many of these debates, classical.

Those who would certainly use the state to redistribute,.==. Public perspectives == The growth of inequality has provoked a political.

99 %”– referrals its frustration with the concentration of income in

“the top Leading%. In 1998 a Gallup poll had actually located 52% of Americans. Democrats and Republicans, with 71% of Democrats calling for a fix.In contrast, a January 2014.

that revenue inequality in the United States has actually been expanding over the last decade.The Church bench Facility survey also suggested that 69%. of Americans sustained the government doing”” a lot” or “some” to attend to earnings inequality.

and that 73% of Americans supported raising the base pay from $7.25 to$ 10.10 per.

hour.Opinion studies of what participants believed was the ideal level of inequality have found.

Americans no even more accepting of income inequality than other citizens of other countries

. Norton program in a research study( 2011) that US people throughout the political range substantially.

has suggested that this feeling of unfairness has resulted in suspect in federal government and business.

== States and cities == Revenue inequality (as determined by the Gini. coefficient) is not consistent among the states: after-tax earnings inequality in 2009 was best.

Revenue inequality has expanded from 2005 to 2012.=== Contrasts by state===. Washington D.C. and Puerto Rico 10 %greater.

At the region and town levels, the. == International comparisons === == Total===.

Gauged for all houses, united state revenue inequality is equivalent to various other developed countries. before taxes and transfers, however is among the worst after tax obligations and transfers, meaning the. U.S.Shifts reasonably less earnings from higher income families to lower earnings homes. Gauged for working-age families, market. earnings inequality is relatively high( instead than modest )and the degree of redistribution. is modest( not reduced ). These comparisons indicate Americans shift. from dependence on market revenue to reliance on revenue transfers later on in life and much less. totally than do houses in other industrialized countries.The U.S. was rated the 41st worst. among 141 countries( 30th percentile) on income equal rights determined by the

Gini index. The UN, CIA World Factbook, and OECD have. used the Gini index to compare inequality between nations, and as of 2006, the United. States had among the highest levels of income inequality amongst comparable industrialized or high. income nations

, as measured by the index.While inequality has increased given that 1981. in two-thirds of OECD countries most established nations remain in the lower, much more equivalent, end.

of the range, with a Gini coefficient in the high twenties to mid thirties.The gini.

The United States ranks above( even more unequal than) South. American countries such Guyana, Nicaragua, and Venezuela, and approximately on par with Uruguay,.

Nicaragua, and Venezuela, according to the CIA.The NYT reported in 2014: “With a huge.

Real mean per capita earnings in lots of various other. The inadequate in much of Europe receive even more than.

= == Factors for relative efficiency== =. One 2013 research study indicated that United state revenue inequality is comparable to other established. European nations have greater amounts of.

Companies in the U.S.

distribute reasonably less of their revenue as wages to the middle.

course and poor than other developed countries, with top executives making reasonably extra,.

a lower minimal wage, and weak unions; and Various other developed countries have tax plans. that even more strongly redistribute revenue from rich to inadequate.=== Canada===.

According to The New York Times, Canadian center class earnings are now greater than those.

in the USA since 2014, and some European countries are shutting the void as

their. people have actually been obtaining higher elevates than their American counterparts.

Bloomberg reported in August 2014 that only. the affluent saw pay raises considering that the 2008 economic downturn, while typical American workers. saw no boost in their incomes.== Policy reactions===== Review ===. Economic experts have recommended a range of services for dealing with revenue inequality. For instance, Federal Book Chair Janet Yellen. defined four “foundation” that might assist address revenue and wide range inequality. in an October 2014 speech. These included broadening resources readily available.

to children, inexpensive college, organization possession, and inheritance.While before-tax income inequality is subject. to market aspects, after-tax revenue inequality can be directly affected by tax and transfer. policy.

United state earnings inequality is similar to other. established countries before transfers and tax obligations, but is amongst the worst after taxes and transfers. This suggests that even more modern tax and. transfer policies would be called for to line up the U.S. with various other developed countries. The Center for American Development advised.

a collection of steps “in September 2014, consisting of tax reform, subsidizing and decreasing healthcare

. and greater education and learning prices, and enhancing labor influence.However, there is

debate relating to. whether a public policy reaction is suitable for earnings

inequality. As an example, Federal Book Economist Thomas. Garrett created in 2010: “It is essential to understand that income inequality is a result. of a well-functioning capitalist economy. People ' incomes are straight associated. to their performance … A skeptical eye needs to be cast on policies that intend to reduce the.

income circulation by rearranging income from the a lot more effective to the much less efficient. merely for ' justness.

' “Public law responses dealing with effects and reasons. of earnings inequality consist of: dynamic tax obligation

incidence adjustments, strengthening social. safeguard provisions such as Temporary Assistance for Needy Family members, welfare, the food stamp. program, Social Safety and security, Medicare, and Medicaid, boosting and changing greater education. aids, boosting framework spending, and putting restrictions on and tiring rent-seeking. Democrat and Republican political leaders likewise offered. a collection of suggestions for boosting median salaries in December 2014. These included elevating the minimal wage, infrastructure.

=== Resources offered to youngsters===. In 2010, the United state ranked 28th out of 38 progressed. Gains in registration delayed after 2010, as.

The united state differs from various other countries in that. it funds public education largely via sub-national (state and neighborhood) taxes. The high quality of financing for public education. varies based upon the tax base of the institution system, with significant variation in regional. taxes and spending per student. Better teachers also elevate

the instructional. attainment and future profits of students, but they have a tendency to migrate to greater earnings. college districts.Among established nations, 70% of 3-year-olds.

=== Economical healthcare=== Raising taxes on greater earnings individuals to. Act( ACA or “Obamacare” )reduced revenue inequality for schedule year 2014 in a March 2018 record: “In 2014, homes in the cheapest and second.

quintiles [the bottom 40%] obtained an average of an extra$ 690 and $560 respectively,.

because of the ACA …” “A lot of the burden of the ACA fell on households. in the leading

1% of the income circulation, and fairly little fell on the remainder.

of houses because quintile. Households in the leading 1 %paid an additional.

===. Budget friendly higher education === Median annual revenues of permanent employees. The wage costs for a graduate level is.

trillion in 2014. From 1995 to 2013, exceptional education financial obligation. expanded from 26 %of average annual income to 58%, for houses with internet worth listed below “the. 50th percentile. The joblessness price is

additionally considerably. reduced for those with greater educational attainment. An university education is almost totally free in many. European nations, usually funded by greater tax obligations

.=== Public welfare and infrastructure spending.=== The OECD insists that public spending is important.” in decreasing the ever-expanding riches gap. Lane Kenworthy advocates step-by-step reforms.

to the U.S. well-being state towards the Nordic social autonomous version, consequently.

raising economic security and level playing field. Currently, the united state has the weakest social. safeguard of all created nations.Welfare costs may attract the bad away from searching for.

remunerative job and towards reliance on the state.Eliminating social safety internet can prevent. free enterprise entrepreneurs by increasing the risk of company failing from a momentary. setback to monetary spoil.=== Taxes on the affluent=== CBO reported that less progressive tax and. transfer plans added to

a boost in after-tax revenue inequality between 1979. and 2007. This shows that more dynamic earnings. tax obligation policies( e.g., higher income tax obligations on the rich and a greater earned-income

tax. credit) would decrease after-tax revenue inequality.Policies enacted under

Head of state Obama enhanced. tax obligations on the wealthy, including the American Taxpayer Alleviation Act of 2012 and the Inexpensive. Treatment Act. As reported by The New York Times in January. 2014, these regulations include several tax obligation rises on individuals earning over $400,000 and couples. making over$ 450,000: Raised the leading marginal tax price to 39.6%. from 35%; Elevated the price on returns and capital gains. by 5 percent factors, to 20 percent; and Two new

surcharges– a 3.8% tax obligation on financial investment.

income and a 0.9% tax on routine income.These modifications are estimated to include$ 600 billion.

That ' s an enormous windfall. It ' s more, in complete dollars, than the tax. This stands for the tax cuts for the top 1%.

top 1% by Obama.The CBO approximated that the typical tax obligation price for the top

1% climbed from. 28.1% in 2008 to 33.6% in 2013, minimizing after-tax income inequality loved one to a baseline without. those policies.The financial experts Emmanuel Saez and Thomas Piketty suggest much higher top. marginal tax rates on the wealthy, approximately 50 percent, or 70 percent and even 90 percent.Ralph Nader, Jeffrey Sachs, the United Front.

Against Austerity, to name a few, require a monetary transactions tax obligation( also referred to as. the Altruistic tax obligation )to reinforce the social safeguard and the public sector.The Pew Center. reported in January 2014 that 54% of Americans supported raising taxes on the wealthy and. corporations to broaden help to the bad. By celebration, 29 %of Republicans and 75% of Democrats. supported this action.During 2012, investor Warren Buffett promoted greater minimum reliable. earnings tax prices on the well-off, thinking about all forms of earnings”: “I would certainly recommend 30 percent. of taxed earnings in between$ 1 million and $10 million, and 35 percent on quantities above that.

” This would remove unique therapy for. resources gains and carried interest, which are taxed

at lower prices and comprise a relatively. larger share of income for the well-off. He argued that in 1992, the tax obligation paid by the. 400 highest incomes in the United States averaged 26.4 %of adjusted gross earnings.

In 2009, the rate was 19.9 %. == =Reduce tax expenses == =Tax expenditures( i.e., exemptions, deductions,.

advantageous tax prices, and tax credit histories) trigger profits to be much less than they would

. or else be for any provided tax rate structure.The take advantage of tax obligation expenditures, such as. revenue exclusions for health care insurance costs paid for by employers and tax reductions.

They are typically what the Congress uses to. According to a record from the CBO

that analyzed.

This is a proxy for just how much they decreased. revenues or enhanced the annual budget plan deficit.Tax expenditures tend to profit those at. the top and bottom of the earnings circulation, yet much less so between. The leading 20% of income earners received approximately.

50% of the gain from them; the top 1% obtained 17% of the advantages. The biggest single tax expense was the. exclusion from revenue of company sponsored health insurance ($ 250 billion). Preferential tax obligation prices on resources gains and. rewards were$ 160 billion; the leading 1% received 68% of the advantage or$ 109 billion from lower. revenue tax obligation prices on these types of income.Understanding just how each tax expense is dispersed across. the income spectrum can notify plan options.= == Corporate tax reform===. Financial expert Dean Baker argues that the existence of tax technicalities, reductions, and credit ratings. for the corporate earnings tax obligation adds to increasing revenue inequality by allowing

big. companies with several accounting professionals to reduce their tax obligation problem and by permitting large accounting.

= == Minimum salaries === In his 2013 State of the Union address, Barack. Obama recommended elevating the federal minimal wage. Policy Institute agrees with this setting, mentioning: “Raising the minimal wage would aid.

of 2013, Labor Assistant Thomas Perez claimed that it was another sign of the requirement to increase. the minimum wage for all workers: “It ' s vital to hear that voice … For all a lot of individuals. functioning base pay work, the rungs on the ladder of

possibility are really feeling additionally.

and more apart. “The Economic expert composed in December 2013: “A base pay, supplying.

it is not established too expensive, can thus boost pay without any ill impacts on tasks …

== = Funding of social programs===. == International comparisons === == Total===.

= == Factors for family member performance== =.== Plan reactions===== Introduction ===.=== Affordable healthcare=== Raising taxes on higher income individuals to.America'' s federal minimal wage, at 38%.

of average income, is one of the abundant globe'' s least expensive. Some researches find no damage to work from.

government of state minimum incomes, others see a tiny one, but none discovers any kind of severe damages.”” The.

United state minimal wage was last elevated to $7.25 per hour in July 2009. As of December 2013, there were 21 states.

with minimal earnings over the Federal minimum, with the State of Washington the highest possible at.

$ 9.32. Ten states index their base pay to inflation.The.

Bench Facility reported in January 2014 that 73% of Americans supported elevating the minimum.

wage from $7.25 to $10.10 per hour. By celebration, 53% of Republicans and 90% of Democrats.

preferred this action. Likewise in January 2014, 6 hundred economic experts.

sent the President and Congress a letter advising for a base pay trek to $10.10 an hour.

by 2016. In February 2014, the CBO reported the results of a minimal wage boost under.

two circumstances, an increase to $10.10 with indexing for inflation after that and a rise.

to $9.00 without any indexing: Revenue inequality would certainly be boosted under.

both scenarios.Families with earnings

greater than 6 times the. destitution threshold would see

their earnings drop( due partially to their organization earnings. decreasing with higher worker expenses ), while families with earnings below that limit. would rise. Work would likely fall by 500,000 under. the$ 10.10 option and 100,000 under the$ 9.00 choice, with a wide variety of feasible end results. Approximately 16.5 million workers would certainly have. their incomes increase under the$ 10.10 choice versus 7.5 million under the$ 9.00 alternative. The variety of persons below the destitution income. threshold would drop by 900,000 under the$ 10.10 option versus 300,000 under the $9.00. choice.=== Optimum wage application==

=. Amalgamated Transportation Union global president Lawrence J. Hanley has actually required an optimum. wage regulation, which “would restrict the amount of payment an “employer might receive to. a specified multiple of the wage made by his or her cheapest paid employees.” Chief executive officer pay at the largest 350 U.S. firms.” was 20 times the ordinary worker pay in 1965; 58 times in 1989 and 273 times in 2012. == =Aids and revenue warranties ===. Others suggest for a basic earnings warranty, varying from civil liberties leader Martin Luther. King, Jr.To libertarians such as Milton Friedman( in the form of unfavorable revenue tax), Robert. Anton Wilson, Gary Johnson( In the type of the reasonable tax obligation “prebate”) and Charles Murray. to the Environment-friendly Party. === Rent-seeking limits=”= =. General restrictions on and taxation of rent-seeking is popular with huge sectors of both Republicans. and Democrats.= == Economic freedom===. The financial experts Richard D. Wolff and Gar Alperovitz claim that better financial equal rights could. be achieved by extending democracy into the economic round.

In an essay for Harper ' s Publication, investigatory. journalist Erik Reece argues that “With the political right entrenched in its opposition. to unions, worker-owned cooperatives stand for a less dissentious yet extra extreme

design for. returning wealth to the employees that gained it.”=== Monetary policy== =. The effect on revenue inequality of monetary policy pursued by the Federal” Book is challenging.

Previous Fed Chair Ben Bernanke wrote in June.

2015 that there are a number of effects on earnings and riches inequality from monetary stimulation. that job in opposing directions: Stimulus minimizes earnings inequality by creating. or protecting jobs, which mostly aids the center and reduced classes that acquire more of. their earnings from labor than the rich. Stimulus blows up the costs of economic. possessions( possessed generally by the well-off ), however additionally real estate and the value of little services.( owned extra commonly). Stimulation may enhance the rate of rising cost of living.

or reduced interest prices, which helps borrowers (mainly the center and reduced courses) while. hurting financial institutions (generally the affluent ), as they are repaid with more affordable dollars or. with lower variable price loans.== Measurement approaches === == Review == =. Numerous approaches are utilized to determine revenue inequality and different sources might provide. different numbers for gini coefficients or proportion various proportion of percentiles, etc. The. United States Census Bureau research studies on inequality of home revenue and private earnings. show reduced levels of inequality than some other resources (Saez and Piketty, and the CBO),. Do not consist of data for the highest-income households where many of change in income.

circulation has occurred.Two commonly pointed out incomes inequality information are the.

CBO and financial expert Emmanuel Saez, which vary rather in their resources and approaches. According to Saez,

for 2011 the share of “market. earnings much less transfers” gotten by the leading 1% had to do with 19.5 %.

Saez used IRS information in this action. The CBO makes use of both internal revenue service data and Census information. in its calculations and reported a lower “pre-tax” number for the “top 1% of

14.6%. Both data collection were approximately 5 percent. points apart over the last few years.=== Irs( IRS )information=

==. Leaders in using IRS revenue data to assess income distribution are Emmanuel Saez. and Thomas Piketty at the Paris School of Economics revealed that the share of income. held by the leading 1 percent was as large in 2005 as in 1928. Other resources that have actually kept in mind the raised. inequality included economic expert Janet Yellen that specified, “the development [in real income] was.

Those between the top 1 percent and. == =Demographics Bureau data== =. The comparative use of Census Bureau information, as well as the majority of sources of group income.

At any offered time, the Census Bureau ranks. all families by house revenue and then separates this distribution of homes right into. quintiles. The highest-ranked 'household

in each quintile. supplies the upper income restriction for each quintile. Comparing changes in these upper income restrictions. for various quintiles is just how adjustments are gauged between one moment in time and the. next off.

The issue with presuming income inequality. For the majority of individuals, earnings increases over

time.

later in their lives. Some people shed income over time because. of business-cycle contractions, demotions, occupation modifications, retired life, and so on. The implication of changing private revenues. is that specific homes

do not remain in the very same earnings quintiles gradually.

Hence, comparing different earnings quintiles.

The major problem with this revenue procedure. is that it only mirrors families ' before-tax

money earnings. It fails to represent altering tax obligation worries. and the impact of revenue resources that do not take the type of cash money. This implies, for instance, that tax obligation cuts in. 2001-2003 and 2008-2012 are missed in the demographics data. ' the Census Bureau determine neglects. income obtained as in-kind benefits and medical insurance coverage from employers and the. government. By disregarding such advantages along with

sizeable. tax obligation cuts in the economic downturn, the Demographics Bureau ' s money income measure seriously overemphasized.

the earnings losses that middle-income households experienced in the recession.New CBO revenue data.

are beginning to show the growing importance of these products.

17% of middle class families ' after-tax income. The income items missed out on by the Census Bureau.

are enhancing faster than the revenue things included in its cash income step. What lots of viewers miss out on, nevertheless,

is the. success of the country ' s tax obligation and transfer systems in shielding low -and middle-income Americans. versus the complete results of' a clinically depressed economic climate. As a result of these programs, the spendable.

incomes of inadequate and middle-class family members have actually been far better insulated versus recession-driven. losses than the earnings of Americans in the leading 1%. As the CBO stats show, incomes. between and at the end of the circulation have made out better given that 2000 than incomes. at the really leading.”=== Earnings actions: Pre-and post-tax== =. Inequality can be gauged before and after the impacts of tax obligations and move settlements.

such as social safety and security and unemployment insurance. Market earnings, or revenue prior to transfers & tax obligations:. Efficiency, job and knowledge experience, inheritance, gender, and race have had a solid.

After transfers & tax obligations: Lowering the progressivity. The equalizing effect of government taxes.=== Market concerns= “==.

Contrasts of income with time need to readjust for changes in ordinary age, family members size, number.

of breadwinners, and various other attributes of a populace. Gauging personal earnings ignores dependent. kids, yet home revenue additionally has problems– a household of ten has a reduced criterion. of living than a couple of individuals, though the earnings of both families might be the exact same.

People ' s profits often tend to rise over their. The inequality of a recent university grad.

have actually concentrated on the flaws of household earnings as a step for standard of life in order. to refute cases that revenue inequality is expanding, becoming excessive or positioning a trouble. for culture. According to sociologist Dennis Gilbert”, expanding. inequality can be clarified partly by expanding engagement of women in the workforce. High earning houses are most likely to.

be twin earner households, And according to a 2004 analysis of income quintile information by. the Heritage Structure, inequality becomes less when house income is adjusted for. size of house. Accumulated share of earnings held by the upper. When figures are readjusted to show, quintile (the top earning 20 percent) lowers by 20.3%.

The 2011 CBO study “Patterns in the Circulation. The CBO research study confirms earlier studies.Overall,.

= == Gini index == =The Gini coefficient summarizes earnings inequality. It utilizes a range from 0 to 1– the higher. No represents excellent equality( every person.

to make them simpler to comprehend. )Gini index scores can be utilized to compare. inequality within( by race, gender, employment) and between nations, prior to and after taxes.Different resources will certainly usually give different. gini values for the very same country or population measured. As an example, the U.S. Demographics Bureau ' s official. Gini coefficient for the United States was 47.6 in 2013, up from 45.4 in 1993, the earliest. year for equivalent information. By contrast, the OECD ' s Gini coefficient for. income inequality in the USA is 37 in 2012 (consisting of wages and various other cash money. transfers), which is still the highest possible in the established world, with the cheapest being. Denmark (24.3 ), Norway (25.6), and Sweden( 25.9

). Teacher Salvatore Babones of the. College of Sydney notes: A major space in the dimension of revenue

inequality. is the exemption of funding gains, revenues made on rises in the worth of investments.Capital gains are omitted for simply sensible. reasons. The Demographics doesn ' t ask

regarding them, so they. can ' t be consisted of in inequality data. Undoubtedly, the rich earn far more from financial investments. than the inadequate'. As an outcome, genuine levels of income inequality. in America are a lot more than the official Demographics Bureau numbers would recommend.=== Determining inequality with intake. vs. revenue === Traditional scientists have actually said that. earnings inequality is not substantial due to the fact that consumption, instead of earnings should be. the action of inequality, and inequality of intake is much less extreme than inequality.

Will certainly Wilkinson of the libertarian Cato Institute. According to Johnson, Smeeding, and Tory,. The dispute is summarized in “The Hidden Success.

Other studies have not discovered intake inequality.

less remarkable than family earnings inequality, and the CBO ' s study located intake information. not “effectively” capturing “usage by high-income families” as it does their income,. It did concur that house usage numbers reveal a lot more equivalent distribution than. household income.Others contest the significance of consumption over revenue

, explaining that. Due to the fact that they are conserving, if middle and lower income are consuming even more than they make it is.

less or going deeper right into debt.A “expanding body of work” suggests that income.

inequality has been the motoring aspect in the expanding home debt, as high earners. bid up the rate of realty and middle earnings earners go deeper into debt trying. to preserve what as soon as was a center course way of living.

Between 1983 and 2007, the top 5 percent saw.== Wide range inequality == Related to income inequality is the topic. Net well worth is influenced by activities in the.

over the temporary. Income inequality likewise has a substantial impact.

over long-term changes in riches inequality, as income is collected. Riches inequality is also very focused. and boosting: The leading 1% owned approximately 40 %of the. wealth in 2012, versus 23% in 1978.

The leading 1 %share of wealth went to or listed below. 30% from 1950– 1993. The leading 0.1% had approximately 22 % of the.

The leading 0.1% share of wealth was at or below. The threshold for the leading 1% of wide range team.

Virtually half the top 1%

group team income is. Stood for in the leading 1% team by wealth.The increase in wealth for the 1% was not homogeneous,.

The reduced 50 %of families held 3% of the. The ordinary net worth of the bottom 50% of. This wealth inequality is obvious in the share.

of possessions held. In 2010, the top 5% richest houses. had about 72% of the monetary wide range, while the lower 80% of families had 5%. Financial riches is determined as total assets.

minus home values, implying income-generating economic assets like supplies and bonds, plus. business equity.The Center for American Progression reported in September 2014 that: “The fads.

in increasing inequality are also striking when gauged by wealth.Among the top 20 percent of households by internet.

worth, ordinary riches increased by

120 percent in between 1983 and 2010, while the middle 20.

percent of households only saw their wealth increase by 13 percent, and the lower fifth. of family members, typically, saw financial obligation go beyond properties– to put it simply, adverse internet well worth … House owners. in the lower quintile of wealth shed an amazing 94 percent of their wide range between 2007 and.

== See likewise=== =References ==== Further reading ==== External links ==. A Gigantic Analytical Round-up of the Earnings Inequality Dilemma in 16 Charts from The Atlantic.

(Enter your home revenue and see just how you. Revenue Inequality in the United States: Hearing. All You Required to Know Regarding Income Inequality,.

Assume. The great divide between our ideas, our. ideals, and reality( April 2015), Scientific American. ' Scandinavian Desire ' holds true solution for America ' s revenue inequality. Joseph Stiglitz for CNN Cash, June 3, 2015. Hershey: U.S. Income Inequality Is Changing. The Delicious chocolate Business.

Reuters via The Huffington Post, October 28,. 2015. Stanford record shows that united state does badly. on poverty and inequality measures.Stanford Information. February 2, 2016. Massive new data collection suggests economic inequality. will get back at worse. The Washington Message.

January 4, 2018. Michael Hiltzik( 10 July 2018 ). “Employers will do practically anything to locate. workers to load tasks– other than pay them more”. Los Angeles Times.( with historical charts).

United States Demographics Bureau research studies on inequality of house income and specific income. Leaders in the usage of IRS income information to assess earnings distribution are Emmanuel Saez.=== Income measures: Pre-and post-tax== =. Market earnings, or income before tax obligations & transfers:.= == Gini index == =The Gini coefficient sums up income inequality.